Behind The Numbers – WD-40 (WDFC)

Engaged in the development and sale of maintenance products, and homecare and cleaning products, WD-40 offers multi-purpose products, including aerosol sprays, non-aerosol trigger sprays, and in liquid-bulk form products under the WD-40 Multi-Use brand name for various consumer uses, as well as specialty products, such as penetrants, degreasers, corrosion inhibitors, greases, lubricants, and rust removers under the WD-40 Specialist brand name.

After the close yesterday, the company reported Q4 earnings:

-EPS of $1.54 vs $0.99 estimate – Beat

-Revenue of $102.6M vs $104.55M estimate – Miss

-Q4 Total Net Sales increased 6% Y/Y

-FY Total Net Sales increased 7% Y/Y

-Maintenance Products Net Sales increased 8% Y/Y

-Homecare & Cleaning Products Net Sales decreased 7% Y/Y

-Americas Net Sales increased 2%

-EMEA Net Sales increased 2%

-Asia-Pacific Net Sales increased 36%

-FY19 EPS Guidance of $4.51 – $4.58 vs $4.65 estimate

-FY19 Revenue Guidance of $425M – $437M vs $434M estimate

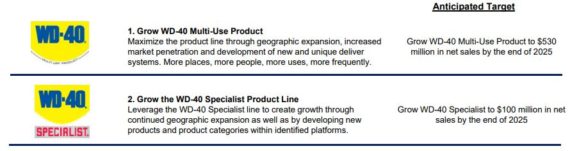

Multi-Use – According to CEO Garry Ridge, the company’s strategic initiative #1 is to grow its WD-40 Multi-Use Product. As part of this mission, they are continuing to introduce WD-40 Multi-Use Product into new markets, targeting increased growth and higher availability around the globe in areas including Latin America, China, India and Europe. “We’re poised to maximize this goal in a way that we’ve never done before. We’re doing this by taking our innovations into growing markets as well as established ones and by leveraging our global infrastructure. Our innovation is also continuing to drive revenue growth with products like WD-40 Smart Straw and WD-40 EZ Reach.”

Specialist – While the company’s goal here is to grow the product line to approximately $100 million in revenues by the end of 2025. While they are optimistic about the long-term opportunities for WD-40 Specialist, there may be some volatility in sales levels along the way due to the timing of promotional programs, the building of distribution and various other factors that come with building out a new product line.

Oil Impact

CFO Jay Rembolt, in his prepared remarks, said that one of the things that is concerning us this year is the predicted instability of crude oil prices.

“As you know, crude oil is one of the primary feedstocks of our petroleum-based specialty chemicals, and we’ve experienced rising oil costs, which have put pressure on our cost of goods sold in all 3 of our trading blocks. Rising petroleum-based specialty chemical costs negatively impacted our gross margin by 140 basis points period-over-period. Also contributing negatively to our gross margin by 50 basis points was the increased cost of aerosol cans. In addition, gross margin was negatively impacted by 10 basis points due to increases in other miscellaneous costs, primarily in the EMEA segment.”

Finally, he would comment that while they’re comfortable with the things that are within their control as it relates to guidance, “we acknowledge that there are some global dynamics that can impact our results that are entirely out of our control.”