Unlock: Skyworks Solutions (SWKS) – Bullish View from Industry Checks Paid Off

It pays to do fundamental research. Here is bullish view presented to clients in chat room yesterday before earnings. Stock is up +12% today. To learn more about our approach and how you can become a successful trader, sign up for 2 week trial and test drive live chat room with some of the best traders: SUBSCRIBE

January 19, 2017

Skyworks Solutions (SWKS) – Critical important supplier to both Apple and Samsung reporting tonight after the close. Not much to see in option activity yet but industry checks and read through from peer earnings are suggesting company should post strong quarter and stock should breakout on this.

Dialog Semi – A very important supplier to Apple in exactly the same kind of business as SWKS out of Asia, on January 9 pre-announced earnings. Reported Q4 preliminary revenues of $365 million, above the mid-point of guidance provided on November 3. See HERE.

Taiwan Semi (TSM) – Another critical supplier that gets 64% of its total revenues from Apple and Samsung, on January 12 announced earnings that beat on margins and for guidance particularly discussed ramp-up in production for 10nm chip which is proxy for demand for iPhone and Galaxy S8 that is launching in March.

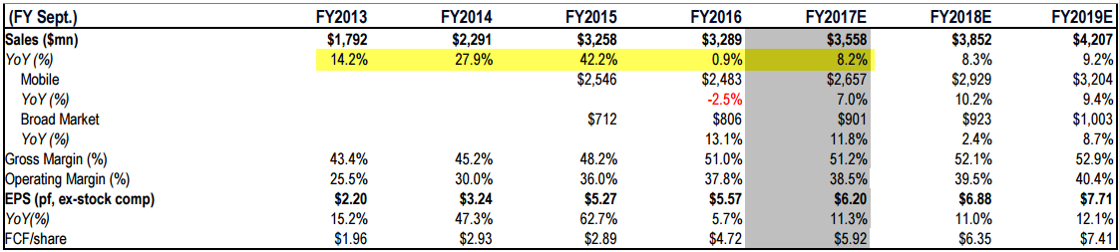

Sentiment Shifting – Smartphones is the largest end market SWKS serves and hence stock’s technical performance is very closely tied to Apple stock. Put two next two each other and you will see. We are very bullish on Apple for reasons well explained. Below is snapshot of consensus view on sales growth. Note how sales growth went down to essentially flat. Note for March quarter consensus is looking for -9% revenue decline, before rebounding sharply in 2H and ending the year with positive +8.2% growth. I believe that’s too conservative based on what peers are telling us above. Expect chart to breakout post earnings.