Unlock: Analog Devices (ADI) – Strong Checks Paved the Way for Big Profits

It pays to do fundamental research. Here is bullish view presented to clients on May 10 in ADI based on improving asset allocation, upside to cost and revenue synergies with LLTC acquisition, and most importantly strong sequential improvement in SIA checks mid quarter. As a result, stock is sharply higher today after posting blow out quarter. To learn more about our approach and how you can become a successful trader, sign up for 4 week trial and test drive live chat room with some of the best traders: SUBSCRIBE

May 10, 2017

Analog Devices (ADI) – Time to get long? Type of action that would skip many traders’ radar but catches my attention.

– Buyers of 1,000 June 80 calls for up to $2.35 offer

– Buyers of 700 June 82.5 calls for up to $1.25 offer

– Buyers of 1,000 June 85 calls for up to $0.65 offer

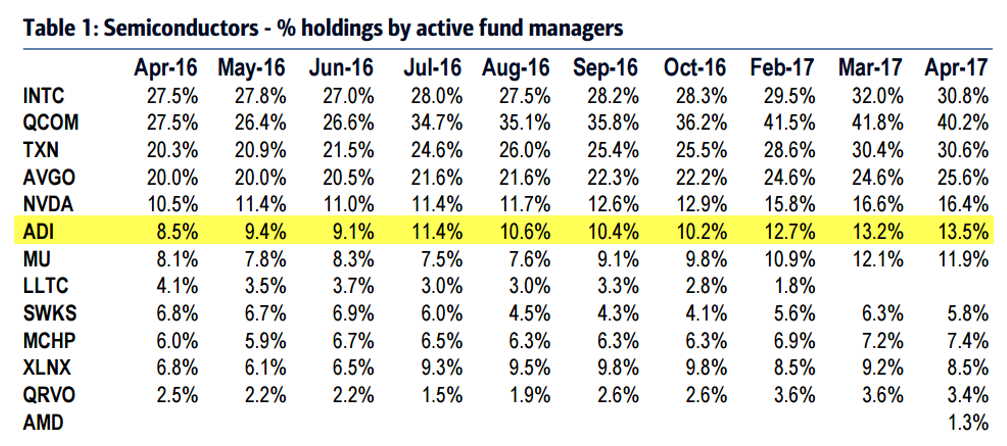

Active Managers’s Survey – On biggest observation, there is a strong consistent bid under semis. Take a look at look intra-day spike in TER intra-day. XLNX has been breaking out. MCHP is breaking out big time after strong earnings. Similar action in many other names. MXIM with fantastic looking chart is breaking out to new 52-week high today. A clear evidence or this strength can be seen in steady accumulation by active money managers as shown in picture below with ADI highlighted in yellow.

Analog Powerhouse – As a reminder, ADI acquired Linear Tech (LLTC) back in July 2016 but only recently in March 2017 the merger finally closed. This combination is expected to create “analog powerhouse” with FY2018 EPS rising to $5.00 which spits out forward multiple of 16x while most peers are trading near 20x. The combined company will have $5.2 billion in revenues and #1 or #2 position with leading market share in 5 key markets: Core IP in Data Conversion (#1 Share), Power Management (#2 Share), Amplifiers (#2 Share), Interface (#2 Share) and RF/Microwave (#1 Share). The key here is before the acquisition ADI was heavily reliant on Apple business (26% of revenues), which will shrink to 9% of revenues. As Credit Suisse pointed out in its stock initiation with Outperform rating and $100 price target on March 13:

“More importantly, the combined company has ~85% of Rev in more stable, higher multiple I/A/I buckets, well above the Semi average of 60%. Within the last 3 quarters, ADI has begun to consistently outgrow peers in I/A/I with future leverage to AD, 5G, Industry 4.0 and Medical likely to accelerate relative growth.”

To boil this down, LLTC acquisition has drastically changed the revenue mix for the better with company now positioned for higher growth. But the big unknown still out there (key for stock performance) is operating margin leverage that will come with LLTC acquisition. Since this upcoming earnings report on May 31 will be first for management to discuss that, I believe it presents upside opportunity. Proforma projections show Operating Margins rising from 35% to 42% in next 2 years. Management needs to lay out the foundation in earnings call that they can get there, and on that basis expect stock to move higher.

