Radware (RDWR) – Transition to Recurring Revenue Model

Radware (RDWR) is a provider of cyber security and application delivery solutions providing attack mitigation and application services as well as protection to thwart such events before they cause harm to networks.

The company is part of the RAD Group which was founded in Israel back in 1981. The group consists of 10 enterprises operating within as independent entities, without a holding company. Along with Radware, three others are listed on NASDAQ:

- Ceragon Networks (CRNT)

- RADCOM (RDCM)

- Silicom Ltd (SILC)

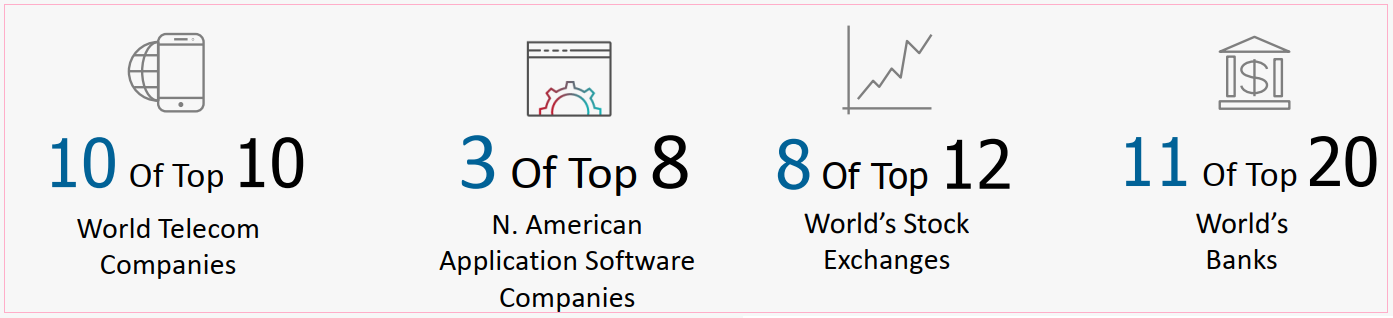

Worldwide number of customers exceeds 12,500 and includes stock exchanges, banks, telecom enterprises and software companies. They also provide services to government agencies and has a fairly balanced geographical exposure overall. The company has grown through market share increases, partnerships with major firms and plans to further expand through acquisitions.

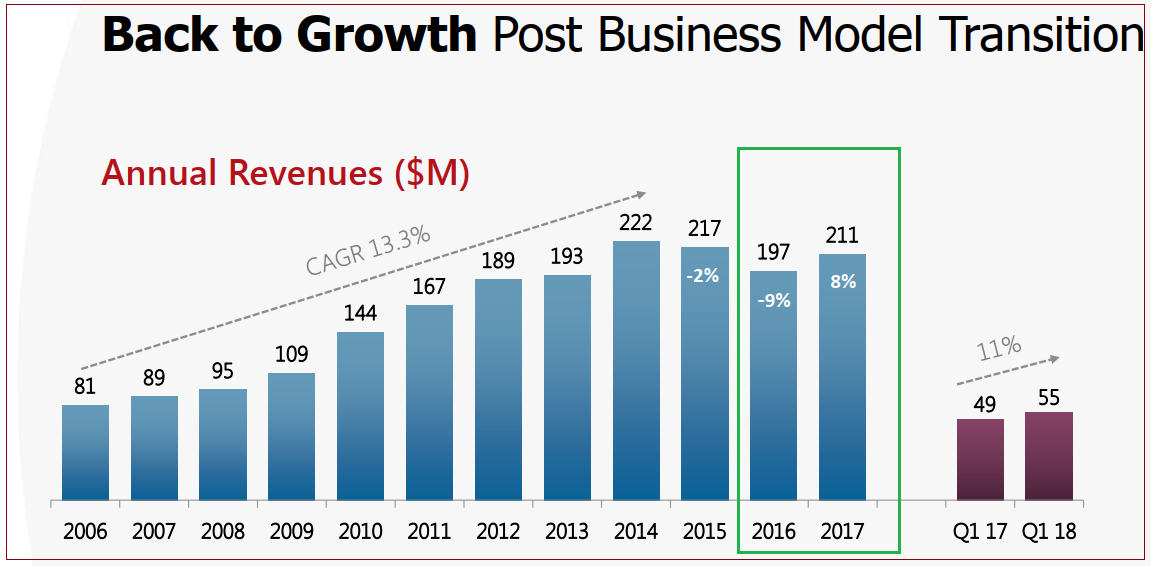

Model Transition

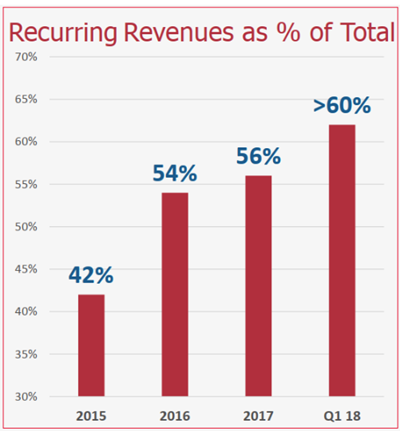

In 2016 Radware transitioned from Cybersecurity hardware and software solutions seller to Sales as a Service (SaaS) provider model. Following the initial adjustment period that saw a drop in revenues, the last few quarters have returned to revenue growth and year-over-year acceleration from the start of 2016. The shift from a business based on selling appliances with perpetual licenses into a business based on recurring SaaS provides the company with a steadier source of income that is far easier to forecast and base future spending and development dollars.

