Behind The Numbers – CONMED Corporation (CNMD)

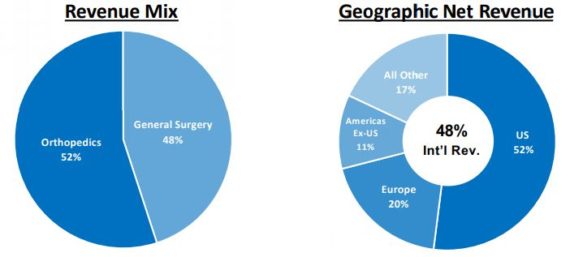

CONMED is a global medical technology company specializing in the development and sale of surgical and patient monitoring products and services. Its broad portfolio includes products used by healthcare professionals within the Orthopedic, Laparoscopic, Robotic & Open Surgery, Gastroenterology & Pulmonology and Cardiology & Critical Care industry.

After the close yesterday, the company reported its Q4 earnings:

-EPS of $0.73 vs $0.73 estimate – In-Line

-Revenue of $242.4M vs $228.5M estimate – Beat

-Total Sales increased 8.9% Y/Y**

-Domestic Sales increased 12.9% Y/Y

-International Sales increased 8.7%

-Worldwide Orthopedics Revenue increased 4.6%

-Worldwide General Surgery Revenue increased 18.4%

**The fourth quarter was a highest growth quarter in recent memory for CONMED, even up against the toughest comparable quarter we have faced to-date.

-Gross Margins also improved by 60bps Y/Y (The improvements in gross margin in 2018 occurred against the backdrop of an active and increasing new product development pipeline. The execution of that pipeline remains a priority for our operations teams, and against that same backdrop in 2019, we expect adjusted gross margins to improve again by 50 basis points to 100 basis points compared to 2018.)

Piper Jaffray analyst Matt O’Brien, in a note last night, said that the domestic revenue outperformance was the key standout for us on the call, as management’s investments for getting closer to the customer and a high new product cadence delivered strong momentum off of tough comps. The general surgery business in the U.S. continues to be a strong performer with broad-based category contributions all above market growth rates for the full year. This segment will be facing tough comps in 2019, but management believes their R&D pipeline is robust and will help further the segment’s performance. As far as ortho, the segment had the highest two-year stack in 4Q in domestic markets with SG&A investments and new product launches gaining further traction with their customers.

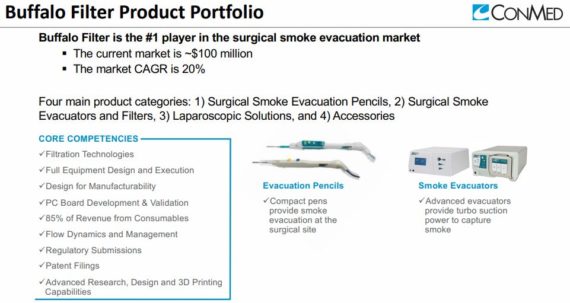

Buffalo Filter

Last month, CONMED announced a definitive agreement to acquire privately-held Buffalo Filter, the market leader in surgical smoke evacuation technologies, for $365M.

On the conference call last night, CEO Curt Hartman said that this acquisition remains on track to close during the first quarter of 2019. He added, “We are excited about both the near and long-term opportunities in smoke evacuation market and we believe Buffalo Filter’s product portfolio, combined with CONMED’s existing channels, will allow us to quickly grow and gain share in this expanding market. The team that will integrate Buffalo Filter is the same team that did an outstanding job integrating SurgiQuest three years ago and all of us at CONMED are committed to capitalizing on this exciting transaction.”

Something else to keep in mind, the guidance provided last night excludes any impact from the Buffalo Filter acquisition. The company anticipates providing updated guidance on the Q1 earnings call.

Leerink analyst Richard Newitter, in a post-earnings note, remains optimistic the Buffalo Filter transaction can help drive an additional 200bps of cumulative margin expansion through 2021 vs. their current estimates and will make this happen faster than otherwise might have materialized.