What Gander Mountain and hhgregg Bankruptcy Filings Mean for the Industry

Within the last week, there have been two companies that have announced bankruptcy filings: Gander Mountain and hhgregg. Let’s take a quick look at each announcement and what company’s could possibly be affected.

Gander Mountain

Hunting and fishing retailer Gander Mountain filed for bankruptcy on Friday with plans for a quick sale, according to Reuters. In a statement, Gander Mountain said that “today’s action is the result of an in-depth review of the company’s strategic options undertaken in recent months to preserve the value of the company and position it for long-term success, adding it has also suffered from underperforming stores and excess inventory.”

In a research note this morning, Credit Suisse spoke about both Dicks Sporting Goods (DKS) and Sportsman’s Warehouse (SPWH).

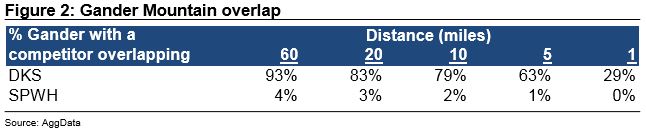

Dicks Sporting Goods (DKS) – In the case of DKS, Credit Suisse said that the company is not an obvious beneficiary based on mix and just <20% of the base closing initially. There was the hope that store closings could put sales volume up for grabs equivalent to when The Sports Authority went through its liquidation. But, based on Gander’s filing, 53% of its mix is hunting and shooting, which is not core to the DKS format. Additionally, Credit Suisse assumes a market share capture rate for DKS at under 10% of Gander Mountain sales. That would equate to a benefit of just under 1% to comps in a full liquidation scenario.

Sportsman’s Warehouse (SPWH) – Credit Suisse said Gander’s challenges are not a good read through for the closest public peer SPWH. While their hunting exposure is similar, Gander skews to more apparel/footwear at 23% vs SPWH at just under 16%, which has been more impacted by online. For SPWH, Credit Suisse believes that one of the many concerns embedded in the current depressed stock price is that the company could go the way of Gander Mountain and other troubled companies in the sporting goods sector.

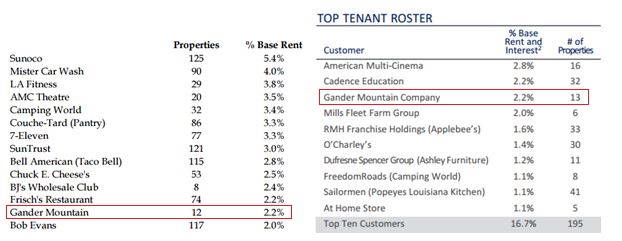

In a research note from Stifel on March 10th, they point out that Gander Mountain is a top tenant of both National Retail Properties (NNN) and STORE Capital Corporation (STOR) at 2.2% of revenue. Below, I have included each company’s top tenant roster (NNN on the left and STOR on the right). To be specific, two stores out of 13 are closing for STOR, one in Lubbock, TX and one in Gadsden, AL. Three stores out of 12 for NNN are closing, one each in Springfield, IL, Eau Clair, WI, and Greenfield, IN. However, according to Stifel, “closures are quite manageable.”

hhgregg

On Tuesday, March 7th, electronics and appliance retailer hhgregg announced it was filing for Chapter 11 bankruptcy. They signed a term sheet with an anonymous party to buy the retailer’s assets. The selling of assets will allow the company to exit Chapter 11 “debt free with significant improvement in liquidity for the future stability of the business.” The company expects to emerge from the restructuring in about 60 days.

With this news, the most obvious beneficiary would be Best Buy (BBY). However, at this time, there is definitely a disagreement between two analysts at Loop Capital and Sanford Bernstein. Here is their commentary:

Loop Capital – Analyst Anthony Chukumba was out with a research note on February 28th saying, “We believe Best Buy would be the major beneficiary of an hhgregg liquidation. We conducted a location-by-location analysis of hhgregg’s 220 stores and found over 90% have a Best Buy withing 5 miles (and in most cases, within 1-2 miles). In addition, we estimate over 90% of hhgregg’s product assortment can be found at Best Buy. We believe former hhgregg shoppers would be more likely to migrate to Best Buy stores than large format discounters, home improvement chains, or online given the latter’s more similar store format and customer service levels. Assuming a 30% sales transfer rate from shuttered hhgregg stores to nearby Best Buy locations and a 20% incremental operating margin, we estimate a complete liquidation of hhgregg could add as much as $0.21 of annual diluted EPS to Best Buy, or 6.0% accretion to the current F2017 consesus forecast.” The analyst reiterated his Buy rating and $58 price target.

Bernstein – Analyst Brandon Feltcher was out with a note on March 3rd in which he “estimates that hhgregg’s decision to close 30% of its shares will increase Best Buy’s earnings by less than 1%. He adds that even if hhgregg closes all of its stores, Best Buy’s earnings will rise less than 2%.” The analyst said that if hhgregg sells off its existing inventory through mid-April, he thinks that its discounts will put pressure on Best Buy. The analyst kept a $34 price target and an Underperform rating on the stock.