American Axle (AXL) – Shifting Gears

American Axle (AXL) designs, engineers and manufactures driveline and drivetrain systems and related components for light trucks, sport utility vehicles, crossover vehicles, passenger cars and commercial vehicles. Its products include axles, driveheads, chassis modules, driveshafts, power transfer units, transfer cases, chassis and steering components, transmission parts, electric drive systems and metal-formed products. Their Swedish subsidiary e-AAM Driveline Systems AB engineers and develops battery electric and hybrid driveline systems to be commercialized for crossover vehicles and passenger cars.

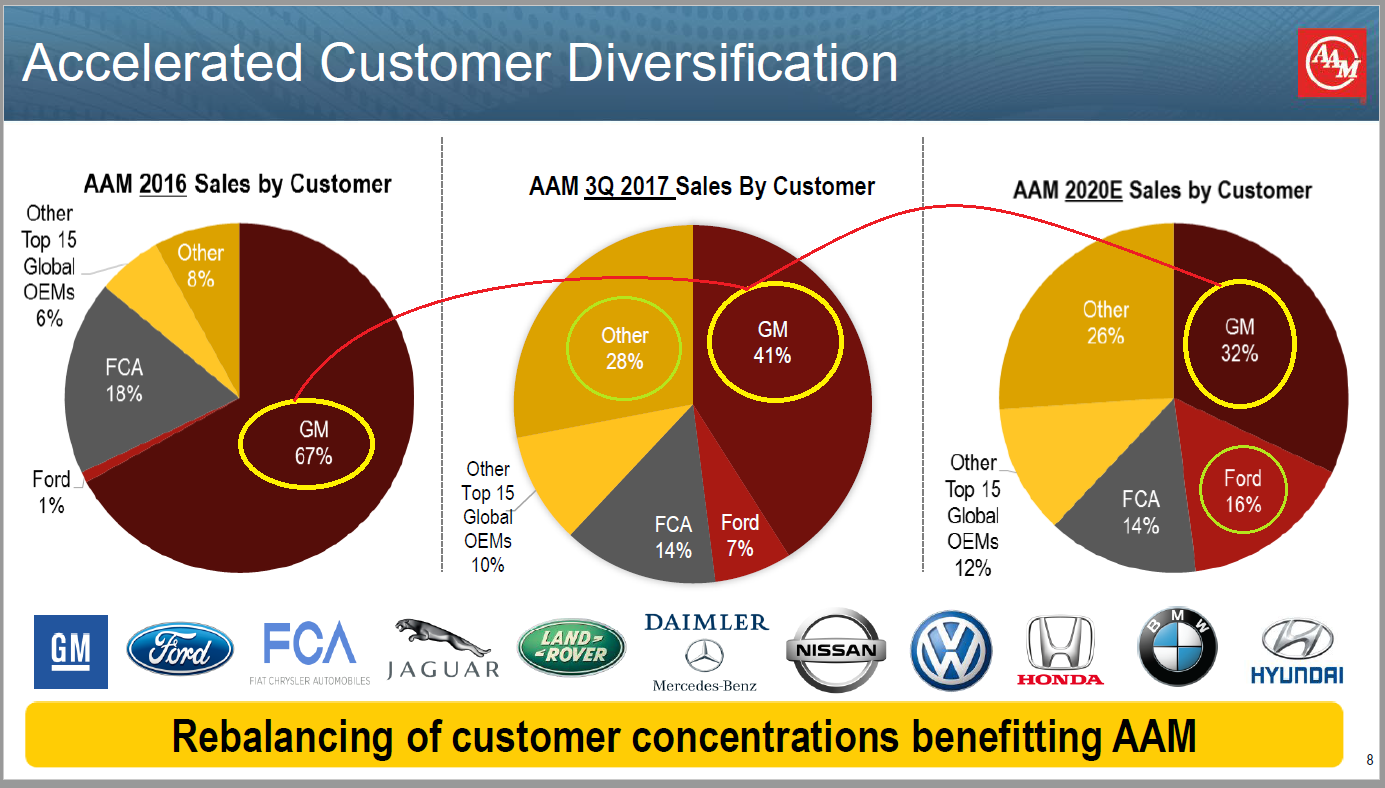

Headquartered in the US, American Axle operates in 17 countries and has approximately 90 manufacturing, engineering and business office facilities around the world. The company is the principal supplier of driveline components to General Motors (GM) for its full-size rear-wheel drive (RWD) light trucks and SUVs manufactured in North America, principally the K2XX line, supplying substantially all of GM’s rear axle and four-wheel drive and all-wheel drive (4WD/AWD) axle requirements for these vehicle platforms. In an effort to reduce primary exposure to one client, management has been diversifying their sales since early 2017, specifically with the acquisition of Metaldyne Performance Group (MPG) in April. While GM still remains their largest single-customer, sales derived from the multinational auto maker have been re-balanced lower by 2600 basis points in the past year, from 67% down to 41%.

