Insider Spotlight – PetIQ (PETQ)

PetIQ is a distributor and manufacturer of pet care products, including veterinarian-grade prescription (Rx), over-the-counter (OTC), and health and wellness products for dogs and cats.

After being founded in 2010, PETQ has successfully introduced products into all major retail channels, such as mass, food and drug, clubs, pet specialty, online, and pharmacies. More specifically, some of its retail partners include: Wal-Mart (WMT), Sam’s Club, Costco (COST), PetSmart, Petco, Kroger (KR), Target (TGT), and BJ’s Wholesale Club, as well as more than 40,000 retail pharmacy locations.

Per the Jefferies initiation note, here is snapshot of the company’s Product Portfolio:

As the title of this report suggests, I decided to take a closer look at this company based on Form 4 filings from May 22nd that showed Director Ronald Kennedy acquiring 20,200 shares at $17.88, a total value of $361,176. Mr. Kennedy has been in this role with the company since 2010. It should also be noted that this is first notable insider buy since the company’s IPO back in July 2017.

![]()

By now, most investors realize that there are a number of favorable trends/studies driving growth within the animal pet health and medication industry. Here are a few examples:

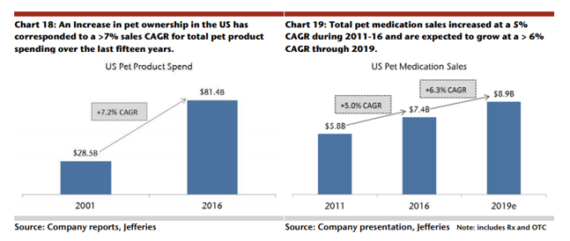

• In its 2016-17 Pet Market Outlook Report, Packaged Facts indicates that Americans spent $81.4B on pet products and services in 2016, nearly triple the 2001 spending of $28B, and forecasts the spending category to increase to $101.3B by 2021, suggesting a 5-year compound annual growth rate (CAGR) of nearly 5%.

• Per Jefferies, within the pet medications space, pet owners are shifting purchases to retail (including online) and away from non-veterinarian-grade products to premium products that PetIQ sells. As a result, PETQ’s total addressable market (TAM) in the US vet recommended pet care products (or pet medications) industry is large at an estimated $8.4B as measured across all channels (including the vet channel).

• The flea and tick category, which accounts for close to two-thirds of PETQ’s sales, has similarly grown at a >7% CAGR since 2006.

• Brakke Consulting suggests that the much-discussed millennial generation is less trusting of their vets (64% vs. 70% for Gen X and 78% for Boomers), tend to comply less with their vet’s recommendations (67% vs. 70% for Gen X and 79% for Boomers), and feel less of a sense of loyalty to their vet (55% vs. 59% for Gen X and 63% for Boomers). Unsurprisingly, millennials want more choice in where they fill their scripts for their pets (62% vs. 54% for Gen X and 45% for Boomers) and tend to visit the vet less often (17% vs. 12% for both Gen X and for Boomers).

Q1 Earnings Commentary

On May 15th, the company would report its Q1 earnings in which it missed on EPS (-$0.14 vs $0.04 estimate) but beat on Revenue ($115.1M vs $108.58M estimate). Management would go on to say that Q1 Net Sales increased 71.7% Y/Y. The stock would ultimately close higher by 4.59%.

Looking at specific commentary from the earnings call, the two most frequent topics revolved around its Flea & Tick category and its VIP Petcare acquisition.

Flea & Tick – CEO McCord Christensen, in his opening remarks, would comment, “This past quarter there’s been a lot of discussion about the slow start to the flea and tick season, all of that is very warranted based on the extremely cold spring we have had across the country and Nielsen data measured accounts reporting that flea and tick category was down 18% compared to last year.”

“The first thing I want everyone to understand about our company is only 36% of our sales in Q1 were in Nielsen’s measured sales channels, the 64% of our sales that was in unmeasured sales channels dramatically outpaced the measured flea and tick customers.”

McCord Christensen would go on to say, “Scan data through the register across all accounts both measured and unmeasured, and the significant replenishment order as we’ve seen the 1 of May kick-in leads us to feel very comfortable that not only did the trend we saw in Q1 that allowed us to have such incredibly strong sales quarter. We’re seeing some of the best days we have seen in the history of the company with last Friday being the most significant number of flea and tick orders we’ve received in the history of the company in a single day.”

VIP Petcare – On January 8th, 2018, PetIQ announced it had entered into a definitive agreement to acquire VIP Petcare for $220M, a leading provider of veterinary wellness and pet preventive services, as well as a distributor of pet wellness products and medications. They provide a comprehensive suite of services at its 2,900 community clinics and wellness centers hosted at local pet retailers across 31 states, which includes diagnostic tests, vaccinations, prescription medications, microchipping and wellness checks.

Oppenheimer analyst Brian Nagel has said that the merger with VIP Petcare meaningfully enhances the positioning of the legacy distribution business of PETQ in that it affords the operator a presence in the vet category, and hence a better claim on once channel-exclusive items.

On the Q1 earnings call, SunTrust Robinson analyst Bill Chappell would ask management if they could provide an update on this new business and whether or not they had heard from specific retailers since the deal was announced.

CEO McCord Christensen would start off by saying that this year, the company was given a range of 20 to 30 new units (i.e. clinics). “It’s unlikely that we will surpass that 20 to 30 units when you think of lead times on reviewing sites. Leases and all the stuff that needs to happen. And the other part is, us being responsible in allowing ourselves to gauge the success of the clinics and how they’re performing to make sure we’re seeing the right activity and replication that we’ve seen in past models.”

Finally, he would go on to say that in the first quarter, they opened up 3 wellness centers, two VetIQ Wellness Center and one VIP Wellness Center. So far in Q2, they’ve opened up another 9 wellness centers and they’re on track to have all 20 locations open by the end of the quarter.