A-Mark Precious Metals (AMRK) – All Bullioned Up

Headquartered in El Segundo, California, A-Mark Precious Metals (AMRK) is a precious metals platform that offers an assortment of gold, silver, platinum, palladium, and copper bars, plates, and coins to wholesale and retail customers. The company operates through three segments: Direct-to-Consumer, Wholesale, and Secured Lending. The company’s global customer base spans sovereign and private mints, manufacturers and fabricators, dealers, financial institutions, industrial users, investors, and collectors.

The Direct-to-Consumer business, which is their largest and fasting growing segment and the focal point of this write-up, is where the company operates through a number of different subsidiaries, most notably JM Bullion. JMB is a leading e-commerce retailer providing access to gold, silver, copper, platinum, and palladium products through its websites and marketplaces. Currently, JMB operates five separately branded, company-owned websites targeting specific niches within the precious metals retail market. AMRK acquired the 79.5% interest in JMB that it did not previously own back in March 2021.

Back in early-February, the company reported its fiscal Q2 earnings in which they said that total revenues increased 28% to $1.95B from $1.52B in Q2 of last year. Management indicated that the increase was due to an increase in gold and silver ounces sold. Regarding their Direct-to-Consumer business, they highlighted that JM Bullion contributed $489.3M of revenue to the quarter. Onto more specifics, the company said it sold 631,000 ounces of gold in fiscal Q2, which was up 32% from Q2 of last year while they sold 32 million ounces of silver in fiscal Q2, which is up 51% from Q2 of last year and up 14% from last quarter.

Additional metrics for its DTC business that were shared were that the total number of active customers in the quarter increased by 87,100 compared with the prior year second quarter and increased by 201,700 for the six-month period. Meanwhile, the number of total customers came in at 1.9 million at the end of December 2021 vs 160,300 at the end of December 2020.

It should also be noted that a couple days after earnings came out, the company shared January metrics:

• Reported platform assets of $90.5B at the end of January, up 21.3% Y/Y

• Net flows came in at $650M, up 31.6% Y/Y

• Client cash came in at $2.85B, up 16.8% Y/Y

• Number of households increased 12.5% Y/Y to 211,601 at the end of January.

Volatility – I would be remiss if I did not mention that during the Q&A session on the Q2 call, management was asked by DA Davidson analyst Tom Forte about market volatility. CEO Greg Roberts would respond by saying, “And we did as we expected over the couple of weeks that you’ve described recently, we did see an increased level of activity and we saw a burst of interest from our customer base, particularly in the last two weeks when you had a significant drop in gold and silver in a two to three-day period, that was positive for our demand from our customer base and it was good to see the expanding customer base react as we would expect. Slow rising prices of gold and silver don’t create the exact same result or the exact same change in behavior from the customers, but it’s still good for us because it is a more affirmation that precious metals are in-demand at all levels.”

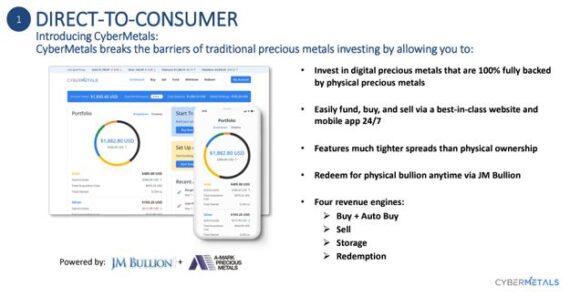

Cyber Metals – Finally, one upcoming catalyst to keep an eye on revolves around the company’s rollout of CyberMetals, their innovative online platform that “digitalizes large gold, silver, and platinum bars and allows consumers to buy and sell fractional shares in a range of denominations with the option to convert these holdings into physical coin and bar in the future.”

Roth Capital analyst Andrew Scutt would ask management if they could provide any additional color during the Q&A session, CEO Greg Roberts said the company has about 40 people in the beta right now testing the platform. “I’ve been on there myself, I’ve done a number of trades. I think it is a fantastic product. I think that the guys at JM Bullion and the tech people, Andrea and Al did just a great job, and we’re very pleased with the results and from the people that have been testing to this point, we’re very happy with what we’re hearing from them, and getting a lot of good comments and a lot of good input. And we’re very excited to to launch this to our first set of chosen JM Bullion customers on a commercial level, probably around the first week of March. So we’re very close to rolling this out, and right now, I think it’s exceeded my expectations.”