American Axle also supplies driveline system products to Fiat-Chrysler US (FCAU) for heavy-duty Ram full-size pickup trucks, the AWD Jeep Cherokee, and also some of their passenger cars. Sales to Fiat-Chrysler were approximately 18% of consolidated net sales in 2016, and 14% in 2017 making them their second-largest customer.

Other global automotive manufacturers that American Axle provides components to include Ford Motor Company (F) to which sales are expected to more than double by 2020, Nissan (NSANY), Mercedes-Benz, Volkswagen and Audi (VLKAY), Jaguar Land Rover (TTM), Honda Motor (HMC) and PACCAR (PCAR).

RBC Capital Management Meeting

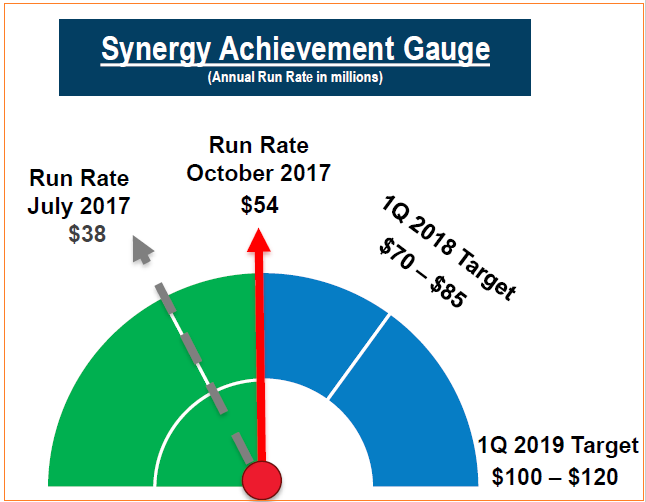

After their meeting, RBC analyst put out a bullish note citing the company’s comments on their $450M gross backlog which is coming in at the high end of margin ranges, and further, continued synergies from their $3.3 billion Metaldyne acquisition that transpired in early 2017.

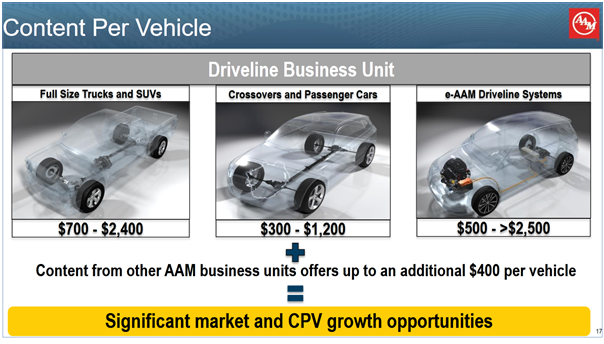

Other points that were brought up include the increasing Electric Vehicle (EV) market’s opportunity, regarding which management brought up a planned 2018 launch of a high-profile EV program with a European OEM that would be worth $2,500 or more in content-per-vehicle. This is slightly above their bread-and-butter full-size truck and SUV content revenue and double what a regular passenger car amounts to.

RBC analyst believes that American Axle will see $300 million free cash flow in 2018 with $400 million opportunity in 2019 if the auto cycle holds. Lower CapEx spending which is expected to normalize at 5.5%-6% of sales, down from today’s 8% level, is anticipated to help achieve this forecast.

