Standex International (SXI) – Food Service Acceleration?

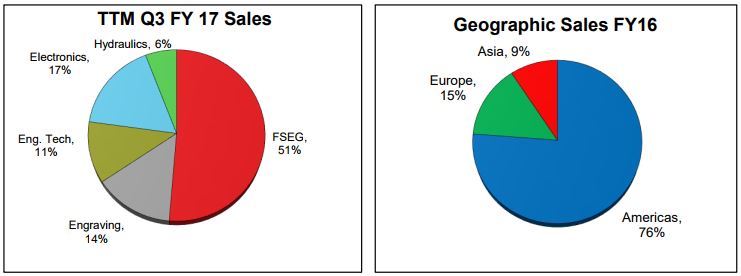

Founded in 1955, Standex International manufactures and sells various products and services for commercial and industrial market segments in the United States and internationally. Per their FY17 Third Quarter Investor Presentation, here is how revenues are broken down:

Food Service Equipment – A broad-line manufacturer of refrigeration, cooking, and specialty food service equipment such as refrigerated cabinets, display units, coolers and freezers, ovens, griddles, char broilers, commercial ranges, rotisseries, pressure fryers, deep fryers, and baking equipment.

Engraving –Provides mold texturizing, slush molding, and in-mold graining tools to the automotive, plastic, building product, synthetic material, textile and paper, computer, houseware, hygiene product tooling, and aerospace industries.

Engineering Technologies – Offers customized solutions used in the manufacture of engineered components for the aviation, aerospace, defense, energy, industrial, medical, marine, oil and gas, and space markets.

Electronics – Designs and delivers custom magnetic components, sensors, and value added assemblies for transportation, smart-grid, energy, appliance, HVAC, security, military, medical, aerospace, test and measurement, power distribution, and general industrial applications.

Hydraulics – Designs and manufactures custom mobile hydraulic cylinders for use in construction equipment, airline support, mining, oil and gas, and other material handling applications.

Option Flow

This is a name we came across for the first time today when Fahad alerted every one of the following bullish options action:

-Buyer of 110 February 95 Calls for 6.00 on the offer when the bid/ask spread was 5.20 x 6.00. This was a $66,000 bullish bet.

-Buyer of 50 February 100 Calls for 4.00 on the offer when the bid/ask spread was 3.90 x 4.00. This was a $20,000 bullish bet.

Q3 Recap

The next catalyst, as pointed out in the chat room, will be earnings before the bell on Monday, August 28th. Ahead of this report, I believe the focus/emphasis will be on the company’s biggest revenue driver, Food Service Equipment. Let’s quickly recap, from May 2nd, what the company reported last quarter coupled with management and sell-side commentary.

-EPS of $0.98 vs $1.10 estimate – Miss

-Revenue of $184.7M vs $182.65M estimate – Beat

-Net Sales increased 4.1% Y/Y

-Food Service Equipment sales increased 5.4% Y/Y

-Engraving sales decreased 10.7% Y/Y

-Engineering Technologies sales increased 22.3% Y/Y

-Electronics sales increased 8% Y/Y

-Hydraulics sales decreased 10.2% Y/Y

With regards to its Food Service Equipment, CEO David Dunbar said:

“In Refrigeration, we are seeing a strong increase in demand for cabinets and walk-ins as large chains and national accounts begin to ramp up spending as expected.” In early April, we resolved production issues and began shipping the new freezer panels. At the same time, with a double-digit increase in backlog during the quarter, we expect good sales growth in Refrigeration during the fourth quarter.”

“Sales were down approximately 8.5% in Cooking Solutions as a result of non-recurring prior-year roll-outs, proactive rationalization of low margin products, and slower sales to select major dealers. Even with the top-line softness, gross margin was flat versus the prior year due to our continued focus on operational improvements. Specialty Solutions Group sales increased by 4.9%, with strong volume in the beverage and merchandising segments, partly driven by new products.”

NRA Expo

On May 23rd, Seaport Global analyst Walt Liptak issued a research note detailing his takeaways from the National Restaurant Association (NRA) Expo. In terms of the overall industry, Mr. Liptak said:

“Following the NRA Expo, we remain cautious regarding the 2017 growth trends for the foodservice equipment sector. In our view, restaurant equipment manufacturers are not expecting an acceleration in 2017 organic revenue growth. Our meetings suggest that the general foodservice sector is growing at a low-single-digit rate, if there is any growth at all.”

“Foodservice market participants that we talked to were cautious due to volatile trends in their sector in the last year. Each company that we talked to had new food equipment with a fast payback, but market share gains are choppy, and in our view, the Q2:17 sales growth was not meaningfully accelerating. “

Mr. Liptak would go on to cover individual names like Middleby (MIDD), Illinois Tool Works (ITW), and Welbilt (WBT). However, when it came to Standex, he said:

“The focus of our booth tour was in the refrigeration segment, which has been the source of recent profit weakness. SXI management believes that the new foam-related shipment issue is 99% behind the company. The refrigeration backlog is up 24% Y/Y, which suggests that revenue growth will accelerate, and profit issues will be behind the company. SXI’s foodservice business is investing in new products that improve productivity, lower the cost of usage and improve safety.”

Wall Street Coverage

As you can probably guess, this is a name that is not covered my many analysts. In fact, there are only 2 Buy Ratings and 1 Hold Rating on the stock with a consensus price target of $115. Some recent actions include:

FBR & Co. – On July 18th, they reiterated their Buy rating

Sidoti – On May 19th, they upgraded the stock from Neutral to Buy and increased their price target from $103 to $115