Fitbit (FIT) – Health e-Tracks

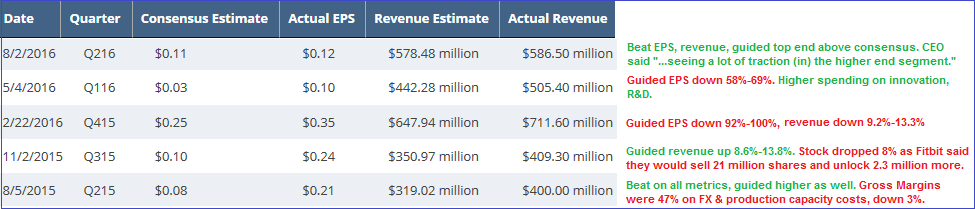

On August 3rd Fitbit (FIT) shares rose sharply on earnings. As was the case with the previous four reports, FIT beat EPS and Revenue estimates. This time however, management reaffirmed FY2016 guidance whereas in the previous two quarters, guidance had been lowered. They also broke form and did not issue any major negative news to impact share price. This was followed on August 29th by the unveiling of two new wearables models, one of which, the Flex 2, is water-resistant and offers swim tracking features.

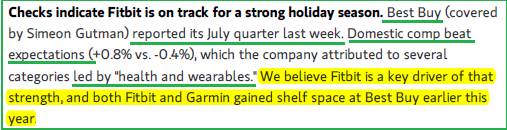

Interestingly, when Best Buy (BBY) reported their earnings on August 22nd, management mentioned that “Category trends were similar to 1Q, with growth coming from demand for health & wearables, home theater (TV), major appliances, and computing….”. There wasn’t any further elaboration, nor were there any specific questions by participants at the conference call following the earnings release.

A few days after that report, Morgan Stanley released an update on their Bullish FIT coverage with mention, among other factors, to BBY’s comment on wearables:

Their report continued on, stating that they believe “… most of the demand upside will be reflected in 4Q16, as retailers destocked legacy products in 3Q but will not finish restocking for the holidays by the end of 3Q”.

Can we substantiate this any further?

Unfortunately there isn’t a fool-proof method that doesn’t involve insider information (which I am NOT partial to..), however a quick Sherlock-esque dig shows three possible clues all pointing in the same direction.

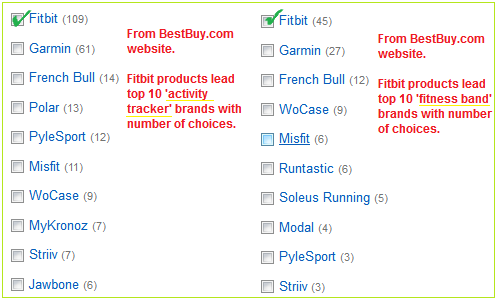

- Fitbit products have the most virtual shelf space on BBY website (US and Canadian) when “activity tracker” or “fitness band” is queried, the two search terms that consumers would most likely use:

- Amazon (AMZN) US’s Category Best-Seller query for “fitness tracker” shows top 14 of 18 items as Fitbit brand models, one Garmin brand and three other, dissimilar products. More likely than not, the probability is high that “fitbit” is used as a query term on retailer websites as well as Google (GOOG) increasing direct association with their products, similar to “kleenex” being used instead of “tissue“.

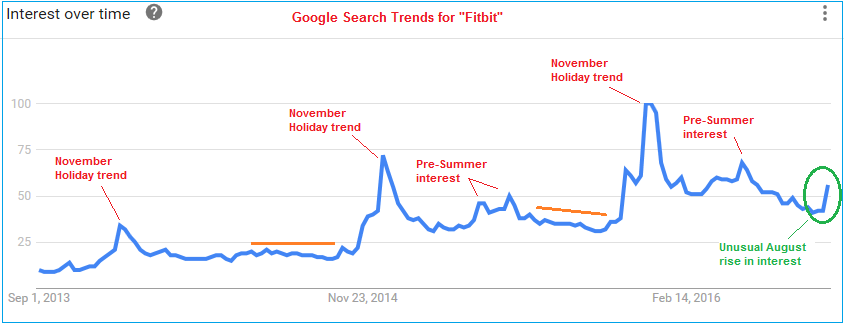

- The third indication of increased interest comes in the form of Google Search Trends as outlined below. Perhaps aspiring Couch Olympians decided to increase activity levels, as the trend shows a sharp increase right around Rio 2016’s time-frame. This could very well be reflected in next quarter’s numbers.

CapEx Diem

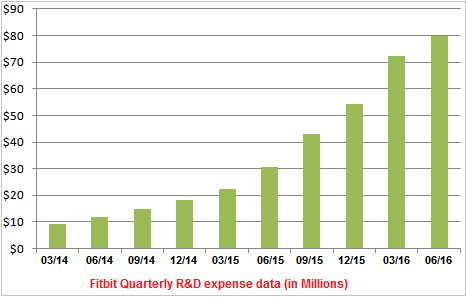

Sector competition has been heating up for the past few years and management seems well aware that complacency could be their downfall. Despite FIT’s increasing R&D expenditures reducing current bottom line, they are necessary for the company’s future growth.

Over the past two years, FIT has been spending increasing amounts of capital on developing new products as well as expanding their market reach. Although newcomers have increasingly nibbled away from their top market share spot, FIT still leads the way in terms of total units shipped at 4.8 million (1Q16), an increase of 1 million y/y. China’s Xiaomi holds the second spot at 19% market share, a decrease from 2015’s 22.4%, while shipping out 3.7 units for 1Q16. It should be noted that Xiaomi’s products are at the lower to bottom end of the market and sold mostly in China.

