Behind The Numbers – Gaia Inc. (GAIA)

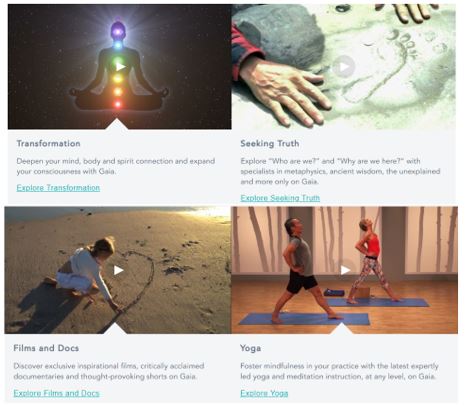

Gaia is a media and community company that operates a global digital video subscription service that caters to a unique and under-served subscriber base. Its digital content library of over 8,000 titles is available to subscribers on most Internet-connected devices anytime, anywhere commercial free. Subscribers have unlimited access to a vast library of inspiring films, cutting edge documentaries, interviews, yoga classes, transformation related content, and more.

Yesterday, after the close, the company would report its Q4 earnings:

-EPS of ($0.62) vs ($0.59) estimate – Miss

-Revenue of $12.38M vs $12.89M estimate – Miss

-Revenue increased 47%

-Streaming Revenue increased 50%

-Gross Margins increased 100bps

CEO Jirka Rysavy would comment, “During the third quarter of 2018 when we surpassed the 500,000 paid subscriber milestone, we began to shift our customer acquisition focus primarily towards non-yoga subscribers and announced that over 80% of the subscribers acquired in the third quarter were in the Seeking Truth and Transformation channels. We have continued this focus in the fourth quarter and into 2019. In January we increased the monthly subscription price for new subscribers to $11.99, while grandfathering our existing subscribers until their first renewal in 2020.”

On the conference call, CFO Paul Tarell would add that they have continued their focus on adding higher lifetime value subscribers, which represented over 80% of subscriber additions in the fourth quarter, which is the second quarter in a row it’s been at that level. They also took advantage of matching funds provided by certain distribution partners and invested an incremental $3M in marketing activities to support growth. While the result of this spend will take some time to really reflect in the revenue and subscriber numbers, it has elevated the awareness of Gaia within the SVOD ecosystem. “We intend to allocate a portion of our marketing spend in 2019 to continue to grow and nurture these partner relationships to maintain revenue from distribution partners in the range of 18% to 20% of total revenues.”

Analyst Commentary

Roth Capital analyst Darren Aftahi lowered his price target to $15.50 last night saying the main reason for the weaker revenue was around net subscriber adds, with GAIA adding just 35K net, ~47K lower than their ~82K estimate as GAIA shifted its SAC initiatives towards higher LTV segments (Transformation/Seeking Truth) which accounted for ~80% of 4Q adds.

Roth added that what they highlighted as a possibility earlier this year has become the go forward strategy for GAIA as the company transitions to slower subscriber growth by tapering back marketing expense in order to accelerate its adjusted EBITDA profitability timeline. “While this results in a growth slowdown (albeit a still healthy ~mid-high 20% y/y in FY19/20 based on our model), we believe GAIA’s focus on higher LTV subscribers, and reduced spend should mitigate cash burn and help ease investor concerns as its profitability profile improves. Meanwhile, its recent price increase and premium offering, while impactful on a lag, should aid ARPU accretion going forward, and thus growth.”

Lake Street analyst Mark Argento lowered his price target for Gaia to $20 saying the company is taking a more prudent approach to subscriber acquisition by focusing on acquiring higher return on investment and quality subscribers using internally generated cash flow while preserving liquidity. The analyst believes the market for Gaia’s content “remains sizable but it is prudent to manage customer acquisition capital given the current environment.”