IXYS Corporation (IXYS) – Power On

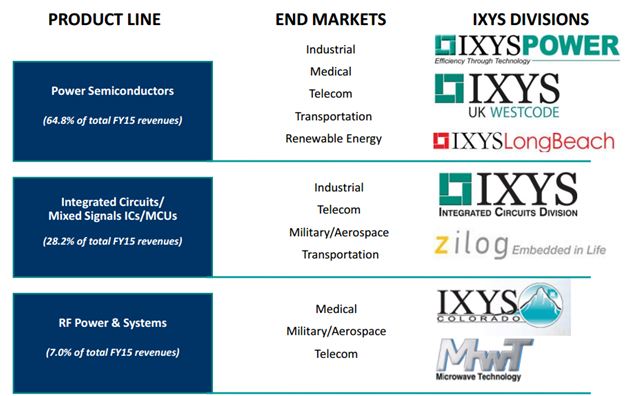

IXYS is an integrated semiconductor company that designs, produces and sells products whose ultimate aim is to convert high voltage electrical current into closely regulated, manageable and steady power used to drive electronic devices. It currently has a niche in the growing market for high-voltage power management discrete semiconductors and integrated circuits (ICs), along with radio frequency (RF) power devices and systems. The company’s reputation for quality and reliability has sustained the franchise and facilitated entrance in industrial and commercial, consumer applications, telecom infrastructure, medical, telecom infrastructure, and transportation end markets, which comprise 43%, 14%, 14%, 10%, and 5% of sales, respectively.

Deals, Deals, Deals

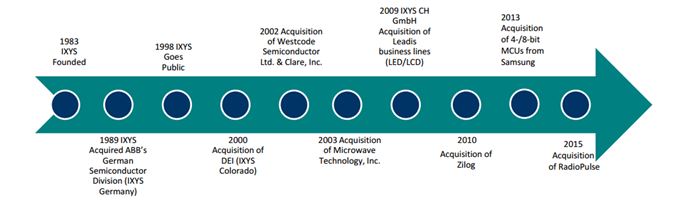

Per Sidoti, IXYS acquired 10 companies or business units during its history in an effort to offer a lineup of power management chips of unmatched breadth and technical performance and to acquire trailing-edge manufacturing assets at a fraction of their original cost. Acquisitions in the past eight years mostly served to augment IXYS’s core discrete franchise with microcontrollers that allow the company to market power management solutions rather than just the key components. The first deals came in 2009 and 2010 with the purchase of Leadis Technology’s LED and LCD drivers for $4M and the acquisition of publicly-traded Zilog for $62M. IXYS added to its microcontroller product range and customer base via the purchase of Samsung’s 4- and 8-bit microcontroller business in June 2013 for $50M. The latest acquisition came in May 2015 when IXYS closed on RadioPulse, a South Korean manufacturer of wireless communication chips and modules for $16M that expanded an existing RF product footprint.

Current Operations

The company has four in-house fabrication facilities (fabs) that provide approximately 50% of production capacity. This includes:

• A 100,000 square-foot leased facility in England for high-voltage bipolar devices

• A 30,000 square-foot leased fab in California that produces a specialty line of gallium arsenide RF power semiconductors.

• Two owned facilities of 170,000 square feet in Germany and 83,000 square feet in Massachusetts produce bipolar (e.g. IGBTs) and high-voltage driver ICs, respectively.

Management thinks that the use of external producers gives the company access to competitive technologies and pricing, while enhancing flexibility to ramp up production when demand accelerates. As with most others in the power semiconductor industry, IXYS makes most products with proven technologies at least one generation or two removed from leading-edge fabrication technologies. This controls costs, helps ensure adequate capacity in third-party fabs and reduces risks to IXYS’s supply chain.

Growth Potential

A return to growth in core industrial markets in Europe, Asia and the U.S., or emergent arenas likely would provide IXYS with the topline catalyst that many investors seek. In a research note, Sidoti thinks IXYS’s revenue has stabilized and that there are several promising opportunities for growth:

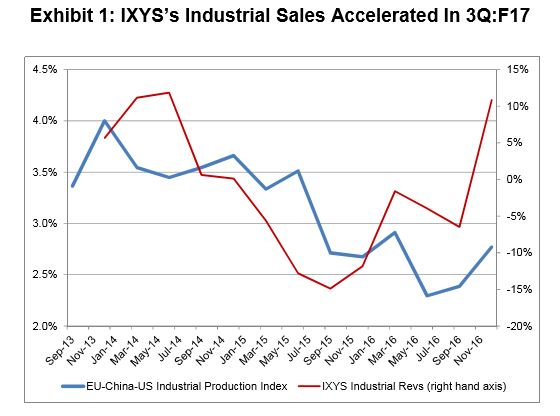

• Industrial and commercial revenue for IXYS recently emerged from a period of Y/Y declines. They note that the declines coincided with a decelerating industrial production index for the most relevant industries for IXYS spanning the EU, China and the U.S. IXYS’s industrial and commercial revenue increased 11% in 3Q:F17 (Exhibit 1), following an annual decline of 6.5% in 2Q:F17. The improvement coincided with acceleration in the global industrial production index to a 2.8% year-over-year increase in 4Q:C16. This provides reason for optimism that a period of decelerating industrial production in IXYS’s most relevant markets has subsided and, perhaps, begun a return to sustainable growth.

• IXYS has an established foothold in various end use applications ranging from electric vehicles, to mass transit and infrastructure-related projects such as power transmission upgrades in Asia. The company also has exposure to various applications related to the Internet of Things (IOT), supplying power management components to a growing number of “things” to be outfitted with sensing, monitoring and control elements as part of the IOT phenomenon.

• IXYS also has good exposure to the ramping up of data management that seems likely to grow rapidly irrespective of IOT. Global telecom equipment provider, Ericsson (ERIC), forecasts that fixed Internet traffic will grow at 20% CAGR from 2016 to 2022, and projects 45% growth in mobile data traffic in the same period. Western European and North American usage per smart phone appears set to lead the world with usage rates reaching 22 GBs and 25 GBs per month by 2022, compared with 2.7 GBs and 5.1 GBs estimated for 2016. IXYS would benefit from the necessary build-up in telecom infrastructure to handle this data growth given the company’s exposure to server power supplies, uninterruptible power supply systems employed at most facilities, related back-up electrical generators and climate control systems utilized to cool server farms.

From my findings thus far, the only coverage on this name is from Sidoti, who initiated coverage on April 6th with a $16 price target.

Per the company’s Investor Relations page, the next catalyst will be its presentation at PCIM Europe (Power Conversion and Intelligent Motion) starting on May 16th and running through the 18th.