Monro Inc (MNRO) – All Inclusive Auto Care

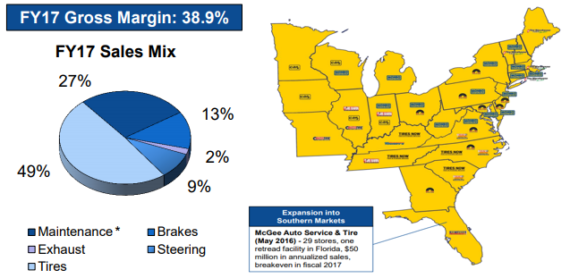

Formerly known to many investors as Monro Muffler Brake, Monro Inc. is a regional chain of roughly 1,000 company-operated stores providing automotive undercar repair and tire services in the United States. Stores are primarily located along the East Coast and Midwest with Monro’s core store base anchored in the Northeast market (Revenue Breakdown and Locations Shown Below).

Back on December 18th, we highlighted the following call roll in the chat room:

-4,000 January 55 Calls Sold to Close for $2.15

-4,000 February 60 Calls Bought to Open for $1.53

These options will cover the company’s Q3 earnings report, which historically takes place at the end of January/beginning of February.

Q2 Results & Commentary

While the company beat on the both the top and bottom line in the second quarter, it also reported:

-Sales increased 13% Y/Y

-Comparable Store Sales decreased 0.4%

-Comparable Store Sales for Brakes increased 6%

-Comparable Store Sales for Front End/Shocks increased 2%

-Comparable Store Sales for Alignments were flat

-Comparable Store Sales for Tires decreased 2%

-Comparable Store Sales for Maintenance Services decreased 2%

Jefferies analyst Bret Jordan, in a post-earnings note would say, “As regional trends were consistent with prior Q’s, (South stronger/North-central weak), MNRO should eventually benefit from easing regional hurdles, while commentary around increasing supplier incentives bodes well for a trough in the current Q3. Management noted sequentially more aggressive discounting from tire supplies facing weak demand and increasing production, which we expect could be applied to increasing traffic via customer discounts or capturing incremental margin in a category representing 45% of sales.”

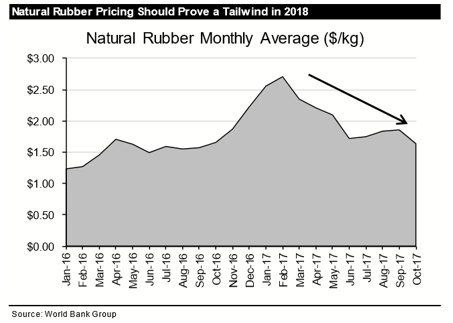

In a channel checks note from November 29th regarding the tire industry, KeyBanc would say, “Natural rubber pulled back to $1.64 from a $1.81 average in 3Q17 and we maintain that the 2018 outlook remains positive as raw material prices are leveling off and should prove a y/y tailwind in 2018.”

In addition, CEO Brett Ponton would lay out 5 strategic areas of focus for the company:

1. Improving Store Operations

2. Re-focusing Marketing Efforts

3. Employee Development/Retention

4. Expanding Omni-Channel Initiatives

5. Continued M&A

It should be noted that on December 15th, Oppenheimer analyst Brian Nagel was out with a note after meeting with senior management. Some of his takeaways included:

1. MNRO is now very focused upon updating and enhancing the overall store experience and upon working to better connect with customers, all in an effort to improve traffic.

2. MNRO remains committed to its growth through acquisition model, and is using a “tax legislation-driven lull” in purchases to begin to aggressively implement new operating procedures in existing stores.

3. Management continued to indicate that it views recent sales weakness in the sector as due largely to cyclical factors, such as weather and dislocations in the car parc.

Overall, Oppenheimer walked away from their meeting with MNRO even more encouraged in the strategic direction of the company. No doubt, cyclical pressures exist. That said, in their view, MNRO has for a while been too lax regarding its store experience. The enhanced efforts of CEO Ponton should go a long way in leveraging an already industry-dominant supply chain infrastructure. Finally, as they look toward 2018, Oppenheimer is turning increasingly optimistic toward the potential for the broader Auto Parts retail sector to rebound, given lagging stock prices in 2017 and indications for a strengthening demand backdrop.

Amazon Talks

Last, but certainly not least, the biggest takeaway from the company’s Q2 call revolves around Amazon (AMZN). CEO Brett Ponton would comment:

“We are in discussions with Amazon currently right now. I have a tendency to move a little bit slower and methodical in that discussion for 2 reasons. One, I want to make certain that we have the technology capability lined up to deliver a good experience as we move into test. We want a good experience for the consumer, number one. And also a good experience with Amazon, number two. So we are in discussions with them. We’re in process of building our capability to make certain that this experience can be seamless, which is requiring a little behind the scenes work from a technology point of view to make that happen. But we intend to support that program.”

Ever since this comment was made, I have not seen any updates from the company or sell-side analysts. With earnings a month away and option traders rolling their position into February, we may get additional clarification on the Q3 earnings call. Stay tuned!