Pentair (PNR) – Valves, Controls, and Peltz

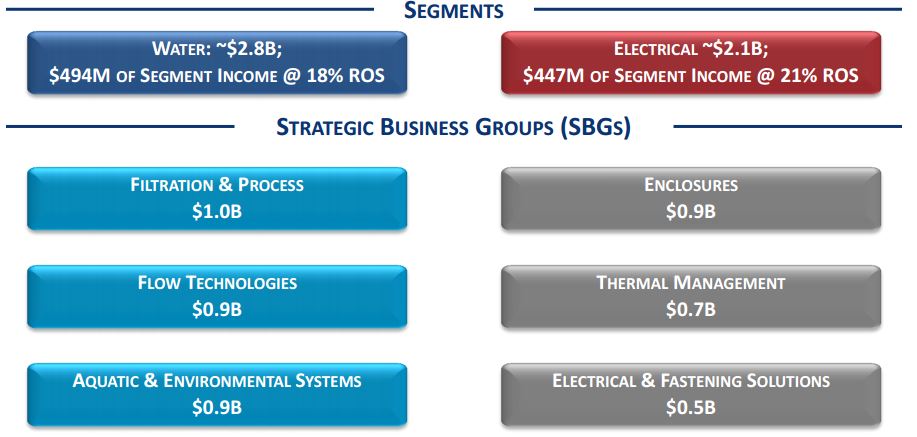

Founded in 1966 as a paper company, Pentair is now a diversified industrial manufacturing company that reports in two main segments: Water & Electrical (as shown below). It should be noted, however, that Pentair has gone through multiple portfolio transformations. In 2004, it divested its legacy wood-working tools business and doubled its water systems exposure by acquiring WICOR Industries. Then, in 2012, it re-branded itself through a Reverse Morris Trust merger with Tyco’s Flow Control business.

Back in June 2016, the Wall Street Journal reported that Pentair was working with Citigroup to explore a possible sale of its Valves & Controls business. A couple months later, in August 2016, Emerson (EMR) officially announced it signed an agreement to purchase the Valves & Controls business of Pentair for $3.15B.

Fast forward to March 15th, 2017 and we noticed a buyer of 2,400 May 65 Calls for 1.05, a $252,000 bullish bet that remains in open interest.

As Seaport Global remarked in their March 16th note, the sale of V&C to Emerson has been cleared by the European Commission and awaits approval from the United States and Mexico. Seaport does not anticipate any material issues with the deal and believes the gross receipt of just over $3B could come any day.

RBC Capital chimed in as well by saying that this divestiture would be a transformative milestone that rebalances the portfolio into a predominantly water-oriented mix. Including the pool business (which they do not technically consider to be part of the water sector), pro forma water-related revenues would be 57%. Meanwhile, oil and gas would be reduced from 17% of revenues to just 10%. That said, by categorizing its portfolio cleanly into these two unrelated platforms, Pentair could stoke investor posturing that a breakup scenario would make sense.

RBC also points out that activist Nelson Peltz’s Trian Partners is the company’s second largest shareholder and has a seat on its Board of Directors, and one of his preferred strategies for unlocking value in his activist engagements is portfolio breakups. In RBC’s view, a spin/sale of Electrical could be the next step, taking advantage of its Irish tax domicile and spurring a positive re-rating for the Water Remainco.

While these two scenarios are the biggest catalysts looming for Pentair, Seaport Global also said that their channel checks indicate that demand for residential products within the Water segment have remained strong during 1Q17 and are likely ahead of PNR’s initial expectations. With Q2 being an important seasonal period, it is unlikely PNR would adjust its outlook for better trends ahead of those results, but we do have an upward bias on estimates in the current environment.

In addition, process industry volumes for short-cycle spending have remained favorable early on in the year. While larger project activity has yet to emerge, highly profitable short-cycle work within the Thermal segment should be up in the first quarter. Thermal short-cycle can carry some of the strongest incremental margins within the segment. Seaport also anticipates the modest snap-back post-election in non-residential should benefit the Enclosures and Fasteners groups as well.

While nothing has been confirmed on the company’s Investor Relations page, Pentair typically releases Q1 earnings in late-April.