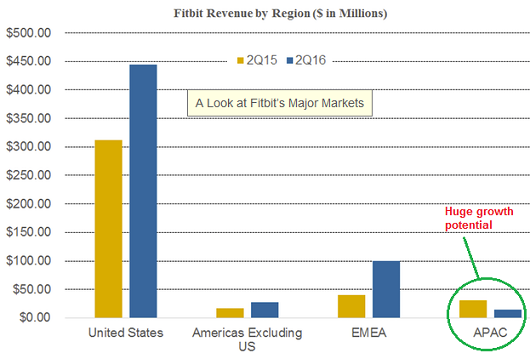

With 76% of FIT’s revenues coming from the United States, international marketing efforts are continuously being expanded with EMEA revenues showing 150% y/y increase for 2Q16. In Europe, FIT has partnered with “Let’s Dance”, Germany’s version of “Dancing With the Stars”, Europe’s corporate running series B2RUN series with an estimated 180,000 participants, and UK sports drink Lucozade, itself a major sponsor of events, teams and athletes.

The Asia-Pacific region might be FIT’s largest future market growth area. Presently APAC accounts for only 2% of revenues however this should change with their recent partnership with China’s Tmall, an online retail marketplace with over 180 million buyers. Tmall, incidentally, is owned by Alibaba (BABA). China has a higher percentage of online retail sales compared to other countries and this partnership should enable rapid sales growth in a market that can be challenging for foreign companies to break into.

Fitbit Group Health

FIT’s wellness unit is the company’s business-to-business unit, where participating enterprises provide employees with Fitbit activity trackers, challenge employees to get active, and encourage healthier lifestyles. It has grown over the last six years with the corporate wellness now adopted by over 70 of the Fortune 500.

Target (TGT) is the largest firm to date with over 340,000 employees receiving fitness trackers since 2015. Barclays (BCS) subsidizes Fitbit trackers to 75,000 employees with plans to expand to all of its 140,000 workers. IBM (IBM) has given out trackers to over 40,000 of their employees. There isn’t a comprehensive list of all the companies that are on board, a partial one from FIT’s website shows the following:

What’s in it for the employers?

Quite simply, as documented by many studies and academic research papers, a healthier staff means higher productivity and lower healthcare-related costs and days lost.

FIT CEO James Park mentions one specific company, San Francisco based Appirio, which bought fitness trackers for about 400 workers. Using data from the wearables, Appirio persuaded its insurer, to lower their yearly insurance costs by about 6%, or $280,000.

In the coming years, Park expects that more employers will use data from their employees’ Fitbits to negotiate lower rates with their health insurers, in fact there are provisions in the Affordable Care Act offering companies incentives to start wellness programs which could lead to decreased costs.

This segment is still seemingly in relative obscurity and contributes just10% to FIT’s revenue stream. It rarely comes up in research notes, in fact the Morgan Stanley note referred to earlier barely mentions it in passing, albeit under Potential Catalysts, saying “Enterprise and healthcare industry subsidies accelerate wearable adoption”. Rather cryptic, unless the reader is familiar with the connotation. BAML report from early August does not refer to Group Health at all.

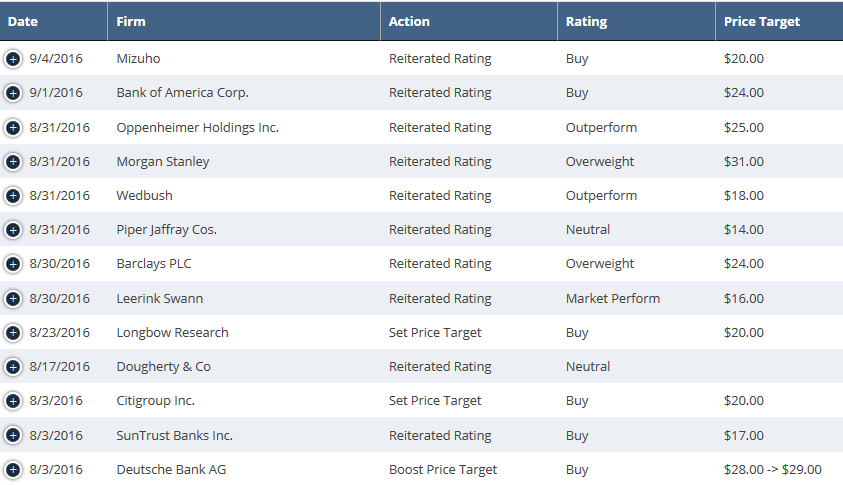

Recent Analyst Coverage

There has been a flurry of reiterations lately. Of 13 ratings since August, 3 are Neutral and 10 are Buy or better.

Options Activity

FIT options see plenty of daily activity. Two recent ones that stand out are:

- August 20th: 9,200 February 15 calls bought

- July 26th: 1,100 September 14 calls bought

Technical Observations

Price collapsed 56% at the start of 2016, bottomed right around $12 in march and retested same level in late June. Since the beginning of July, price has remained above rising trendline to present level. MACD and RSI have eased off slightly form their recent highs but could temper slightly further.

Final Thoughts

It’s clear that Fitbit management is not standing idle with a one-hit wonder. It doesn’t want to be the next Pet Rock, a novelty item that gets thrown in a drawer after the shine wears off. Hundreds of millions of dollars have been spent to ensure sustainability as an innovative company with future developments; R&D department staffing has been increased nearly threefold from 295 to 775. This upcoming quarter could very well show that Fitbit is re-inventing itself through new business segments and international market expansion.