Ulta Salon (ULTA) 3Q16 Earnings Takeaways – Good Quarter But Expected

Ulta Salon (ULTA) reported earnings after-hours on December 1st that beat both EPS and revenue expectations for the 12th consecutive quarter:

- EPS $1.40 vs. $1.37 estimate, beat

- Revenues $1.13B vs. $1.1B, estimate, beat

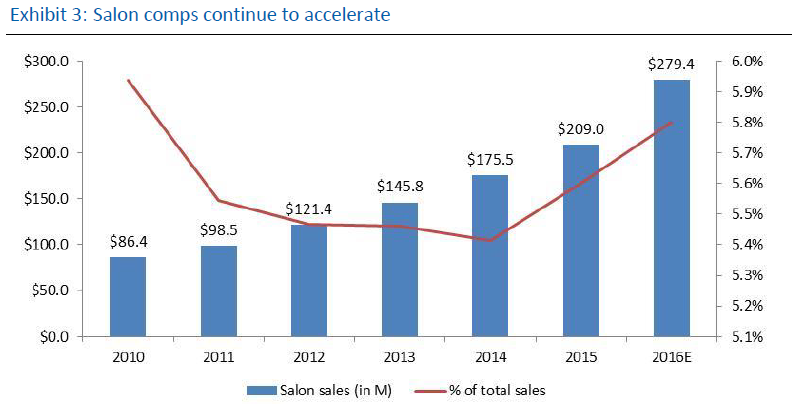

Gross Margins expanded 90bps, Operating Margins increased by 18bps despite higher SG&A as the Company continues to invest in future growth. Comps were up 16.7%, including salon segment increase of 10.3%. E-commerce was also higher, adding 240bp. ULTA also reiterated their three-year margin expansion guidance of 200bps, derived from a 60-40 split between GM and SG&A.

There are numerous products expected to be introduced for the Holiday season; Estee lauder and Nars brands, ULTA’s own Holiday kits as well as select Clinique and Lancome products. Increased and improved marketing and advertising campaigns combined with a growing Loyalty Program member base should support management’s 4Q comp guidance of 12-14%. There are also plans to open 500 new locations in FY2017, an increase from previous intentions, along with an upwards revision of year one sales to $3.1M, 19% higher than previous models.

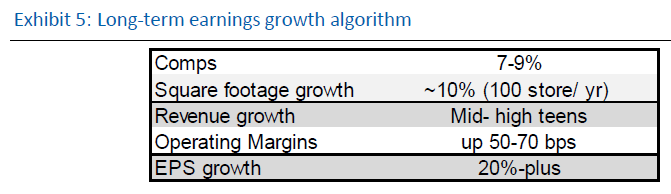

ULTA had recently revised its mid-term growth outlook, raising 3-year comps from 5-7% to 7-9% and indicating that this guidance could be surpassed from a combination of factors, including market share gains from department store demographic shift, additional M&A and new product introductions, higher exposure to well-know prestige brands as well as increasing loyalty membership growth rate now numbering 21.7 million, a 28% increase YoY.