Quality Care Properties (QCP) – The ManorCare Struggle

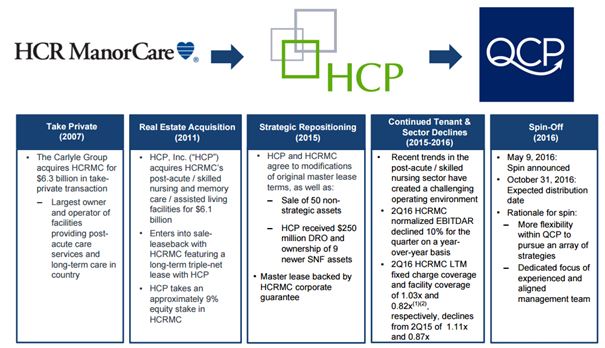

As a self-managed and self-administered real estate investment trust, Quality Care Properties is one of the nation’s largest actively-managed companies focused on post-acute/skilled nursing and memory care/assisted living properties. Below, per the company’s investor presentation, you will see the origins of how it became a publicly traded company:

In yesterday’s trading session, there were some unusually large buyers of 5,600 August 20 Calls for 0.85 – 1.00 on the offer on a wide bid/ask spread of 0.40 x 1.00. This was approximately a $560,000 bullish bet that pushed implied volatility higher by 23.5%. Looking over recent news stories, we now have reasonable assumptions on what the catalyst is.

As shown in the above chart, Carlyle Group has owned HCR ManorCare for 10 years, but is now nearing a deal to divest the company by handing it over to Quality Care Properties. Carlyle’s move to cede control comes after the International Swaps and Derivatives Association on June 8th determined that HCR had defaulted on $380M in senior loans. The Toledo, Ohio nursing home chain was also slammed by news in 2015 that it was being probed by the Department of Justice for allegedly exerting pressure on senior nursing home facility therapists to “exploit” elderly patients for profit.

In addition, HCR also has fallen significantly behind on rent payments to Quality Care Properties, which owns the skilled nursing, memory care, and assisted living facilities that HCR ManorCare operates.

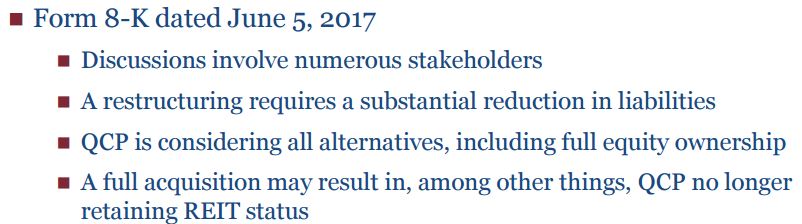

Quality Care Properties entered a forbearance agreement with HCR ManorCare in April that was to defer $22.5M in second-quarter rent until July 5, but HCR ManorCare failed to meet its June rent requirements, effectively putting the company in default. In a filing last week, Quality Care Properties said the deferred and unpaid past rent owed by HCR ManorCare totals approximately $300M.

In a Reuters report from June 8th, Quality Care Properties said it is meeting with lenders to discuss up to $500M in funding to acquire HCR ManorCare.

Quality Care said it is asking lenders for a term loan of up to $400M and a $100M letter of credit to refinance current debt and provide working capital. The company said it hoped to have a commitment by June 15th. The New York Post reported that if QCP takes possession of HCR ManorCare, it will likely ask regulators in Ohio, Pennsylvania, Florida and other states where it operates for permission to close some locations. Lastly, per the company’s 8-K, one thing investors need to keep in mind is that if a full acquisition occurs, QCP may lose its REIT status.