The Brink’s Company (BCO) – Armored M&A Transport

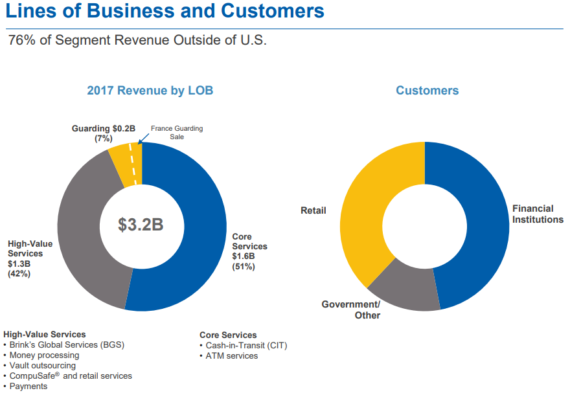

Headquartered in Richmond, Virginia, Brink’s is an American security and protection company with services including armored car transportation, money processing, and long-distance transport of valuables. Per its June Investor Presentation, here is how revenues are broken down:

At the beginning of the year, SunTrust Robinson analyst Tobey Sommer issued a Business & Government Services Note where he listed Brink’s as a Best Idea due to having improving fundamentals and attractive valuation. He would also comment that new management** is remaking the company, expanding margins towards peers and consolidating its markets by acquiring niche players (more on this later). As a result, this should create a more profitable firm, operating with greater market share and in markets with more constructive pricing power.

**Back in July 2016, the company announced that Ronald J. Domanico joined the company as Chief Financial Officer (CFO), replacing Joseph Dziedzic, who served as CFO since 2009. It also announced that Rohan Pal joined the company as Chief Information Officer and Chief Digital Officer (CIO and CDO).

Earnings Recap

On April 25th, Brink’s reported its Q1 earnings results. Here was the breakdown followed by forward-looking commentary:

-EPS of $0.65 vs $0.63 estimate – Beat

-Revenue of $853.3M vs $789.5M estimate – Beat

-Q1 Revenue increased 12%

-North America Revenue increased 5%

-South America Revenue increased 26%

-Rest of World Revenue increased 19%

Management commented that the biggest driver of revenue and profit growth in North America was Mexico, which carried its strong performance in 2017 over into 2018 reflecting growing revenue from retailers, improved productivity and lower labor costs. Similar to the U.S., the company expects productivity initiatives to have an increasing impact throughout the year, especially again with stronger seasonality in the second half. “Our team in Mexico has a 2019 margin target of 15% and they’re well on track of meeting or exceeding this target, and I’m very pleased with the strong results year-to-date.”

In the Rest of the World segment, revenue was up 19% due primarily to favorable currency translation and the acquisition of Temis. However, operating profit was up slightly but down 11% on an organic basis due to continued price and volume pressure in France, which was partially offset by profit growth in other countries. Management believes that the competitive market disruptions and abnormally high volume of tender rollovers last year have had a significant impact on revenue and margins in France. That being said, management is convinced that their team in France will achieve their margin target of 12%.

Finally, CEO Doug Pertz would comment, “As we move through 2018, we expect profit margin growth to accelerate as organic operational improvement initiatives gain momentum, and as we achieve further growth from planned synergies and growth from completed acquisitions. We also expect higher revenue and earnings growth in the second half as we benefit from normal seasonality and from the addition of the Rodoban acquisition in Brazil.”

Buckingham Research would identify four major baskets where the company should generate the most improvement in operating margin:

• Fleet – Lighter-bodied, modular trucks which are cheaper to buy, operate and maintain.

• Labor – One guard operating model (rather than two) on safer routes.

• Branch/Network – Standardize and optimize by investing in new high-speed money processing equipment and utilize secure garages to keep trucks closer to customers to maximize route density and minimize miles driven.

• Information Technology and CompuSafe – Improve routing and scheduling and allow customers to benefit from so-called “smart safe” technology.

M&A

CEO Doug Pertz, in the Q1 press release, would say, “We also remain committed to driving additional growth by pursuing synergistic acquisitions. We expect to invest approximately $800 million in new acquisitions between now and the end of 2019.”

Since the beginning of the year, the company has made 2 notable acquisitions:

Rodoban – On January 10th, the company announced that it agreed to purchase Brazilian-based Rodoban for approximately $145M in cash. Based in the state of Minas Gerais, Rodoban provides cash-in-transit, money processing and ATM services primarily to customers in southeastern Brazil. The company generates annual revenue of approximately $80M.

Dunbar Armored – On May 31st, Brink’s announced it agreed to purchase Dunbar Armored, the fourth largest U.S. cash management company, for approximately $520M in cash. The transaction will be funded from the company’s available cash and is expected to close by the end of 2018. Based in Hunt Valley, Maryland, Dunbar employs approximately 5,400 people, operates 78 branches throughout the U.S. and has more than 1,600 armored trucks in its fleet. Over the last 12 months, the privately-held company generated revenue of approximately $390M.

The acquisition will expand and differentiate Brink’s customer base with Dunbar’s complementary focus on small-to-medium sized retailers and financial institutions. Brink’s expects the combined entity to achieve substantial cost and operational synergies driven by improved route density, branch optimization and administrative efficiencies. In addition, Brink’s expects to invest approximately $50M in capital expenditures over three years to support branch rationalization and the integration of Dunbar’s fleet.

Following the Dunbar announcement, Buckingham analyst James Clement would raise his price target to $110. Dunbar is “geographically strong on the east coast and has done a great job of marketing to middle-market retailers and financial institutions,” Clement tells investors in a research note. The analyst increased his 2019 earnings per share estimate for Brink’s to $5.14 from $4.79 and keeps a Buy rating on the shares.