Unlock: CME Group (CME) – Beneficiary of Rising Trading Volume in Interest Rate Futures

It pays to do fundamental research. We waited for the right opportunity to recommend buying calls on pull back on May 30. The September 120 calls were bought for $3.15 and closed for $8.00 or +153% gain on Monday. Below is trade alert sent to clients regarding increasing trading volume in interest rate futures ahead of FOMC to help the bull case for ICE and CME and trigger a technical breakout. To learn more about our approach and how you can become a successful trader, sign up for 4 week trial and test drive live chat room with some of the best traders: SUBSCRIBE

CME Group

Ticker: CME

Sector: Exchange

Current Price: $117.33

Target: $125.00

Stop Loss: $114.00

Time Duration: 108 days

Trade Idea – Buy CME September 120 Calls for $3.15 or

The bid/ask spread currently is 2.85 x 3.10 and volume at this strike is 21. Placing the alert 5 cents above the offer.

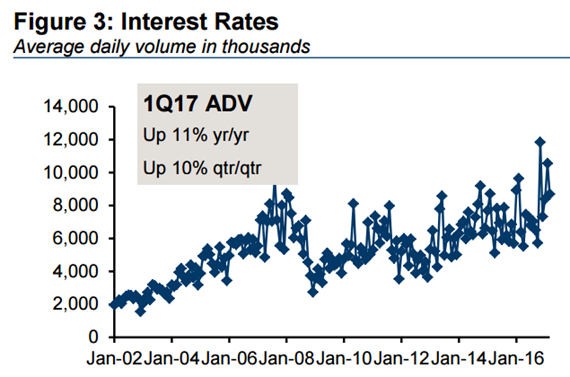

Volatility will not remain depressed forever. At some point it will pick up and with that trading volumes in exchanges will pick up. Part of this will have to do weak equity market seasonality. Additionally we have Fed Meeting coming up on June 14 with interest rate decision that has seen this widest band of expectations and movement in polls in last few weeks, good for interest futures trading volumes in exchanges, in which CME is the leader.

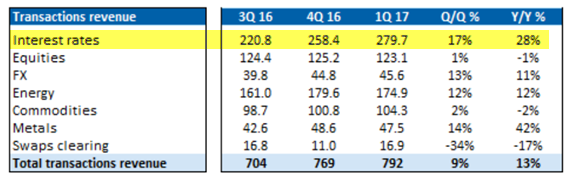

CME posted disappointing quarter on May 1 which has now set low bar of expectations going forward. Q1 EPS came in at $1.22 beating $1.18 estimate however revenues missed by -1.2% below consensus. The miss was driven lower than expected market data coming in flat 0% YoY growth after management guided +6% growth 3 months ago. Market data business makes up only 11% of total sales. Usually market data business tends to pick in direct correlation with higher volumes and open interest in derivative contract listings, which I expect to happen as volatility starts to pick up.

Separately, as RBC Capital points out after reviewing Q1 results:

“CME’s bread and butter interest rate suite drove record overall volumes in Q1/17 (Avg Daily Volume: 17.1MM). Further, we are encouraged by increased market share in metals, and note the asset class’ higher margin profile. Additionally, the options business continues to pick up steam, and volumes during non-US hours are growing.”

Catalysts – There are three particular catalysts in June/July months that could set the tone for upside in exchanges. First is the June 14 Fed Meeting that should be a boost for interest rate futures trading. Second is potential corporate tax cuts as proposed under Trump budget plans submitted to Congress. CME pays one of the highest corporate taxes in the country and management guided 37% rate in Q2. Full year tax rate modeled at 36.3% to arrive at current consensus view. Lastly, in March 2017 CME received approval to park customer cash at the Fed which was previously available to only clearing members. This allows CME to earn a spread and last quarter management guided additional revenues from this will more than offset the weakness in Market data segment, a view that is not fully baked into consensus view and should provide upside when it reports Q2 results in late July.