Behind The Numbers – Mobile Mini (MINI)

Mobile Mini is the world’s leading provider of portable storage solutions as well as a leading provider of specialty containment solutions. As of March 31st, its network included 139 locations in the United States, 15 locations in the U.K., and 2 locations in Canada.

Shares closed higher by 7% yesterday after the company reported its Q1 earning after the bell on Monday:

-EPS of $0.41 vs $0.38 estimate – Beat

-Revenue of $149.7M vs $147.3M estimate – Beat

-Total Rental Revenue increased 8.4% Y/Y

CEO Erik Olsson, in his prepared remarks, would comment, “The economic environment for our U.S. end markets, which represents 86% of our business continue to be positive in the first quarter. And based on our assessment of current business trends and available forecast, we expect that the majority, if not all of our end markets, will continue to drive healthy demand for our products. The exception is the UK where economic and political uncertainty relating to the outcome of the Brexit process continues to be a drag on business investments. However, our UK business still managed to grow revenues in local currency in the quarter.”

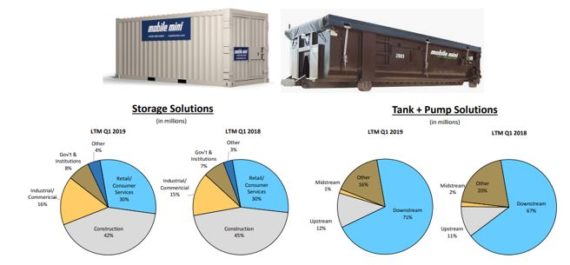

Storage Solutions – Within this segment, Rental Revenue increased 6.7% Y/Y, with the national account focus in North America continuing to be a large portion of its growth in Q1 ’19. Specifically, national account activations were up from Q118 to Q119, and 36% of their Q119 rental revenue for North America storage solutions came from these national accounts.

COO Kelly Williams would say that they currently have a strong pipeline of pending orders for national accounts, including large orders for remodels of various retailers. “We continue to drive value at national accounts by leveraging our national footprint and responding to the customer feedback regarding their additional rental needs.”

In addition, CFO Van Welch would comment that for their North American Storage Solution business, they are being strategic and have secured at the advantageous terms about purchasing approximately 3,000 units through China in bulk and customizing them there in China. “As such, we received some units in the first quarter that we expect to place on rent in Q219.” One of the advantages there is that they’re able to manufacture those, obviously, in China and ship them to various ports of entry that are closest to the demand that they’re seeing for those particular units. So they’re saving money on freight cost associated with those units.

Tank & Pump Solutions – Within this segment, Rental Revenue increased 15.6% Y/Y while downstream revenues, which comprise the majority of the Tank and Pump Solutions business, increased 19.6% in the first quarter Q/Q, largely driven by the continued ramp up of the MSA signed in late 2017 and early 2018. According to management, these MSAs were still in the early stages in Q118. “And while we have largely reached our run rate, we do believe there is potential to expand our share of business with these large customers as we also provide them our popular digital solutions, like EnviroTrack and GPS tracking.”

Q2 Outlook – Oppenheimer analyst Scott Schneeberger, in the Q&A session, would begin by saying that as we move into the second quarter, it sounds like business conditions are strong. “And Erik, I am speaking specifically about the storage solution. We saw a weak ABI in March. It may or may not have been associated with some weather. Could you just give us a little bit more discussion of what you’re hearing from customers about storage demand for the upcoming year?”

CEO Erik Olsson would respond by saying that he thinks that the ABI number is in all likelihood just a blip or a one-off. “We see very strong end market as evidenced by both our order intake, as well as the pending orders that we track on the storage side. And the pipeline is also very good on the Tank and Pump side. So we’re going into the second quarter here in a very strong fashion.”

Finally, as a quick note, Credit Suisse will be hosting MINI at its inaugural eXtreme 1×1 Services Conference on May 7th. Look for additional commentary following this event.