Deutsche Bank on Tax Reform

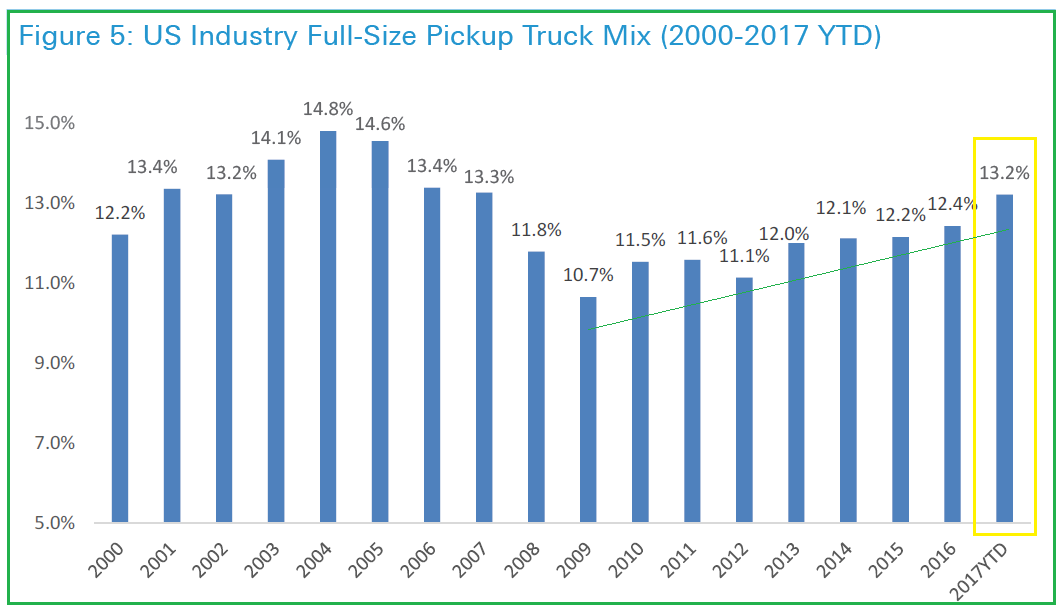

In a bullish note, the analyst cites Joint Committee on Taxation (JCT) forecast of US 2018 taxes paid by individuals that could be lower by an aggregate $122 billion with historical spending of disposable income at ~3.3%. Furthermore, since 1985, this has correlated to auto demand elasticity with 1:1.5 ratio. If this historical trend remains steady, tax changes could potentially increase automotive demand by 200,000 units. Also, it is noted that 100% expensing (deduction) for capital expenditures to businesses could provide an additional boost to vehicle sales, pickups in particular.

RBC 2018 Auto Outlook

In their 2018 US Auto and Auto Parts Outlook, RBC looked at 10 key topics of importance for the industry. Listed below are the pertinent points to American Axle’s operations.

- K2XX program (GM’s trucks), which is American Axle’s most important production line, was down 11% YoY. However, profitability held a 17.3% EBITDA margin which was better than expected – this confirms management’s outlook on margin improvement to the higher end of the 20%-25% range

- 2016 may have seen a peak with 17.6M units

- 2017 should finish at 17.2M units

- 2018 is forecast at 16.9M units

- 2019 is forecast at 16.4M units

US Production is forecast to level out over the next three years, this compares roughly to the last plateau level of 17M lasted for 8 years from 1999-2006, a period that included the US housing boom and just prior to crude oil price hitting the $147 level. Current sustained output is attributed to the US Economy which remains robust, pointing to 2.5% growth into 2018 (Bloomberg consensus). Additionally, the ISM Composite Index’s last reading was at 58.2%, making it 15 consecutive months above 50% expansion zone.

