Behind The Numbers – nLIGHT (LASR)

nLIGHT is a leading supplier of high-powered semiconductor and fiber lasers, serving the industrial, microfabrication, and defense and aerospace markets.

Shares are surging today, currently up 18%, after reporting Q3 results after the bell yesterday:

-EPS of $0.15 vs $0.12 estimate – Beat

-Revenue of $51M vs $49.2M estimate – Beat

-Revenues increased 39.6% Y/Y

-Gross Margin of 35.4% vs 33.8% Y/Y

CEO Scott Keeney would say, “We are pleased with our execution in the quarter despite challenges in the industrial end market in China. With the recent introduction of our 10kW fiber laser and Corona, the industry’s first programmable fiber laser, we have further enhanced our competitive differentiation and are well positioned to continue to grow faster than the overall high-power laser market.”

Stifel analyst Patrick Ho, in a post-earnings note this morning, believes management’s comments on the current China industrial market was consistent with those of its peers and was generally reflected in thier outlook for the December quarter. The analyst would go on to say that while they expected a level of seasonality coming off a very strong June quarter, the magnitude of the decline was somewhat more amplified given the current demand environment, as well as the current trade war situation. “We believe that these pricing pressures and weak environment will continue into the December quarter and carry into the March quarter as well, but our forecasts project a pickup in China (and industrials) in the June 2019 quarter.” He also believes nLIGHT continues to gain share and while China could be flat to down in 2019 for the overall fiber laser market, they are still projecting modest growth (+12% Y/Y) in the region.

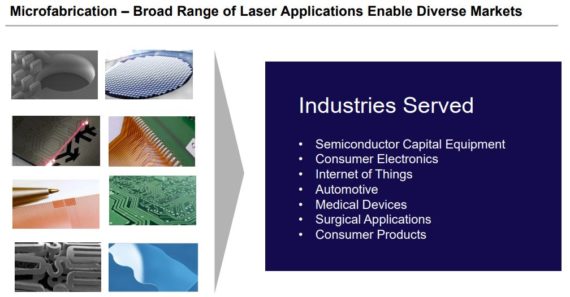

Microfabrication – One bright spot in the report and one that helped offset some of China weakness was strength in North America and in its microfabrication business. Microfabrication comprised 39% of total revenues and came in different segments, including automotive, consumer electronics, scientific and research, and semi cap equipment. Overall, this segment increased 21% Y/Y and better-than-expected results in aerospace and defense (+107%) provided a level of support during this weak period on the industrial front and represents a key differentiator for the company.

Needham analyst Jim Ricchiuti focused his attention on the earnings call on this segment and asked if management could talk in more detail about it.

LASR’s CEO would comment, “We’re seeing continued good growth in that sector for us and indeed it’s because of the diversity. We certainly supply into semiconductor capital equipment that’s one end market but it is just one end market in addition to consumer electronics and a wide range of different end applications, including medical applications. So what we’re seeing is adoption of high performance dyed pump solid state lasers, notably UV and short pulse lasers, lasers that used to be really solely directed at the scientific market. They’re moving out into the real industrial end markets and we have got a very strong position in the leading semiconductor lasers that drive those lasers.”

New Products – DA Davidson analyst Thomas Diffely, in a post-earnings note, kept his Buy rating on nLight noting that the industrial fiber laser market outside of China is still strong and that its new products such as the Corona programmable beam fiber laser “should drive revenue higher and costs lower in 2019 and beyond.”

Stifel would also echo this statement by saying longer term, “We believe the company’s growth momentum can continue driven by new products that will begin gaining traction in late 2018 into 2019. The company has introduced various products (including a compact 3kW solution, Corona-a programmable fiber laser solution, and a compact ultra-high power 10kW laser) which we believe will begin to contribute meaningfully in second half 2019. We believe these different solutions appeal to different performance needs, but the common theme is its shift to higher power solutions, where the market is also trending. These higher power laser solutions tend to have less competition and much better margins (given the higher ASPs), which will help support and expand the company’s margin profile longer term.”