Aramark (ARMK) – Service with Style

Aramark is a leading global provider of food, facilities, and uniform services to education, healthcare, business and industry, and sports, leisure, and corrections clients. In 2007, the company was taken private in a $8.3B management buyout only to IPO again in 2013. The company now operates through three distinct segments: Food & Support Services North America, Food & Support Services International, and Uniform & Career Apparel.

I wanted to take a closer look at the company after seeing an unusual buyer of 1,000 July 45 Calls for $1.20 – $1.30 in yesterday’s trading session.

Food Services

The primary focus of Aramark is on the food services portion. Aramark typically enters into long-term contracts with clients that require an upfront investment from the company. These capital investments are usually for a refresh or build out of the food services areas – a cafeteria, restaurant(s), dining halls, kitchens, etc. There are also operational start-up costs ARMK invests in before the facility will be operational like a hiring a site manager and employee hiring and training. The capital component of the contract is amortized over the life of the contract, though start-up costs are generally expensed as incurred, resulting in lower margins at the onset of a contract.

As Stifel points out in their initiation note, there are two types of contracts Aramark offers: Client Interest and Profit & Loss.

• Client Interest Contract – 30% of food services contract are management fee-based cost-plus contracts, where Aramark does not bear food input costs. The combination of facilities services (about 20% of unit revenue in Food and Facilities Services business, which), the 11% of revenue that is generated from the Uniforms business, and the 30% of Food Services contracts that are cost-plus types of contracts means half the overall business is not exposed to food inflation.

• Profit & Loss Contract – 70% of food services contracts are profit and loss contracts. Aramark receives all the revenue and bears all the expenses from the client location. These contracts sometime have commissions paid to the client as a fixed percentage of sales or a percentage of various categories of sales. Sometimes there are required minimum commissions.

Uniforms

As mentioned at the onset of this report, Aramark also has a Uniform business (11% of overall sales) that operates over 2,600 routes across the United States, Canada, and Japan. The company rents uniforms and work clothing, as well as floor mats, mops, towels, etc., to various end customers across manufacturing, food service, healthcare, automotive, restaurant, and hospitality industries. Aramark also offers products for direct sale as well as cleanroom supplies/chemicals, although this is a smaller part of the business. Customer contracts are typically written for an initial three to five-year term.

Cintas (CTAS) is currently the market leader within the uniform industry, but on January 22nd, Aramark closed its deal to acquire AmeriPride for a purchase price of $1B. Credit Suisse believes this acquisition will drive meaningful shareholder value over the next few years given the asset’s quality and improved competitive positioning.

Q1 Earnings & Notable Commentary

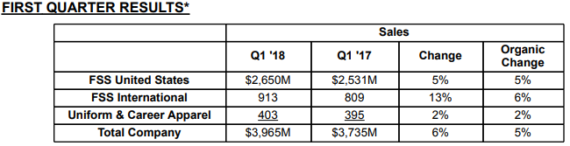

On February 6th, the company reported its first quarter results:

-EPS of $0.59 vs $0.56 estimate – Beat

-Revenue of $3.97B vs $3.87B estimate – Beat

-Shares closed lower by 3.49%

CFO Stephen Bramlage would remind everyone that seasonally, “Our weakest cash flow quarter is always going to be the first quarter and that’s directly related to just the seasonality of a couple of our large businesses.” Both sports and higher education were significantly positive in the fourth quarter with the start of school and the wind down of the baseball season, and then that flips in the first quarter.

Credit Suisse analyst Anjaneya Singh, who increased his price target to $51 post-earnings said, “Longer-term, we see ARMK as a more potent story on recent deals, and would use today’s pullback as a buying opportunity. Maintain Outperform.”

Stifel analyst Shlomo Rosenbaum, who maintained his Buy Rating and $50 price target post-earnings, said, “Strong organic growth top line growth was clearly the highlight of the quarter, with a path to margin expansion in F2H18. While FCF was much more of an outflow than we expected, we should see this reverse over the course of the year, with FCF upside potential from the acquisitions. Overall, looks like the operational improvement thesis is playing out.”

CEO Eric Foss would go on to update everyone on its execution strategy. Some key highlights include:

• The 5% top line growth was their strongest quarter in the last three years. Growth was driven by strong new business performance, very strong base business growth and improving retention rates. The company also continues to see strong leading indicators of future growth opportunities as they continue to drive improved overall consumer satisfaction. In fact, consumer satisfaction has improved across all four critical dimensions: quality, health, convenience and personalization.

• Innovation remains an integral component of the company’s success as they continue to evolve their menu design to make sure they’re offering quality, on-trend flavors, healthy options, and a number of convenient options through their seasonal promotions, restaurant rotations, and pop-up concepts.

• The company continues to evolve their thinking around consumer-facing technology as it strives to reduce the amount of time customers spend in line. “We’re continuing to test kiosk ordering, which cuts down on wait times and easily facilitates individual order customization. We also remain committed to providing on-trend mobile solutions that not only deliver convenience, but also help our consumers meet their nutritional goals. And we’re launching an automated checkout powered by artificial intelligence that greatly improves speed of service. And these technology solutions are designed with the consumer and client satisfaction in mind.”

• It is increasing its full-year outlook for 2018 by $0.05 to $0.10 as it now expects adjusted EPS in the range of $2.15 to $2.30. This outlook incorporates both the expected benefits of the tax reform, as well as the anticipated near-term dilution related to the transactions. “It’s important to note that we continue to expect the transactions to be accretive to free cash flow this year.”

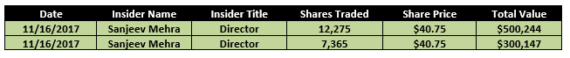

Insider Activity

Finally, it should be noted that back on November 16th, Form 4 filings showed that Director Sanjeev Mehra acquired a total of 19,640 shares at a price of $40.75 for a total value of $800,391. This was the first notable purchase from any insider in the company in over a year.