Freshpet (FRPT) – All-Natural Checks

As a leading manufacturer of refrigerated dog and cat food, Freshpet specializes in all-natural, preservative-free products sold in company-owned refrigerators in all major retail channels including mass, grocery, club, natural and pet-specialty. The company is headquartered in Secaucus, New Jersey and manufacturers 95% of its products in-house at its Bethlehem, Pennsylvania facility.

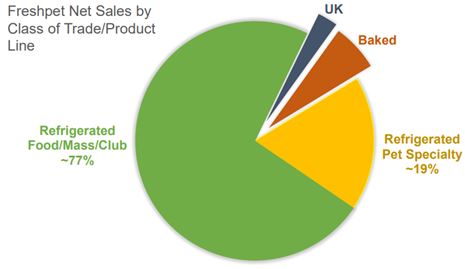

Per a recent earnings presentation, here is how sales are broken down:

For Jaguar Pro members, we last covered this name on June 15th after seeing the following option activity, which still remains in open interest:

– Buyers of 350 August 17.5 calls for $0.80 offer, approximately a $28,000 bullish bet

– Buyers of 200 November 17.5 calls for $1.40 offer, approximately a $28,000 bullish bet

It should be noted that earnings have been confirmed for Monday, August 7th after the bell.

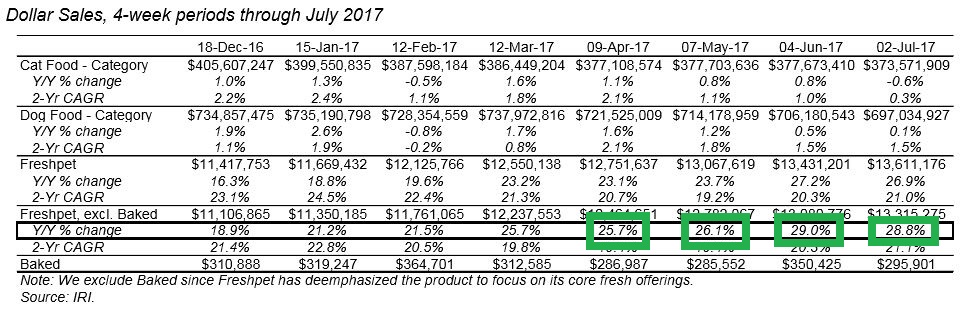

In the chat room that day, we also spoke about a Credit Suisse note in which they raised their price target to $15 on stronger sales trends via channel checks. At that time, Nielsen data indicated that Freshpet dog food sales in grocery and mass grew +25% compared to +24% in the 12 week period and +19% in the 52-week period, which were far better than the +15% top line revenue guidance the company provided on May 4th.

Fast forward to a note from last night in which Stifel said that “Freshpet’s growth in scanner data-tracked channels, which represent approximately 80% of total sales, has been accelerating, with nearly 30% growth in the three most recent 4-week periods compared to 23% in 1Q17 (Data Shown Below).”

Advertising Spend

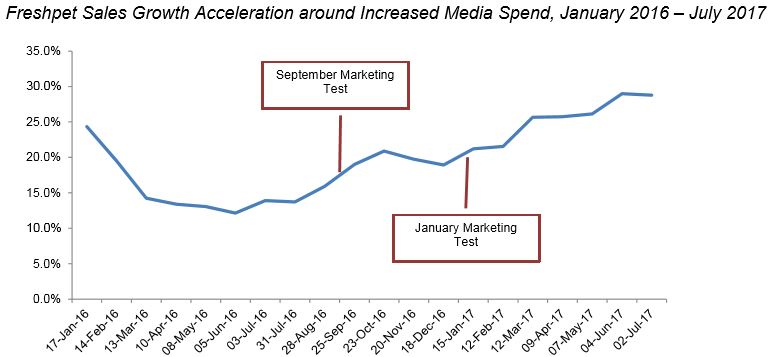

Back on June 15th, when we noticed the call activity in the chat room, we referenced a SunTrust Robinson research note in which the analyst pointed out that 2017 is a “transition year” in which FRPT plans to dramatically increase marketing spend (+50% Y/Y) in order to drive accelerating top-line growth.

Stifel, in their note last night, said Freshpet’s Feed the Growth program, announced in early 2017, uses higher advertising spend to drive awareness, trial, and customer repeat rates. By building a loyal consumer base, Freshpet aims to increase fridge velocity, distribution, and revenue, leading to leverage on manufacturing costs that can be reinvested into the business. The company expects the plan to generate sales growth of 15% – 20% between 2018 and 2020, resulting in the business reaching $300mm in sales and 23,000 stores by 2020.

On its 4Q16 earnings call, the company said it saw a strong correlation between increased spend and accelerating sales growth in short tests it had performed in September 2016 and in January 2017, and Stifel believes this is now playing out on a broader scale given the solid scanner data results we mentioned earlier. Overall, Stifel believes the accelerating results in tracked channels indicate increased marketing spend is helping drive awareness and increase same store sales and new store penetration.

U.K. “Call Option”

Finally, another interesting comment I noticed was when Stifel was talking about the company’s presence in the U.K. After a successful trial run last summer, Freshpet products were rolled out to 300 Tesco stores in the UK. The company has said it is encouraged with the early expansion but has limited its investment until a successful sales model has been figured out. Presently, Freshpet is treating its U.K. operations as an export market, supplying product from the U.S.

Notably, Stifel said that the company’s 2020 $300mm sales goal is not dependent on Europe or expansion into any other international markets. As a result, they believe a potential acquirer of the business is valuing Freshpet only for its U.S. sales, resulting in an implied call option on international expansion.