Behind The Numbers – Harris Corp (HRS) Strong Book-to-Bill Ratio

In Jaguar, we have coined this term: “Bookings in Excess of Billings” also commonly known as Book-to-Bill ratio. Given that our research is always geared towards forwarding looking management commentary that can shed light on improving fundamental trends, a key way to identify such trends is monitor bookings (or order) growth rate relative to current quarter revenue or billings growth rate. The higher the delta, the stronger the business.

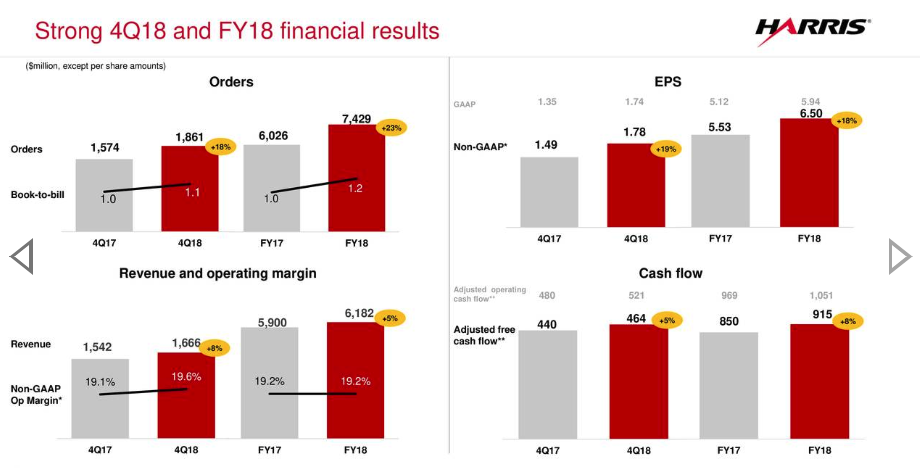

Behind The Numbers – HRS was sharply higher today finishing with a power candle after +9.6% rally on very heavy volume. Company posted +8% revenue growth, 60 bps margins expansion and $1.78 EPS. All three metrics beat street estimate. Operating Cash Flow was very strong at $521M.

But the most important metric that put thick bids underneath the stock all day long was Book-to-Bill ratio that jumped to 1.1x after company stated Order growth was +18% YoY in Q2, more than 2x outpacing the revenue growth. Management referenced strong Book-to-Bill ratio 7 times in earnings call.

CEO, William Brown, commented in earnings call:

“Overall, orders were up 18% and increased by double-digits for the fifth consecutive quarter, ending the year up 23% with a book-to-bill of 1.2, and backlog up 26%. for Electronic Systems, book-to-bill was 1.3 for the year and backlog increased 30% to $2.6 billion. This combined with the $17 billion pipeline and $4.5 billion in proposals outstanding, gives us confidence that revenue will continue to accelerate in fiscal 2019. Communication Systems orders increased 28%, book-to-bill was 1.3x, and greater than 1x in prior quarter. In Electronic Systems Orders grew double-digits for the fifth straight quarter, up 38% with a book-to-bill of 1.3x.”