Unlock: Cabela’s (CAB) – The Price of Option

It pays to do fundamental research. This bearish view was shared with clients on February 3 with stock at $55. Now at $46 in eleven days. To learn more about our approach and how you can become a successful trader, sign up for 2 week trial and test drive live chat room with some of the best traders: SUBSCRIBE

February 3, 2017

Cabela’s (CAB) – Bearish risk reversal:

– 2,500 March 57.5 calls sold to open for $0.45 credit

– 2,500 March 52.5 puts bought to open for $1.20 offer

Aggressive bear with puts bought for $1.20 when bid/ask spread was 0.60 x 1.20. Approx $300,000 put premium bought.

Merger with Bass Pro Shops – CAB is in the process if being acquired by Bass Pro Shops which makes it difficult to short the stock. However, market doesn’t believe this merger will happen. Bass’s offer is $65.50 per share IN CASH. But CAB stock has been selling off sharply since late December and now arbitrage spread is over 20%. On November 29, NY Post reported the FTC is reviewing the merger and has requested documents. Concerns around anti-trust after it was learned that 45% of Bass Pro customers already shop at Cabelas. The process was supposed to be finished in one month, but on December 29, the FTC sent another request for additional documents and that’s when wheels came off the stock as it started falling. The deadline for reviews is now extended to “first half of 2017” with no clear date. In early January, Capital One, which is financing the transaction said the following:

“Capital One informed the Company that Capital One no longer expects to receive approval from the OCC under the BMA within a time frame that would permit the transactions under the Merger Agreement and the Bank Purchase Agreement to close by the end of the first half of 2017. Capital One further informed the Company that while it expects that the transactions under the Bank Purchase Agreement will be approved by the OCC under the BMA, such approval is not currently likely to occur prior to October 3, 2017, the date after which any of Parent, the Company or Capital One would have the right to terminate the Merger Agreement or Bank Purchase Agreement, as applicable.”

So, there is a chance that merger will not be approved until past the deadline. Additionally, worth pointing out that Canada’s antitrust law under Section 114(1) of the Competition Act is now also looking into this merger. That’s whole another chapter to deal with.

Earnings Fallout – Meanwhile, earnings are falling apart and one has to wonder if Bass bid was not on the table where would the stock be given slaughterhouse in entire retail sector. Highlights from October 26 quarter:

– Q3 EPS $0.53 vs. $0.81 estimate, huge miss

– Q3 Revenues $996M vs. $1.02B estimate, miss

– Q3 Same Store Sales -2.8% YoY

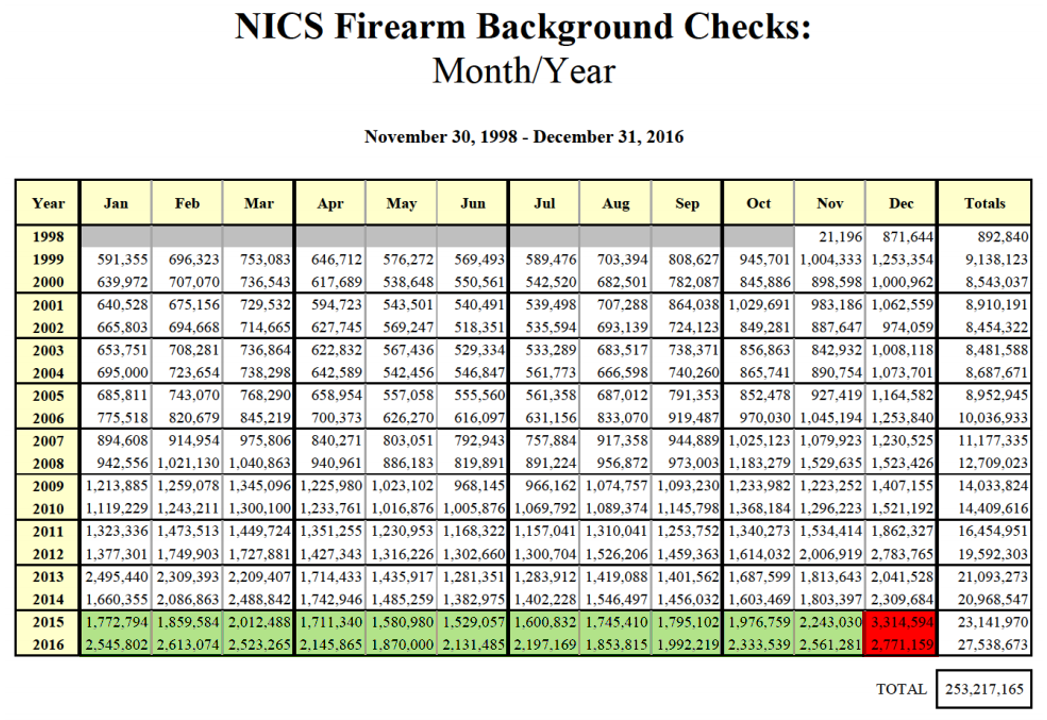

Approx 31% if Cabela’s revenues come from firearms. Gun sales do better under Democrats due to constant threat of 2nd amendment. They don’t do so well under Republicans. Evidence is clear. See snapshot below. In every month of 2016, total FBI firearm background checks were showing big positive YoY growth. In December big negative YoY decline which tells me CAB is going to post a disaster quarter on February 16 before market opens.