Willis Towers Watson (WLTW) – London Calling

Based in the United Kingdom, Willis Towers Watson (a merger of equals between London-based Willis Group Holdings and Virginia-based Towers Watson) is an insurance broker that acts as an intermediary between clients and insurance carriers. The company designs and delivers solutions that manage risk, optimize benefits, cultivate talent, and expand the power of capital to protect and strengthen institutions and individuals.

It advises clients across four business segments: Human Capital & Benefits (HCB), Corporate Risk and Broking (CRB), Investment, Risk & Reinsurance (IRR), and Benefits Delivery & Administration (BDA). Below, you will find a quick overview of each:

HCB – From employee benefits to executive compensation, WLTW takes a rounded perspective, based on leading-edge thinking, data, analytics and software, unearthing new ways to motivate people, foster well-being and implement solutions that work.

CRB – Clients rely on WLTW to craft strategies to quantify, mitigate and transfer risk, taking advantage of their specialist industry experience and unparalleled market know-how.

IRR – Working closely with investors, reinsurers and insurers to manage the equation between risk and return. Blending advanced analytics with deep institutional knowledge, they reveal new opportunities to maximize performance.

BDA – WLTW’s objective is to deliver and accelerate clients’ benefit strategies. They combine operational expertise with user-centered design to help organizations of all sizes, across all industries and all levels of complexity, unlock their benefit strategy.

Earlier this week, on January 8th, Fahad highlighted an unusual buyer of 539 February 155/165 Call Spreads for $2.00.

With the option flow cited, let’s revisit the company’s Q3 earnings results and commentary:

-EPS of $1.12 vs $1.14 estimate – Miss

-Revenue of $1.85B vs $1.83B estimate – Beat

-Total Revenues increased 4% Y/Y

-Total Commissions & Fees increased 4%

-Human Capital & Benefits (HCB) increased 2% Y/Y

-Corporate Risk & Broking (CRB) increased 5% Y/Y

-Investment, Risk & Reinsurance (IRR) increased 3%

-Benefits Delivery & Administration (BDA) increased 11%

Management would up its 2017 growth forecast for the year to 3% from 2-3% and suggested that over time, the company should be able to sustain “at least” 3% overall growth (the rate of underlying market growth) with opportunities to do a bit better than that.

BAML analyst Jay Cohen would say in a post-earnings note, “After timing issues impacted the 1Q and 2Q growth rates, the 3Q growth is encouraging, particularly in WLTW’s two largest segments (HCB, CRB), both of which exceeded our forecast. We had been concerned that restructuring activities in both of these segments could be distracting, but these production numbers give us more confidence that the company can maintain share and growth with the market.”

Catalysts to Watch

Whether it be from the Q3 conference call to a sell side report to a recent tax update, here are some catalysts to watch out for in the next couple of months:

AMX – CEO John Haley, on the Q3 call, would talk about the company’s Investment, Risk & Reinsurance segment and how he felt positive about the momentum of this business and excited about some of the innovation taking place.

He would go on to say, “One prominent example is the development of the Asset Management Exchange, or AMX. This exchange is a more efficient way for institutional investors and investment managers to transact with one another. It offers investors a smarter, easier and less expensive way to access their preferred investment managers by cutting the time needed and the expense occurred in operational tasks, like negotiating contracts, while at the same time introducing an extra layer of risk monitoring. It also provides many of the same efficiencies for investment managers and it reduces their compliance burden while opening up a marketplace for potentially new business.”

AMX is currently available in the UK, in Ireland and Australia, and has only been operational for eight months. Mr. Haley would say that they already have more than $2 billion of assets on the exchange and are getting great traction in adding both investors and investment managers.

Stifel – On November 2nd, in a post-call note, analyst Shlomo Rosenbaum would characterize the Q3 quarter as fairly clean with key trends pointing in the right direction, indicating that the investment thesis is playing out. He would go on to say, “We expect management to provide the next three year plan either on the 4Q17 earnings call of at the analyst day in March.”

Unfortunately, there is no confirmed date for Q4 earnings, but the company historically reports in early February.

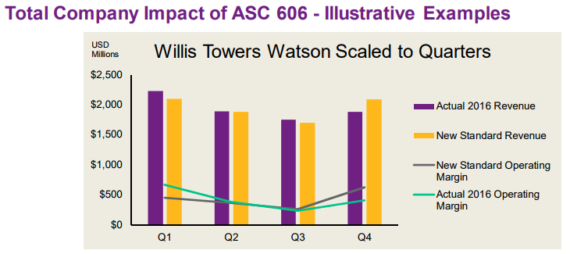

Tax Update – On January 10th, the company would host a call regarding Accounting Standards. They key takeaway from this call is that the company estimates that the enactment of the Tax Legislation will result in a one-time non-cash tax benefit in Q4 of 2017, primarily related to the re-measurement of U.S. deferred tax liabilities at the lower enacted corporate tax rate.