Patterson Companies (PDCO) – Earnings Preview

On Thursday, before the open, Patterson Companies will be reporting their Q118 earnings and Wall Street is expecting EPS of $0.44 and Revenues of $1.35B.

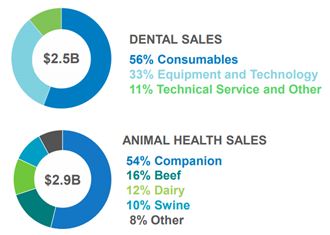

As a quick overview, Patterson Companies currently operates in two segments: Dental and Animal Health (Medical business was sold back in 2015 to Madison Dearborn Partners for $715M). This preview note will focus its attention solely on its Dental segment.

Back on May 25th, the company reported its Q417 earnings in which it saw Dental sales fall by 8.3% Y/Y. Within this segment, its consumable dental supplies fell by 4.3% and equipment sales fell by 16.9%, primarily due to a decrease in sales of CEREC products.

For those that do not know, CEREC is a brand name operated under Dentsply Sirona (XRAY) and is a method of CAD/CAM dentistry used for creating dental restorations. CAD/CAM (Computer-Aided Design and Computer-Aided Manufacturing) is the process that allows dentists to construct, produce, and insert individual ceramic restorations directly at the point of treatment in a single appointment, rather than over multiple appointments.

So far, this month, plenty of negative commentary/checks have surfaced from the following analysts that paint a grim picture for the company’s dental segment:

Northcoast – On August 1st, analyst Ed Snyder said that it appears Patterson’s CEREC sales growth is down about 40-50%, despite promotional activity.

BAML – On August 17th, analyst Steven Valiquette said that for the June quarter, results have been softer from most dental peers in North America. On top of this, Patterson’s dental segment will likely remain challenged as the company also braces for dental equipment business transition off exclusivity with Sirona, and also continues to work on salesforce restructuring.

Craig Hallum – On August 17th, analyst Kevin Ellich lowered his price target for Patterson Companies to $41 from $46 and reiterated his Hold rating to reflect the soft dental consumable environment and potential market share losses once Henry Schein (HSIC) starts to sell CEREC on September 1st.

Cleveland Research – On August 22nd, analyst Rob Eich said PDCO’s fundamentals remain soft due to salesforce execution and morale, management attrition and turnover, CEREC end-user sales seem to have gotten incrementally worse, and execution appears to have been negatively impacted by CEREC distribution change and SAP implementation.

New Leadership

Another item investors should be aware of revolves around a potential announcement of a new CEO. Back in June, Scott Anderson said he would step down from the CEO position he had held since 2010. Former Chief Executive James Wiltz (2005 – 2010) would ultimately become the interim-CEO while a search committee looks for a successor. Most analysts commented that they would be looking for any updates on this when the conference call kicks off tomorrow.

Option Flow

Finally, if we take a look at the Activity Tracker, we see the following bearish option flow from August 10th: