Insider Spotlight – Kratos Defense & Security (KTOS)

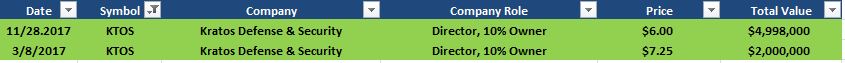

Bandel Carano, Managing Partner for Oak Investment Partners and a current Board member for Kratos Defense acquired 275,862 shares of KTOS at $7.25 for $2,000,000, according to the March 8th Form 4 filings. This is Mr. Carano’s first buy since last November, when he acquired 833,000 shares at $6.00 for $4,998,000 (Figures shown below).

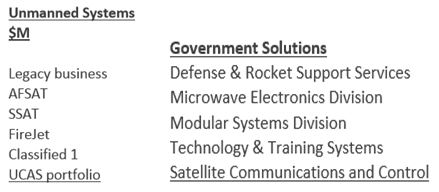

Kratos is a leading supplier of unmanned systems, satellite communications and training systems, microwave devices and other electronics and services for primarily national security (U.S. and international) and other markets. Here are the segments within the company:

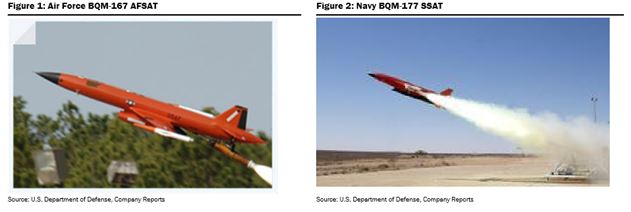

Within the company’s unmanned product portfolio, two important programs exist: The Air Force Subscale Aerial Target (AFSAT) and the Sub-Sonic Aerial Target (SSAT).

SSAT – Within this program, Kratos has the BQM-177A that provides threat emulation for air-to-air engagements. The company is anticipating a low rate initial production (LRIP) 1 contract in mid-2017, likely for approximately 30 aircraft at ~$1M each. A LRIP 2 contract is expected to be for 45 aircraft, with the program hitting between 80-100 in annual procurement levels at full-rate production in 2018-2019. According to Canaccord Genuity, margins would be best for KTOS early in the contract.

AFSAT – Within this program, Kratos has the BQM-167A whose primary role is to provide U.S. Air Force aviators with the world’s most realistic and comprehensive end-to-end weapons-release training. Under an initial $72M contract with the Air Force, KTOS is delivering production of 63 units over a three year period. Negotiations are underway with the Air Force, and Canaccord believes the company will receive the AFSAT contract for production lots 14-16 by the end of 2017, which will help lock in the volume for the fiscal 2018-2020 period. According to the Air Force, each BQM-167 costs $570k, but the real revenue to KTOS is ~$1M due to the fact that each BQM-167 also is sold with other items, such as chaff, flares, decoys, and select launch service.

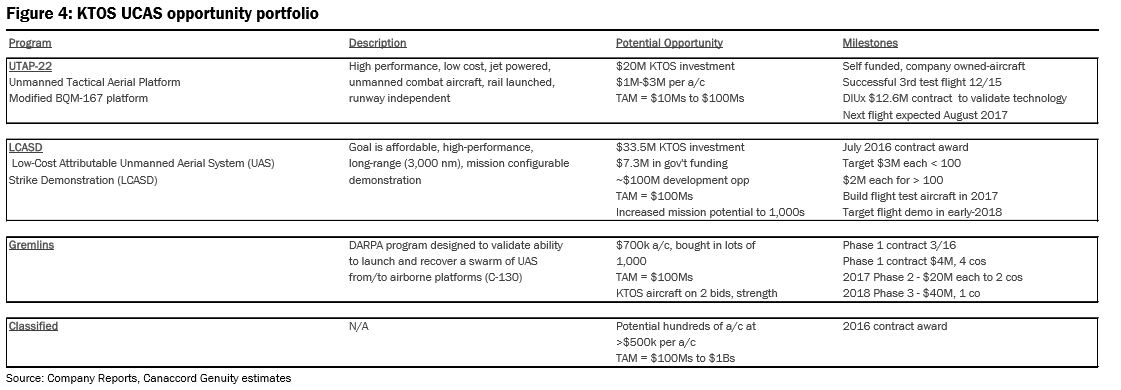

Kratos has also invested over $50M in building a portfolio of low cost, jet-powered, high-performance unmanned systems that can operate in contested airspace from a more near peer adversary. The primary opportunities KTOS is pursuing currently in this new market segment are the LCASD, UTAP-22, Gremlins, and a Classified program. On January 17th, in Canaccord Genuity’s initiation note, they provided a UCAS Opportunity Portfolio overview (shown below).

According to Canaccord Genuity, “the potential financial upside from this business is not included in the current financial outlook, but as this business evolves and the company continues to successfully execute on this strategy, we believe this initiative will be a strong driver for the stock. “

According to the company’s Investor Relations page, there are currently no upcoming events. The next catalyst would be Q1 earnings in early May.

The chart below does show that shares broke down below trendline support due to earnings and a secondary offering over the past couple of weeks. However, it should be noted that the company beat on both the top and bottom line, reaffirmed guidance, and reported sequential growth in its Unmanned Systems segment (+39.3%), Microwave Electronics segment (+30%), Defense and Rocket Support Services segment (+24.4%), and Satellite, Technology, and Training Solutions segment (+12.1%).