Trust The Process

I am one of those individuals that spend 80% of my time worrying about positions that are going against me and remaining 20% looking at winners. It’s something that more and more occurs naturally to me, though certainly wasn’t the case when I first started my investing career some 20 years ago when equation was flipped with 80% focus on winners. Over the years Mr. Market would corner me into a boxing match. Punching, attacking, throwing many knockout hits while I am tangled up in ropes just trying to fight back in dizziness. In reality, all it was trying to do is humble me.

In Jaguar, we produce tremendous amount of research with ideas flowing everyday. Whether they are official trade alerts, webinar, chat room, weekend research, home page articles, conferences, JaguarMedia video productions, etc.

But as I frequently tell Tom during our weekly dinners, of all the research we produce the absolute finest and the highest quality work goes into Jaguar Quarterly Outlook without a doubt. It is 5-star rated document each quarter that I am always most proud of. Gives me a sense of accomplishment. Because it is the only research paper in which entire Jaguar research team comes together, bringing out the best of what we have to offer, debating it thoroughly in heated exchange and narrowing the list to most unique opportunities with only one goal in mind: Beat the damn S&P !!

I can’t imagine how it happens in hedge funds, 90%+ of which are constantly underperforming the market year after year. May be they don’t have the passion and a killing desire to make money like we do in Jaguar. But they still get away with “2 and 20” formula. How? I have no idea. I’m a nerd. A market junkie. Perhaps that’s what lacking in hedge fund community. They need market junkies. A lot of junkies.

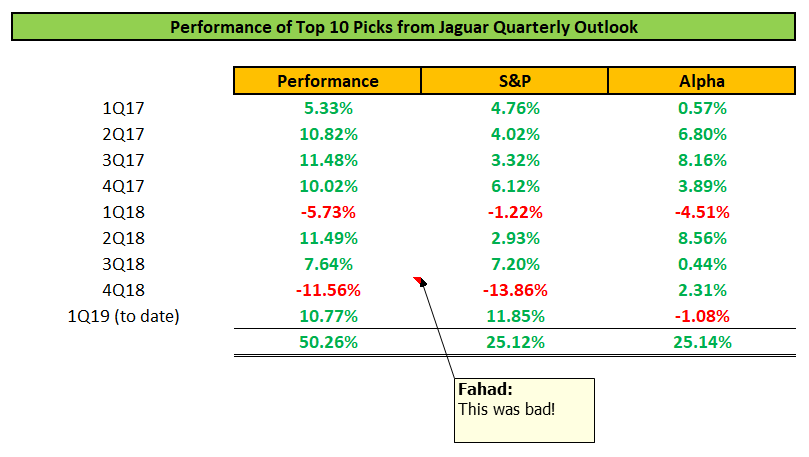

Coming back to top point about worrying about losing positions. As you would imagine, it kills me when I produce this well-researched quarterly document and ideas don’t work out. See snapshot below. Since inception we have beat the S&P by more than 2x the performance. Show this to a hedge fund that charges 2 and 20 and they would kill for such performance scorecard. But what kills me is 4Q18 performance of -11.56%. I don’t care that quarter was still better than the S&P. I don’t care that December 2018 month was worse than sell offs seen after Lehman bankruptcy, 9/11 attack, Pearl Harbor attack, and even Great Depression! That absolute portfolio negative return is like having a coffee stain on a mint-clean firmly-pressed and lightly-starched white dress shirt.

So, I went hunting. Hunting for where I went wrong in Q4. What could have I done differently. I could just bury it. Never talk about that quarter. Just ignore it. Make up silly reasons when someone asks. That may be satisfying from business stand point. But not mentally. I must find out why. I must explain to myself so I don’t repeat that mistake again. It is the only way I’ve been perfecting the research process over 20 years.

