Mohawk Industries (MHK) – Flooring: It’s What They Do

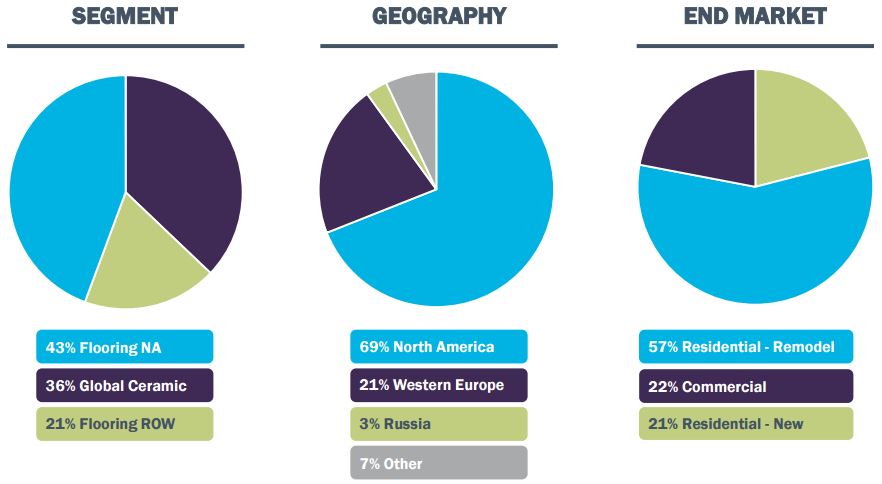

Based in Calhoun, Georgia, Mohawk Industries is the largest total flooring manufacturer in the U.S. and the second-largest producer of carpet. The company sells a wide array of products including ceramic tile, carpet, rugs, hardwood, laminate and vinyl to more than 34,000 customers, ranging from home centers to carpet retailers and to mass merchandisers and department stores. Per the company’s Q1 Investor Presentation, here is how revenues are broken down:

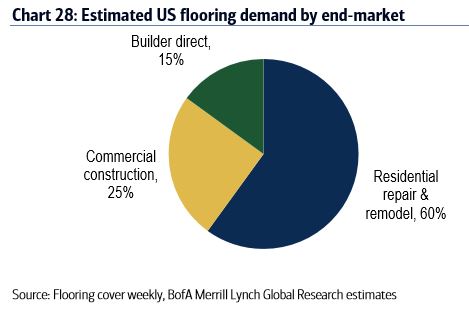

According to Flooring Cover Weekly , flooring is roughly 60% exposed to residential repair and remodel activity, 25% to commercial construction and 15% to builder direct (Chart shown below). In terms of distribution, specialty stores account for 48% share, with contractors contributing roughly 22% and home centers such as Home Depot (HD) and Lowe’s (LOW) at roughly 15%. By product type, the US flooring industry consists of about 46% carpets and rugs, 16% hardwood, 14% ceramic, 13% LVT and sheet vinyl and the remainder a mix of laminate, stone and other.

Trends in the US flooring industry include a shift away from soft surfaces (carpet) to hard surfaces (wood or ceramic), a preference for longer rectangular tiles, longer and wider planks, and resilient surfaces such as luxury vinyl tile (LVT). Also, while carpet demand has been in structural decline for decades, the introduction of softer fibers and stain resistant technologies has seemingly stimulated renewed consumer interest. Furthermore, the industry has become more focused on renewable resources, with recycled plastic bottles used as a key input in the carpet manufacturing process.

On April 28th, Mohawk reported Q1 earnings in which EPS came in-line at $2.72 and Revenue came in at $2.22B vs $2.27B (a slight miss). Looking at its major segments:

Global Ceramic – Sales increased 2% with operating margins increasing 15%. Sales growth was impacted by customer inventory adjustments, weather in Russia and Europe, and a weaker Mexican Peso. However, management commented that customer purchasing patterns are now normal and sales growth is increasing. Price increases have been announced in North America for the end of the second quarter to offset rising costs, which impacted the quarter by $9M. In the U.S. the company plans to open 18 to 20 ceramic tile or stone centers to expand distribution.

Flooring North America – Sales increased 4% and operating margins increased 10%. Hard surface products, particularly LVT and premium laminate, continue to expand and grow the fastest. Productivity and volume both added benefits of $13M and $5M, respectively. Investments are being made, including a new LVT line that is expected to startup in the fourth quarter, to increase capacity and lower costs.

Flooring ROW – Sales were up about 3% but margin contracted about 100 bps due to higher material costs ($11M) and currency fluctuations ($5M) that more than offset the $10M of productivity gains. Price increases were announced as well as news that Laminate capacity would be increasing with new equipment installations.

In addition, on its earnings call, the company announced plans to invest $750M to expand capacity in the form of new plants, lines, marketing, and startup costs. During the quarter the company entered the European carpet tile and countertop market and the Russian sheet vinyl market. Also the company purchased a mine for the U.S. ceramics operation. All totaled, the price was $270M plus future investments to optimize them.

Following the company’s earnings, certain sell-side provided their commentary:

Stifel – Analyst John Baugh said that Mohawk’s shares were under modest pressure likely due to 1) Recent share price strength 2) An in-line quarter on earnings that missed slightly on revenues and 3) lower than Street consensus Q2 EPS guidance. On the latter point, our estimate heading into the Q1 print for Q2 was $3.58 which is comfortably within the guidance given by management. In other words, the Street had modeled Q2 incorrectly.

Robert W. Baird – Analyst Timothy Wojs said Mohawk results were in line but fell short of high expectations as revenue timing and higher raw materials costs created a near-term price/cost mismatch. He believes the mismatch will be made up in the second half of the year as the company reiterated its full year guidance. Wojs reiterated his Outperform rating and raised his price target to $262 to $245 on Mohawk shares.

RBC Capital – Analyst Robert Wetenhall reiterated his Outperform rating and raised his price target to $267 and said in his opinion, the transitory earnings shortfall implied by 2Q17E guidance will be offset by larger gains in 2H17E which should result in full-year earnings performance that is consistent with management’s expectations. Favorable tailwinds, strong execution, and a history of accretive M&A activity support our Outperform recommendation.

Home Depot Read-Through

Lastly, another positive factor to consider is last week’s commentary from Home Depot’s earnings call. On it, Executive Vice President of Merchandising, Ted Decker would say, “All our merchandising departments posted positive comps. Appliances, Lumber and Flooring had double-digit comps in the quarter. Looking at big ticket sales in the first quarter, transactions over $900 which represent approximately 20% of worldwide sales were up 15.8%. Few drivers behind the increase in big ticket purchases were Appliances, Flooring, and Roofing.”

Keith Hughes of SunTrust would follow up by asking about the double-digit categories specifically flooring. He asked, “Could you just highlight what appears to be well above the industry? Could you talk about what’s working there? What’s allowing you to gain share?”

Ted Decker would respond with, “We have a nice mix there. The hard surface flooring had been much stronger over the past couple of years, and we’ve done a lot of work in our showrooms with hard surface flooring particularly with tile and laminate. But recently vinyl plank has been taking off, so luxury vinyl plank manufacturers are now putting a solid core in the products, so you can get much greater use cases about final product. And the efficacy of it and the look is getting better and better and that is selling very well.”