Lululemon (LULU) – Apparel in Peril?

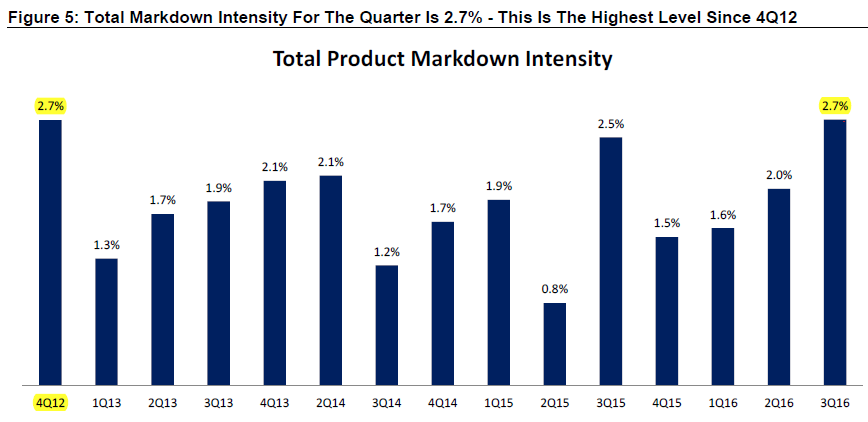

Two recent analyst reports have identified possible inventory and sales pressures at Lululemon (LULU) during this quarter. Both BMO and Credit Suisse point out a rapid increase in markdowns starting about halfway through the period, and at an intensity registering its highest level in the past 14 quarters, going back all the way to 4Q2012. The 2.7% rate calculated by CS is higher than last quarter’s 2.0%, and also higher YoY’s 2.5%.

Last quarter, LULU management decision to maintain price levels was presumably an attempt to defend brand perception and seemingly it did work out favorably as its gross margin saw a 260bps expansion YoY (49.4% 2Q16 vs. 46.8% 2Q15). However, despite this increase, earnings missed the mark in same-stores growth, which management partly blamed on macro environment.

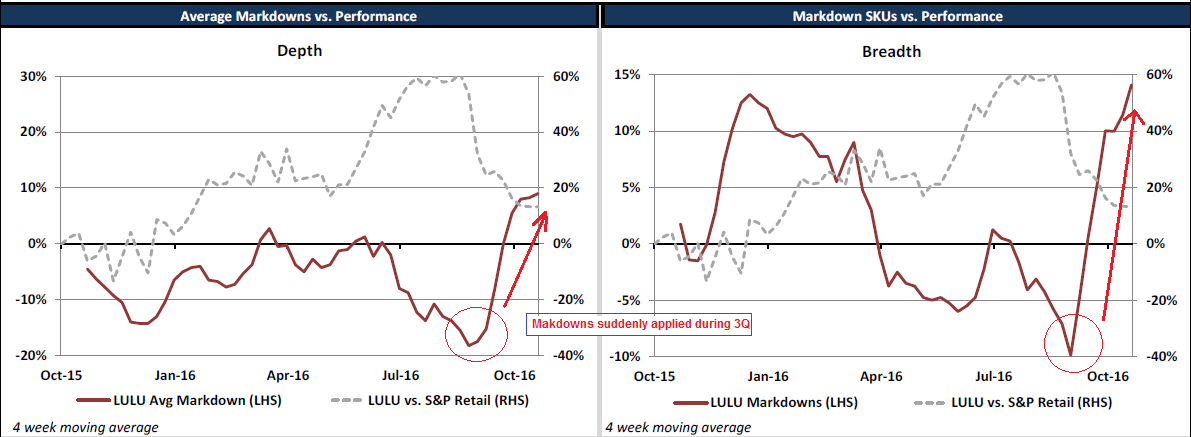

Spike in Discounts

LULU started 3Q with 7% of its women’s tops on sale in August. The number of sale items escalated quickly in September to 13% and even higher to 16% in October. This is nearly double the historical average rate of 8-10%, and understandably a concern.

In their other core apparel categories, markdowns are about par with last quarter in sports bras and pants, with outerwear’s discounts remaining lofty but down from highs. CS notes that these numbers are within expected range of season-closing inventory clearance averages.

Men’s categories have fared better, down from the past two quarters that saw heavy discounting. Only 8% of outerwear is discounted this quarter, compared to 16% in 2Q and 20% in Q1.

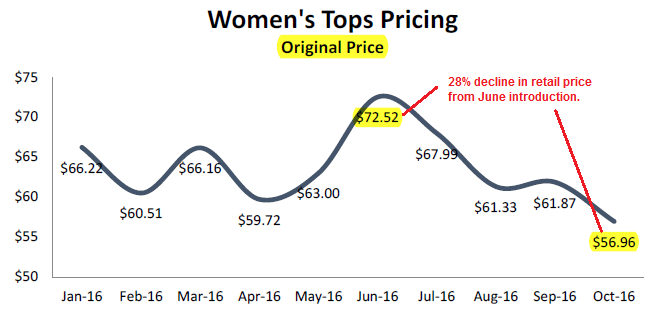

Drops in Original Pricing

Full-price selling of new items introduced in June saw resistance and LULU subsequently lowered retail by 28% over the course of the quarter. With new fall item arrivals, the price drop appears to have been necessary and it could be surmised that the particular product line wasn’t well liked by devotees of the brand. Additionally, there is increased market saturation to contend with as other manufacturers and retailers enter the athletic apparel segment, decreasing LULU’s share.

While pricing was maintained last quarter, this time around lower demand resulting in higher inventory seems to have forced their hand into dropping levels.

SKU Skew

In an effort to curtail and rationalize unprofitable or low-selling product lines, LULU management has been reducing their SKU count on both women’s and men’s categories. Overall counts are down 39% YoY and 32% since last quarter, broken down into 44% decline for women’s apparel, and 23% for men’s. This can be construed as a means to increase merchandise margins through inventory control and better sourcing.

Technical Observations

Share price has not recovered from last quarter’s drop and is threatening to break down from Bollinger bands.

Final Thoughts

Can Lululemon retain its loyal clientele and add new ones? They are known for product quality, which translate into higher prices, limiting client base. It also exists in an increasingly competitive market segment that it was the front-runner for, practically creating the “athleisure” moniker. While margins are well off early-years’ highs, they seem to have stabilized in posting large declines.

Peers in apparel group have been reporting declines in sales, with off-price retailers being the ones posting gains. Needless to say, the main concern is why the sudden turn in pricing and discount level, and how this decision will impact earnings announcement on December 7th.