The Marcus Corporation (MCS) – Get Your Popcorn Ready

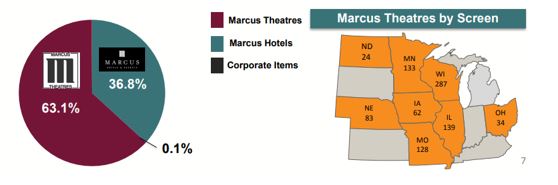

Headquartered in Milwaukee, Wisconsin, The Marcus Corporation owns and operates movie theatres as well as hotels and resorts. Based on their recent December Investor Presentation, the company operates 890 screens across a handful of Midwestern states.

With 63% of the company’s revenue coming from Movies, this is where I’d like to focus my commentary on today. Looking back to the company’s Q3 earnings report, on October 25th, it reported that total revenues increased 5.1% Y/Y, while revenue for Theaters increased 5.2% Y/Y, and revenue for Hotels & Resorts increasing 4.9%.

Taking a closer look at its Theater division, reported box office revenue increased 4.3%, while the company’s concession revenue increased 6.6%.

Management, who clarified that they are not making excuses, pointed to the reality of what they saw within the industry in Q3:

“We do believe that a change in film product mix had an unfavorable impact on our average ticket price during the third quarter of fiscal 2018 compared to that third quarter last year. Our top film during the third quarter of fiscal 2018 was the PG-rated family movie Incredibles 2, which results in a higher percentage of a lower-priced children’s ticket sold compared to our top film during the third quarter of fiscal 2017, which was the R-rated film IT, which resulted in a higher percentage of a higher-priced adult ticket sold.”

“Our investments in nontraditional food and beverage outlets continue to contribute to higher per capita spending. But having said that, we believe that the same change in film product mix that I just discussed during the third quarter likely reduced the growth of our overall average concession sales per person during the fiscal 2018 period as those family-oriented films, such as the top film during the third quarter, described — tend to not contribute to sales of nontraditional food and beverage items as much as adult-oriented films.”

Upcoming Movie Slate

CEO Gregory Marcus, on the conference call, would say that even though baseball impacted attendance at their Milwaukee theaters in the early weeks of October, “I think it is pretty well known that the fourth quarter box office has started very strong thanks to some of the films noted in our release .” (Q4 Snapshot Below).

The CEO would add that one of the great things about the movie business is that there is always the possibility of one or more surprises. In fact, we’re starting to see some of the films scheduled for release in November and December and so far they look very good. And of course, you probably heard about that the early buzz on the 2019 film slate is very positive.

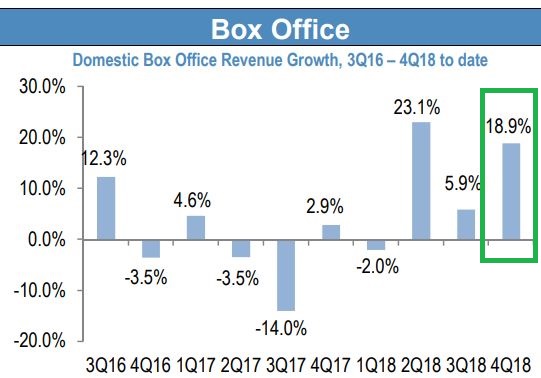

Based on the Box Office chart, provided by JPMorgan, Q4 is already showing 18.9% revenue growth, a huge jump from Q3 that only saw 5.9%.

M&A

Finally, it should be noted that back on November 2nd, Marcus Theatres announced that it has signed an agreement to acquire the assets of Movie Tavern from VSS-Southern Theatres, a portfolio company of Veronis Suhler Stevenson, a private equity firm. The purchase price is currently valued at approximately $126M, comprised of $30M in cash and 2.45M shares of common stock, subject to certain lock-up restrictions. New Orleans-based Movie Tavern has 22 locations and 208 screens in nine states. The transaction is expected to be completed early in Q1 of 2019.

Barrington analyst James Goss would issue a note following this news where he reaffirmed his Outperform rating and $49 price target on Marcus, which is also on Barrington’s Best Ideas List. The analyst calls the acquisition a “good fit” as Marcus has a “commitment to a high-quality experience, showcased by the significant investment the company has made in upgrading its legacy circuit as well as the acquired Wehrenberg properties.”