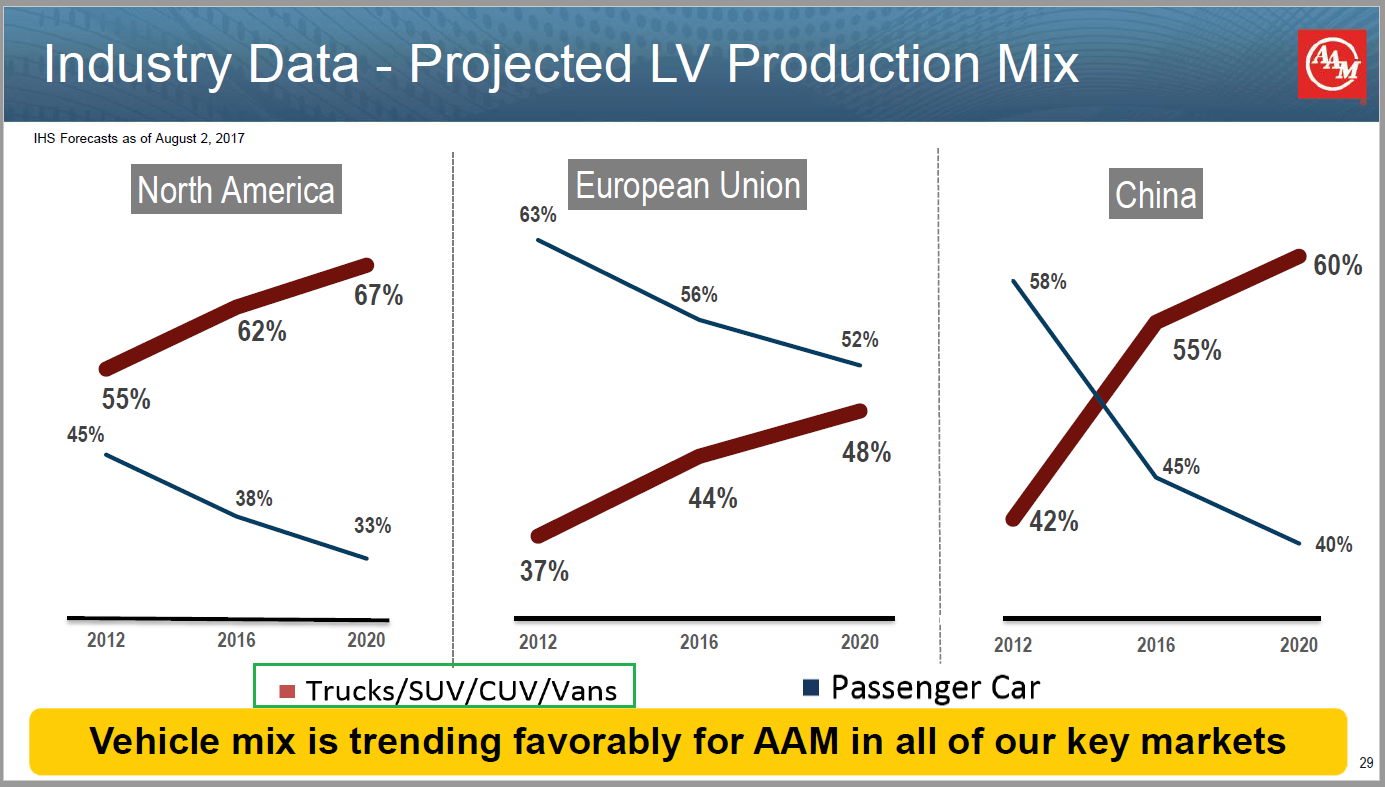

The European market is expected to hold present levels for the next 3-5 years, while China’s market, although lower in 2018, is anticipated to still see 3%-4% mid-term annual growth. Overall, net Global CAGR is seen at approximately 1.5% over 2017-2022 time frame.

Deutsche Bank Auto Conference

Deutsche Bank will hold their Annual Global Auto Industry Conference in Detroit on January 16th and 17th which coincides with the Auto Show. In their preview note, the analyst highlighted the four companies they are most bullish on: American Axle, General Motors, Fiat-Chrysler and Tesla (TSLA).

