Oxford Immunotec (OXFD) – TB, or not TB….

Oxford Immunotec (OXFD) is a global manufacturer and supplier of tuberculosis and other immune-system affecting testing kits, it also provides diagnostics for the collected samples either its own laboratories or through partnered companies.

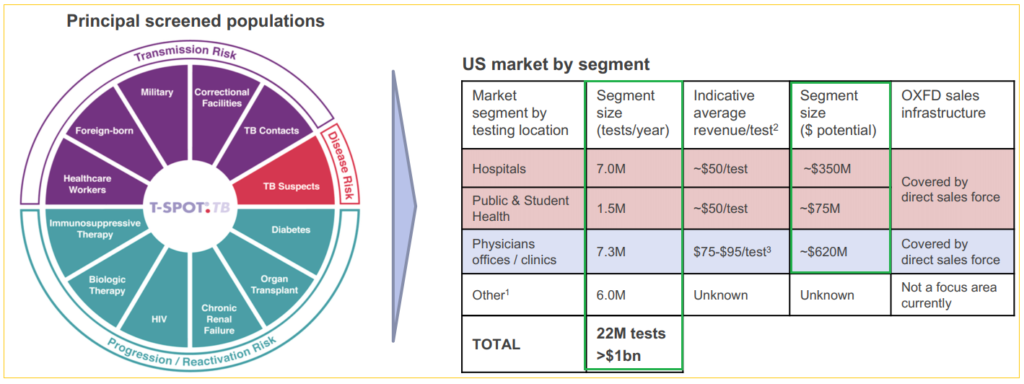

In 2017, 10 million people worldwide were afflicted with tuberculosis resulting in 1.6 million deaths, including 230,000 children. 9,105 cases were reported in the US which have caused around 520 deaths per year for the past decade. California, Texas, New York and Florida account for almost 50% of all US cases, although the national incidence of infections has continued to decline, remaining under 10,000 since 2012.

About 25% of the world’s population has latent TB, meaning the bacteria have infected them but they have not yet developed the disease: it also means that they cannot transmit the condition to others. Of those with the virus, 5%-15% run a lifetime risk of falling ill with TB and certain population groups, such as those with HIV, diabetes, malnutrition and tobacco users, have a much higher incidence of being affected by the condition.

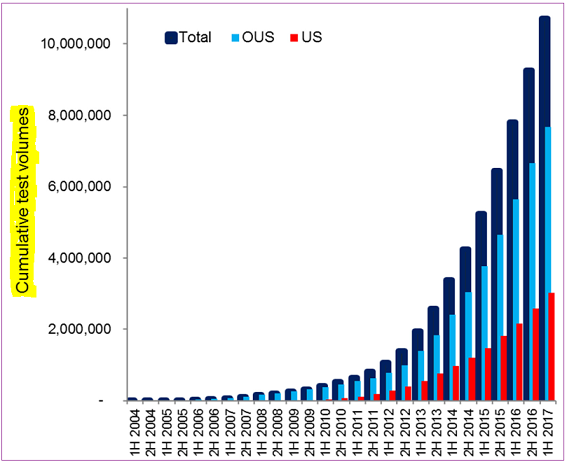

Globally, over 50 million latent TB tests are performed every year and the estimated market potential is over $1 billion. Comparatively, Oxford processed 850,000 TB and Tick tests in the US in the twelve months to September 2018.

Last Quarter

On July 31st, Oxford reported 2Q2018 earnings. Management announced that the TB business had resumed double-digit growth rate in all major geographies, returning record quarterly revenue overall. With recent changes and expansion of testing programs, management believes there is ‘substantial headroom’ for continued TB market growth as the market share penetration of IGRA tests is low.

Select metrics (note that Tick-borne disease business was subsequently divested):

- 12% YoY revenue growth to $29.3M, largely in-line with expectations with both TB and Tick-borne disease rising sharply sequentially

- TB revenue was up 17% YoY to $25M, strongest growth in the business since 2016

- Tick-borne and other businesses declined 9% YoY

- US revenue grew 10% YoY on TB strength which resumed double-digit growth, also posted strongest growth rate in six quarters

- Europe and rest of the World revenue grew 17% YoY, driven by strong TB performance in core European markets, especially in the UK

- Asia region revenue grew 16% YoY with strong acceleration in testing

- Launched T-Cell Select in Europe

Business Segments

Last year, Oxford sold over 250,000 TB tests in the US, and nearly 650,000 tests in rest-of-the-world markets, including kits and tests that were processed at their UK location. Management sees US latent TB testing growth rate to be sustainable for ‘at least’ the next couple of quarters, and they are equally optimistic about the other major geographic regions. The company remains the dominant TB market player in the UK with more headroom to grow into.

