Chipotle Mexican Grill (CMG) – Checking In

Ahead of earnings on Wednesday after the close, I wanted to share some recent commentary on what investors can expect, especially since the company presented at last month’s ICR Conference in Orlando:

BAML – On January 18th, analyst Gregory Francfort was out with a note following the ICR Conference in Orlando saying that investors were expecting a pre-announcement of Chipotle’s sales (and they were expecting solid comps with accelerating trends over the past several weeks). However, the company chose not to address near-term sales trends, instead “saving” that news for its 4Q earnings.

CEO Brian Niccol noted encouraging results from CMG’s loyalty program test which is seeing high utilization from infrequent and lapsed customers. Having lapsed customers in the program allows the company to test different levers to increase the frequency of these lower volume guests and get valuable data feedback on those tests.

Finally, thru-put is down to 25 transactions per fifteen minutes from the peak of 35 at the height of the brand’s operational efficiency. The company did not give a lot of tangible data points that were incremental to the story but noted that ex-stock comp G&A could be choppy in the short term but should reach 5%-5.5% relatively soon.

JPMorgan – After hosting meetings with CEO Brian Niccol, CFO Jack Hartung, Global Head of IR Ashish Kohli, and VP of Strategy Coralie Witter at the ICR Conference, analyst John Ivankoe wrote:

• Management highlighted the improvement in new unit volumes demonstrating the significant whitespace opportunity ahead for Chipotle (potential for ~5,000 units on a current base of 2,463 as of 3Q18). The company also noted that they will not open new stores to cannibalize existing store volumes.

• The slow use of digital-only pick-up windows will expand from a current 6 stores to an additional 30-40 new stores in F19. Pick-up shelves are in 14% of stores currently with national rollout expected by mid-2019 and “digitally enhanced” second make lines (currently in 40% of stores) will be fully installed by the end of 2019.

• In addition to national promotions around delivery, Chipotle has a loyalty program – currently in test in 3 markets: Kansas City, Columbus, and Phoenix. The company has been surprised at the level of light/medium user adoption and the high incidence of “banking” (saving) points as 50% of rewards have been redeemed vs norms of 90%. National loyalty should be at the company sometime during 2019, with initial thoughts that 10 transactions would lead to a free entree.

Cleveland Research – Said that Q4 comps are likely ahead of consensus with momentum continuing into the new year with a positive January.

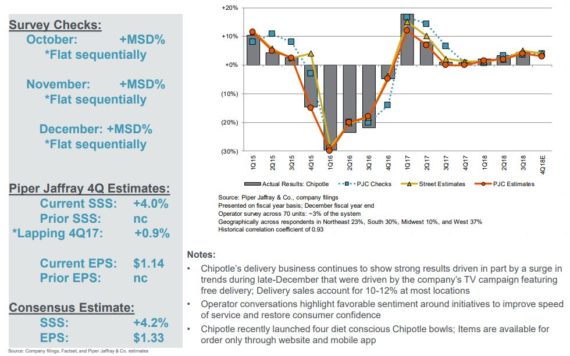

Piper Jaffray – On January 10th, analyst Nicole Miller Regan issued a note maintaining her Q4 comp estimate of +4.0% (vs. the street at +4.2%) following December checks that suggest the continuation of +MSD% trends. She would note that her checks could prove conservative as reported results in 3Q18 came in slightly ahead of their checks and they note that Y/Y trends were steady sequentially into 4Q17.

Then, on January 30th, Piper Jaffray was out with an updated note looking at the current 1Q19 period, where they believe investors remain focused on the opportunity for continued same-store sales momentum. Their recent checks suggest a continuation of +MSD% trends to date through January which builds off their last monthly checks that suggested a +MSD% trend in all three months of 4Q18. In addition, at the store-level, Piper believes operational momentum is building as the now fully formed management team continues to make a positive impact by aligning incentives with strategic goals.

RBC Capital – Last night, analyst David Palmer issued a preview note saying they believe Chipotle’s sales accelerated through the end of quarter driven by an early December price increase and Chipotle’s successful free delivery promotion during college football season. Despite their above-consensus SSS estimate, they are modeling below-consensus restaurant margins (RBCe 15.5% vs consensus of 16.0%) with COGS representing 33.2% of sales (consensus of 33.0%). That said, RBC wonders if they have been too conservative on margins since the company has said that the free delivery promotion was “margin neutral” (e.g. greater sales leverage and labor efficiency offsetting the delivery fee).