Last Quarter

1Q2018 revenues were reported at the high-end of expectations and showed continued growth in their deferred revenue balance.

- Revenues were $54.5M, up 11% year-over-year with Americas geographic segment returning a 32% increase while accounting for 44% of the total.

- Recurring revenues from continued strong subscription growth contributed to over 60% of total revenues for the quarter.

- Operating cash flow for the last 12 months was $37.3M.

Deferred Revenues

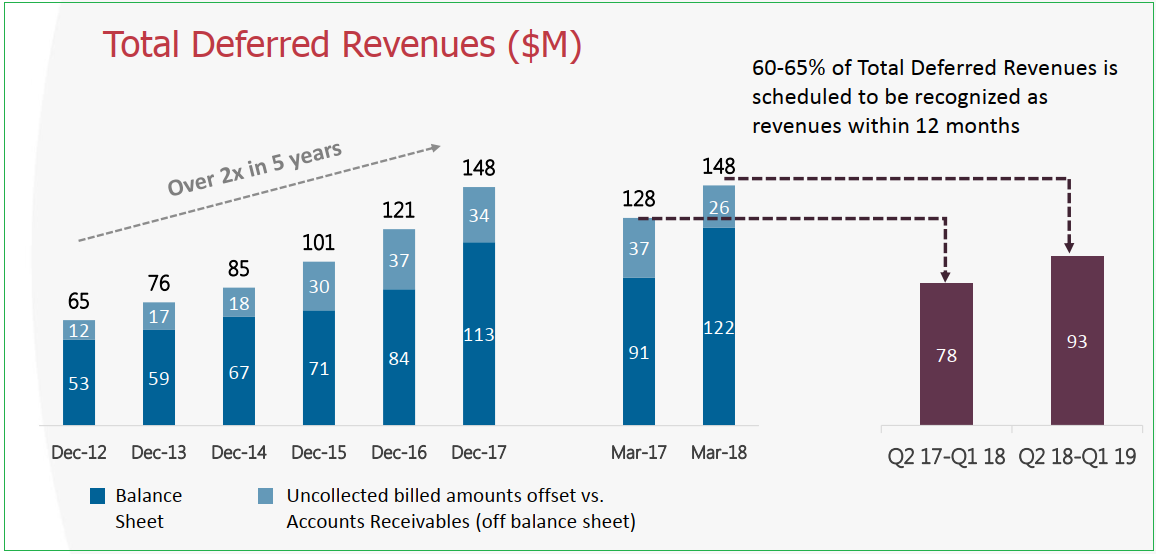

Deferred revenues increased 15% year-over-year to $148M and during the conference call, management stressed that this did not reflect full bookings as late-quarter deals were not yet invoiced nor included in the totals.

Over the course of the next 12 months, Radware expects to recognize around $93M of this as revenues but at the same time, it expects future deferred revenue growth to outpace reductions. While they did not specify an exact number, book-to-bill was said to be “significantly higher than 1”. Looking ahead, fourth consecutive quarter of double-digit growth is expected.

New Products

As Radware continues to invest in its Cloud Security portfolio, it keeps developing new solutions to meet specific criteria to meet customers’ needs.

Active Attackers Feed is a new subscription service launched this past spring that targets known attackers and blocks them before they can even attempt to cause any harm.

Cloud Malware Protection, also launched during the first quarter, is able to detect malware infections before activation and apply a solution to eradicate or mitigate any potential issues.

Partnerships

Channel partner relationships include Nokia (NOK), Check Point Software (CHKP) and Cisco Systems (CSCO), all three of which have driven new clients towards Radware according to management. The relationship with Cisco in particular appears to be very strong and contribution from that source keeps growing over previous quarters. A sequential increase is anticipates in 2Q, as well as the remainder of FY2018.

Differentiation

During 1Q earnings conference call, management responded to an analyst’s question regarding Amazon’s (AMZN) AWS Web Application Firewall (WAF) being a competitive threat to Radware. CEO and Director Roy Zisapel was able to alleviate this concern by pointing out that the AWS product is based on an open-source design with static rules that does not encompass the advanced behavioral learning algorithm’s advanced capabilities of Radware’s product. As well, AWS being a basic offering, the levels of security are not directly comparable to Radware and don’t fit the consumer segment that it targets.

Share Gains

Carrier segment trends remain strong and last quarter’s slight underperformance appears to have been a result of order booking timing that did not translate into the company’s revenue stream. According to the company, they continue to take share in the carrier market, a trend that has been in place for more than a year. Furthermore, over the past two and a half years, Radware’s client count has gone from including the top three of ten carriers to all ten out of ten.

Deals

Just prior to last quarter’s earnings, Radware announced they had signed on two of the largest SaaS companies within an Asian governmental department, a European homeland security authority involved in an Asian “Smart Cities” project and two other leading e-Commerce entities. Due to the sensitive nature of the business, specific country or department information was not mentioned to protect privacy.

One of those contracts was stated to be worth $7M for a military branch, yet again unspecified, that requested setting up a next-generation network, along with the associated security requirements to support the system’s safe operation.

Closing Thoughts

Radware has sparse analyst coverage.

- Jefferies rates at a Buy at $34.50, recently raised from $28. The analyst also lists it as a ‘Favorite Small-Cap Idea’.

- Needham rates at a Buy at $32, also recently raised, from $26. A recent visit to the company’s Israeli headquarters strengthened the analyst’s conviction.

Options activity is very low the last meaningful transaction was a few weeks ago when a buyer of 400 August 26 calls paid $1.05 offer on a bid/ask spread of $1.00 to $1.05 which remain in open interest.