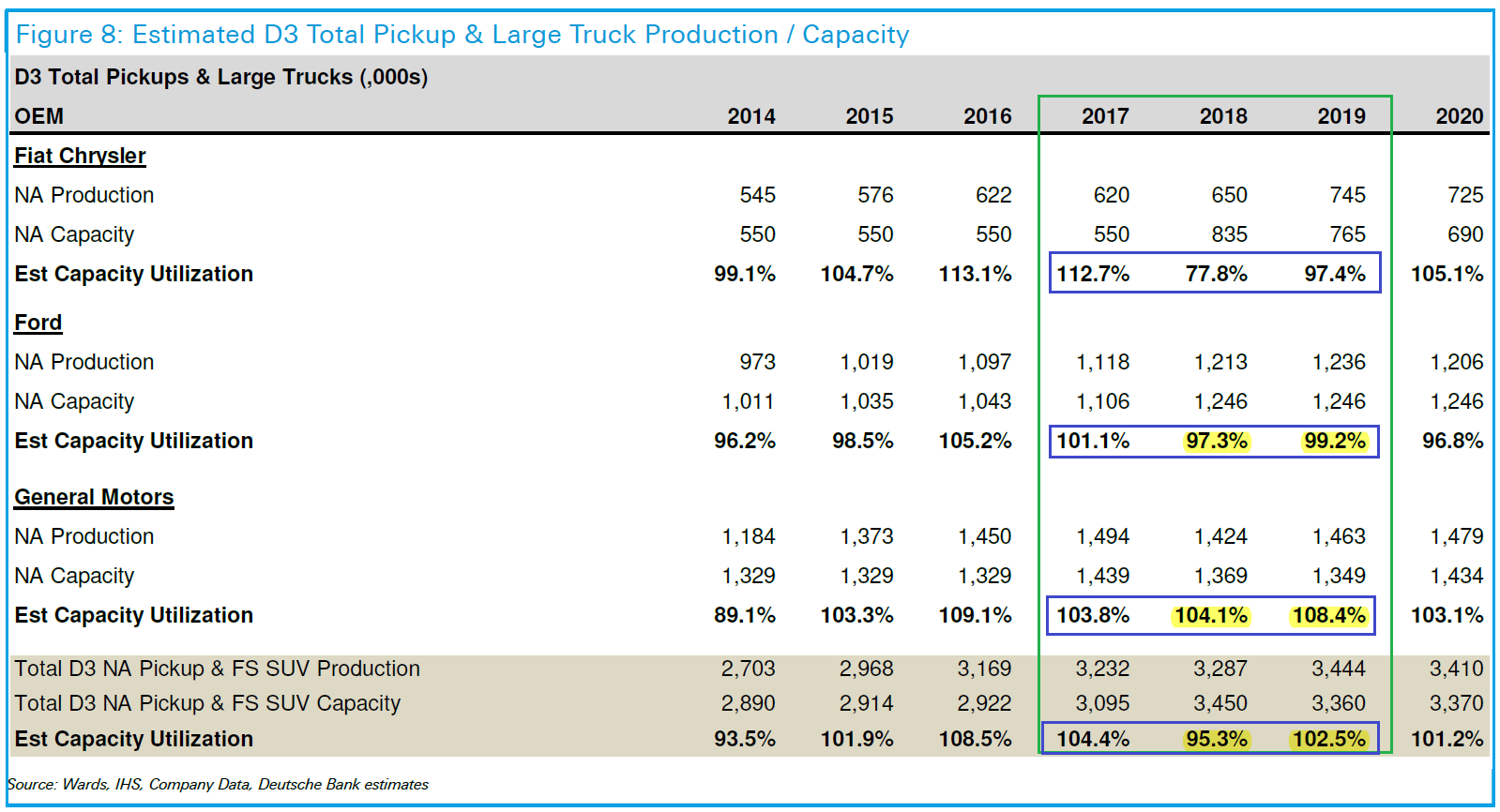

Expectations are high for GM with 2019 upside potential from new trucks anticipated to be in the order of $2B-$3B; this would be very beneficial to American Axle since GM remains their largest client. The analyst also thinks 2019 free cash flow guidance could be even better on lower launch costs, lower interest and reduced CapEx.

GM management has suggested that North American segment can yet again see 10%+ margins, above Deutsche Bank’s forecasts. GM also remains well positioned to benefit from their new trucks in 2019 – average transaction price at this time is $2,600 lower than Ford’s, with the disparity starting to close.

As was the case with Allison Transmission Holdings (ALSN), it appears that investors are misinformed that with the proliferation of electric vehicles traditional drivelines will no longer be required. The simple fact is that the need for torque distribution still remains, even with electric motors. Moreover, management also sees increased content-per-vehicle gain as they migrate into electric vehicle drivetrain components, having announced that during 2018, they will be launching their first platform with a European luxury OEM that has a very high content of $2,500+. A second customer is expected to be announced during 1H2018 which the company believes will be a “material growth driver” over the upcoming years.

Deutsche Bank SAAR Update

December SAAR pushed higher and above consensus to the 17.8M unit mark spurned by one of the strongest retail selling months of 2017, even against tough comps; this was partially boosted by hurricane-related recovery volumes.

Of importance to American Axle, GM’s Large Truck sales increased by 17.4%, leading to speculation that their K2XX platform’s North American SAAR had edged over 1.60M – higher than the fiscal year’s pace of 1.3M. It is also likely that 4Q2017 K2XX production rate was at 330,000 units, 7.8% higher than Deutsche Bank’s 306,000 forecast which itself was already above consensus – this suggests that analyst forecasts would be quite behind if the fourth quarter’s rate is indeed that high.

Overall inventory at the end of 2017 registered at 63 days’ supply; this is below their historical 73-day inventory, and heading into 2018, GM’s setup looks good with large truck inventory at less than 60 days, well below normal levels of 80-90 days. This means that 1Q2018 production could show an upside surprise, boosting EBITSA/FCF estimates for American Axle.

EU15 December Registrations

European registrations remain very strong with 2017 totals expected to end up being higher by about 3.3% YoY. While American Axle’s European exposure remains low presently– 2017-2019 backlog is 10% of total production, it still accounts for an increase in vehicle demand and sales.

Parting Transmissions

Industry capacity utilization rate remains very high, especially for GM and Ford while Fiat-Chrysler production has been reduced as the company continues to shrink their fleet market exposure, as they had announced they would be doing back in late 2016. Just a few days ago, Ford announced they would restart their Ranger pickup model production after an eight-year hiatus, expected delivery date is early 2019.

A multitude of recent bullish comments from various analyst firms prior to North American International Auto Show, better known as the Detroit Auto Show, make an interesting case for American Axle especially when General Motors’ outlook and recent production information is factored into view.