Arista Network (ANET) Identified as Takeout Target

Excerpt from Credit Suisse in a report issued on May 17:

“We see Hewlett Packard Enterprise as a potential suitor. We note that a potential deal could be GM accretive (60%+ margins at ANET vs HPE Corporate at~30%), provide significant cost synergies, and also improves HPE’s portfolio of offerings, especially in the converged system and Cloudofferings, as it leverages Arista’s SDN solution and Cloud EOS. We see a potential deal as financially attractive, i.e., EPS accretive to HPE by as much as 8% by 2020, and also strategically sound.”

Worth pointing out for over 9 months ANET is popular among put sellers under the stock. On March 16, one bull sold to open 2,800 September 50 puts for $4.50 to $4.60 credit, collected approx $1.26 million put premium and remains in open interest. On April 25, traders sold over 2,000 May 60 puts for $1.60 to $1.65 credit, also remains in open interest.

To learn more about our approach and how you can become a successful trader, sign up for 2 week trial and test drive live chat room with some of the best traders: SUBSCRIBE

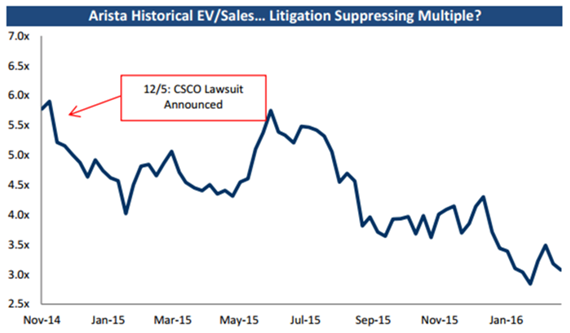

Strategically, CS note makes a lot of sense as great fit for HPE. However, the hangover regarding existing major dispute with Cisco over patents isn’t something that’s going away anytime soon, though there is a timetable in play and some recent developments have been constructive as they have started to settle 13 patent disputes one by one out of the court, potentially lifting the hangover and setting the stage for multiple expansion. Chart below shows how this dispute has significantly depressed Arista’s EV/Sales multiple.

Aside from M&A potential and patent case, we note the company posted +35% YoY revenue growth last quarter with gross margins expanding by +40 bps. It is the best growth story in networking sector. We see multiple drivers moving the enterprise switching market from 1GbE to 10GbE to 40GbE and 100GbE, driving a 15% CAGR towards a $14 billion total addressable market long term. We believe Q2 is shaping up to be another strong quarter as RBC Capital pointed out on March 31 after Arista announced launch of 7500R Series, which combines 100G density with internet scale to lower cost and increase performance for cloud service providers and enterprise data centers:

“We think the product is positioned particularly well to target the “Cloud Titans” and highlights Arista’s current technology lead within the cloud networking segment (Netflix a noted customer). The product line will likely act as a tailwind for Q2 revenue and we think this could help modestly de-risk top-line guidance for the June quarter.”

Chart is gradually setting up for breakout as it attacks $68 resistance.