Workday (WDAY) – Earnings Preview

Company Overview

Workday is a leading provider of enterprise cloud-based applications for human capital management (HCM), financial management, and analytics applications.

Wall Street Expectations

EPS of $0.15 and Revenues of $507.4M

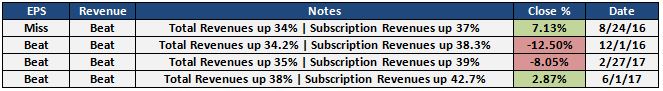

Historical Earnings Performance:

Channel Checks/Analyst Commentary:

Jefferies – On August 29th, analyst John DiFucci said his field checks indicate that Workday has signed numerous large HCM deals with marquee customers. The analyst believes there remains a significant amount of large enterprises that have yet to move to a cloud-based HCM solution and that Workday is likely to get its fair share of those transitions.

Speaking specifically on HCM upgrades, Mr. DiFucci said his checks have also revealed that existing HCM customers are also looking to upgrade from core HCM product to now include modules such as recruiting, payroll, and planning.

Finally, speaking specifically on its pipeline, Mr. DiFucci said his checks also indicate that Workday’s sales pipeline remains healthy and believe F3Q also started off well.

Piper Jaffray – On August 23rd, analyst Alex Zukin was out with a note saying his checks suggest another strong quarter within enterprise HCM in addition to a continuation in momentum around Financials. The reason Piper continues to be buyers of the stock is that 2Q sounds generally positive but the pipeline commentary is incredibly strong, which suggests a 2H bookings and revenue acceleration.

The analyst would go on to say that while 2Q is not typically a high demand quarter, he believes this quarter was better than a typical 2Q. As a result of the vertical strength mentioned above, Piper believes the eastern and central U.S. regions are showing the greatest strength and EMEA posted a very strong quarter.

RBC Capital – On August 25th, analyst Ross MacMillan said he remains positive on shares as we see a path to subscription revenue beats and upside to operating margins.

His field work highlighted a number of wins including a US based contract manufacturer, a CPG company, and a business service company. He said he would d escribe his checks this quarter as good, but we did not turn up as many F500 wins as we have over the prior couple of quarters. In terms of financial management, we continue to see strong momentum in core FM in non-profits, higher education, and mid-market. Lastly, for enterprise customers, we think the strategy of selling edge products continues to find traction.

Option Flow:

-On 6/15, 8,000 September 85 Calls were bought to open for $15.80 debit

-On 8/23, 1,000 September (8) Weekly 104 Calls were bought to open for $4.85 debit while 1,000 September (8) Weekly 108 Calls were sold to open for $3.00 credit