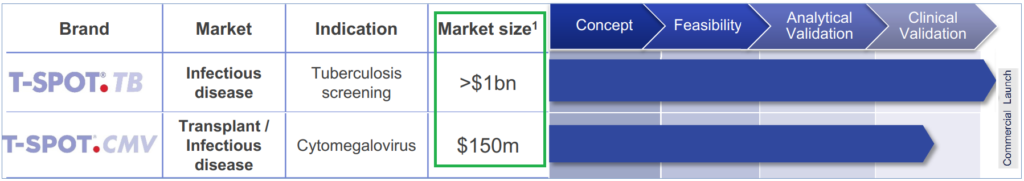

Oxford Immunotec manufactures the following products:

- T-SPOT.TB Tuberculosis Interferon Gamma Release Assay (IGRA) testing kits

- T-Cell Select reagent kit that allows storage of T-SPOT-TB sample for up to 54 hours, at room temperature, before processing. This is beneficial in situations where the testing facility is not nearby.

- T-SPOT.CMV Cytomegalovirus (CMV) assay kit

The company also performs laboratory services in the UK, and up to this quarter provided the same service in the US before selling the business.

Tariffs Inconsequential

Oxford manufactures all of their test kits that get sold to China at their UK location. As such, it is not subject to US-China trade war issues.

US Lab Divestiture

On September 25th, Oxford sold its US Laboratory Services business to Quest Diagnostics (DGX) for $170M in cash, a transaction that also included their T-SPOT and Acutix Tick-borne disease testing services. Oxford will sell TB test kits to Quest Diagnostics under a long-term supply agreement, and both companies will collaborate to drive continued growth of T-SPOT use.

Upon closing of transaction, Oxford’s US revenues will be solely derived from product revenue and management expects to provide FY2018 guidance at that time.

Oxford will use part of the cash proceeds to pay off its $33M outstanding debt, after which it will become debt-free.

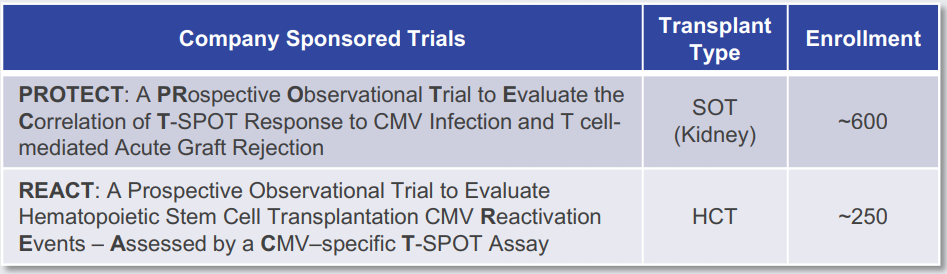

CMV Trials

Mid-year data presented at the American Transplant Congress and also at the Transplantation Society Meeting showed the accuracy of the T-SPOT.CMV assay to measure the strength of the T cell response against Cytomegalovirus (CMV) and predict infection risk.

CMV is a common virus that can infect almost anyone, and it remains in the body for life. Since the virus rarely causes problems in healthy people, most of the infected aren’t even aware of its presence. However, those with weakened immune systems and persons receiving organ transplants can potentially suffer illnesses and possibly death from the effects of the virus, and pregnant women will pass it to their child and one in ten newborns can develop lifelong issues, including deafness, poor eyesight, intellectual disabilities and organ enlargement.

Homeland Security Requirements

As of October 1st, US Citizenship and Immigration Services (USCIS) has required that all US civil surgeons must use TB blood test (IGRA) as the initial screening method: the Tuberculin Skin-Testing (TST) method will no longer be accepted. This is expected to drive additional business to Oxford as the T-SPOT.TB test is IGRA.

Worldwide, IGRA method is recommended in at least 34 countries, including Japan, China and many in the Europe and overall the testing method has just 15%-20% penetration, presenting a large potential.

Closing Thoughts

Conversion of TST to T-SPOT.TB testing will increase market access for Oxford and the company also expects growth to continue going forward from abated immigration restriction headwinds. T-Cell Select introduction last quarter with US launch soon to follow is another source of revenue that compliments TB test kits and, lastly, new CMV tests contributing to revenues in 1-2 years all make a compelling case for a visible path towards profitability.