Unlock: Swift Transportation (SWFT) Improving Growth Trends Lead to M&A

It pays to do fundamental research. We rarely ever recommend buying anything purely on M&A speculation, but often find the fundamental research eventually leads to M&A. Here is bullish piece on SWFT presented to clients a month ago on March 6. Stock up +25% today after merging with KNX. To learn more about our approach and how you can become a successful trader, sign up for 4 week trial and test drive live chat room with some of the best traders: SUBSCRIBE

March 6, 2017

Swift Transporation (SWFT) – Right out of the gate buyer of 1,000 April 22 calls pays $1.20 offer. Approx $120,000 bullish bet on 1.5x daily average call volume with implied volatility spiking higher by +5.3%. This is the same spot where they bought 1,000 contracts on Friday as confirmed under OI check above. Call buying picked up immediately after on Friday ACT Research reported big jump in Class 8 truck orders.

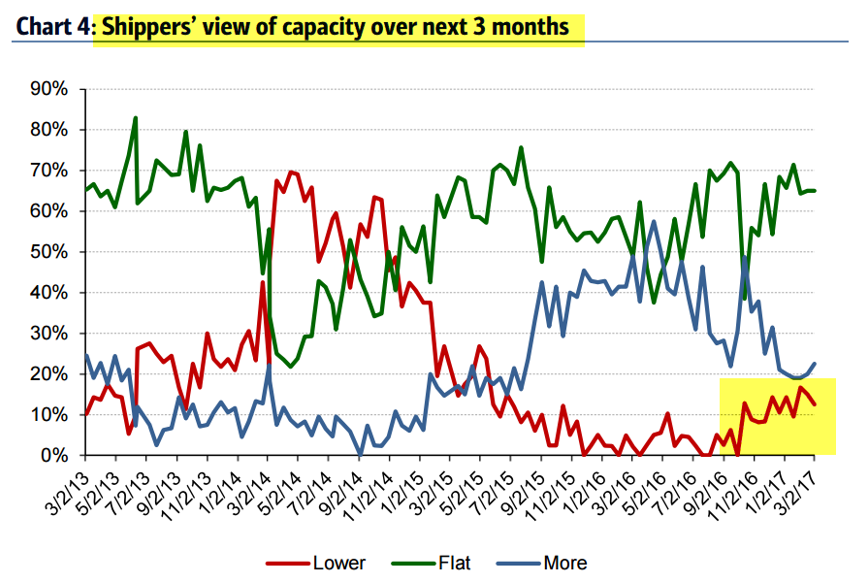

Truckload Diffusion Indicator – Aside from ACT Research report, in a separate note BAML conducted survey of 43 truck shippers nationwide to gauge shippers’ 0- to 3-month freight demand outlook. Survey results improved to 57.6 vs. 56.3 in prior survey, a 2% sequential uptick, and a 13% year-over-year increase. One shipper commented on tightening trucking supply. Another shipper sees steady shipping volume in steel and increasing volumes in the construction and pipe markets, adding that the perfect storm in transportation could be building for later this year.

Conclusion is trucking market is seen balancing currently, followed by rate pressure rising in 2nd half of 2017 with tighter supply. This could be significant for entire sector to raise prices in much the same way specialty chemicals are benefiting from pricing power given tighter supply. Hence the bullish view in SWFT which has pulled back to trend support.