Strong SIA Channel Checks – On April 30, the Semiconductor Industry Association issued its (SIA) showed industry wide sales up +1.6% sequentially MoM and up +18% YTD. Unit sales were up +16% YoY and average selling prices rose by +2% YoY. This is the 8th consecutive month of accelerating YoY growth for overall semis sales.

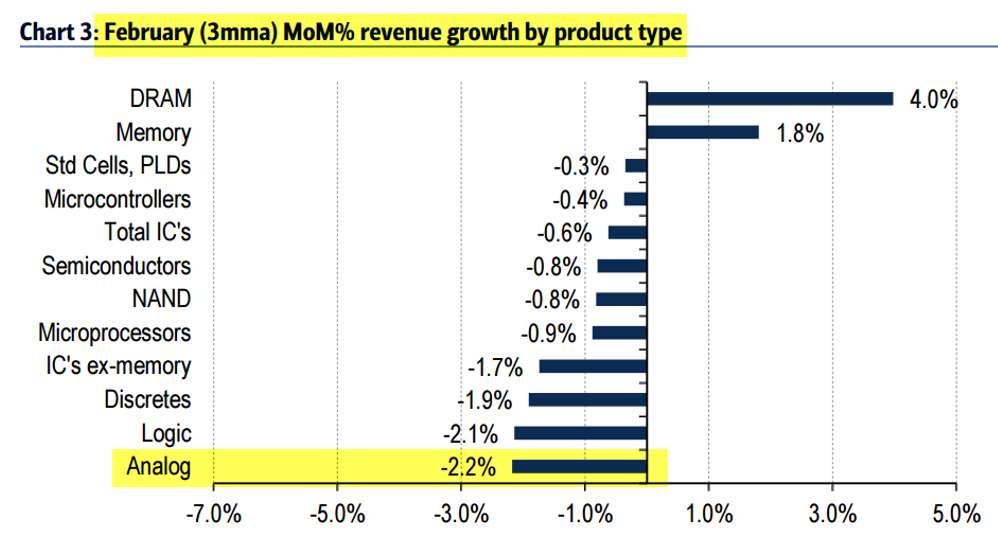

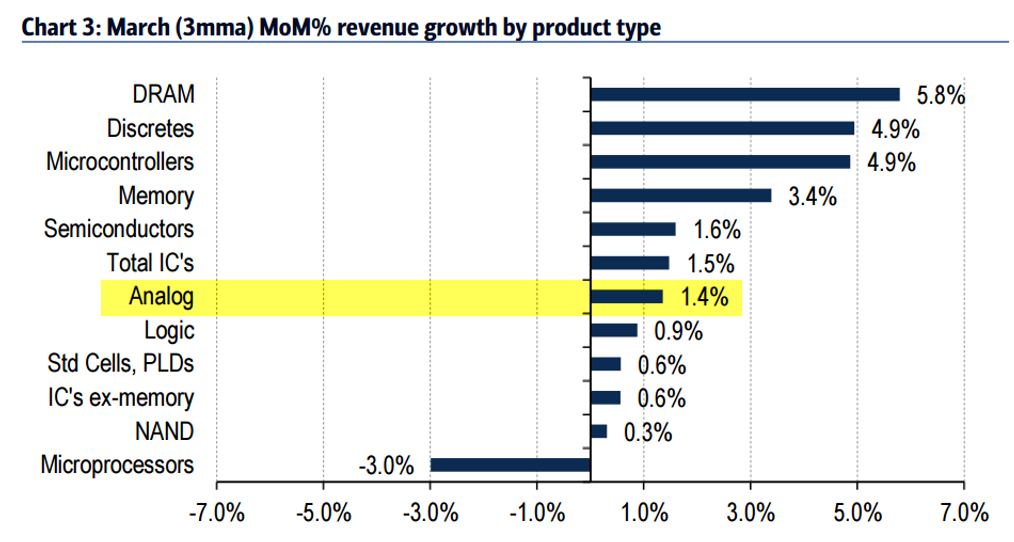

Below are two charts from SIA one from April 3 and one from April 30. Every category in semi space saw drastic improvement from February to March. Analog went from -2.2% (the biggest laggard) to +1.4%.