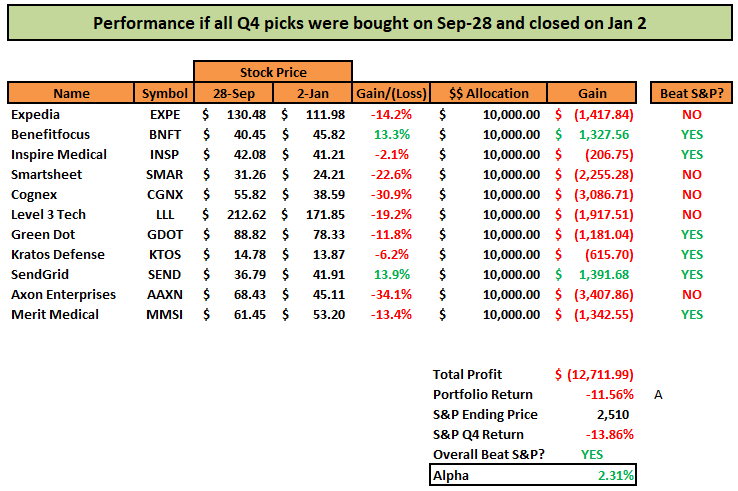

After thoroughly reading and analyzing, I realized that our core research process was never broken. Only the timing was off. Here is how 4Q ideas performed when we benchmark against the S&P Q4 return at the end of December:

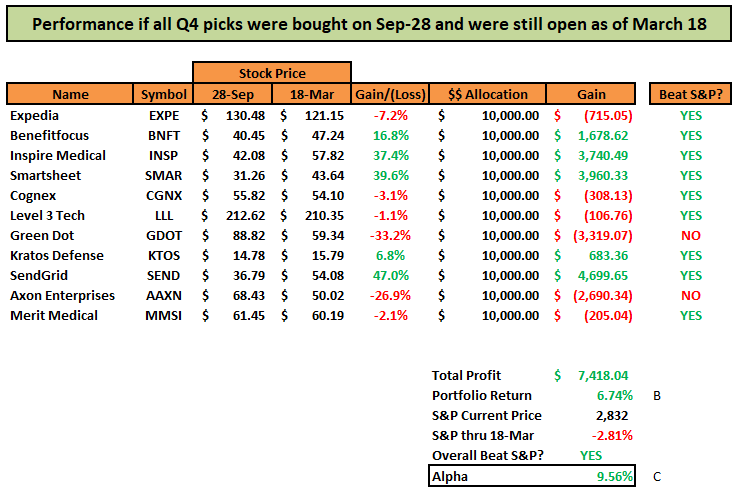

And here is how Q4 ideas performed if we assume that all picks were held through today (March 18):

What a difference two and half months can make. You can download this comparison HERE and all Jaguar Quarterly Outlooks HERE.

Net swing in portfolio balance equates to +18.3%. Total absolute return in portfolio is +6.74% and net alpha generation is +9.56%. That’s remarkable!

Now, I know many readers would say “could have, would have, should have, but didn’t …” after reading this. But be mindful that in early January when we issued 1Q19 Outlook we did recommend holding SMAR (up +75% YTD), LLL (up +21% YTD), INSP (up +37% YTD), NSTG (up +83% YTD), among many other names. Overall, the improvement in alpha generation was noticeable by more than 700 bps by simply holding many names and that in itself confirms the strength of our process for making picks. Put it differently, had these Q4 picks simply performed in sync in linear fashion with market recovery during Jan-Mar period (or worse underperform), I would’ve been highly disappointed to the point of concluding that something is broken in the process. That wasn’t the case at all. Quite the contrary, we materially outperformed the market YTD 2019.

Time to time market will throw a curve ball, or using boxing analogy it will corner you and punch you around. At each difficult interval, I go back and try to fine tune our core research process. Our timing was off in Q4 but our research process was not. That’s the biggest takeaway from Q4.

Trust the process!

Please note 2Q19 Outlook will be released on Sunday, March 31.

Fahad

P.S. I hate boxing! It is one of the worst sports created by mankind.