Axon Enterprise (AAXN) – Accelerate 2020 Takeaways

Earlier this week, Axon Enterprise hosted its virtual Accelerate 2020 event where it showcased its portfolio of products. Both Needham and Morgan Stanley attended this event and shared their key takeaways:

Officer Safety Plan (OSP) – Management hosted an investor Q&A at the end of the first day highlighting additional details on products and pricing. Needham believes the key point from the Q&A is the stability of the customer base and limited competition from other vendors able to provide an end-to-end platform for digital evidence management combined with the sensors necessary is under appreciated by investors. Net revenue retention for SaaS products in the last three quarters is 119%. The puts and takes to this figure is very low customer churn off Evidence.com almost zero, while the company upsells the more expensive OSP 7 and OSP 7+ plans that are twice the price of the original OSP plans at $99/month.

The combination of up-selling a product at twice the price, low gross churn and seat additions should lead to strong net revenue retention for the next several years. They estimate only a few hundred agencies are on the highest value bundles versus thousands of potential agencies domestically. “We believe the current body camera penetration is less than 500K seats for Axon. Of those that have adopted body cameras, we estimate Axon’s market share is just over 50%. As a result, we estimate about 85% of the install base of 500K body camera users can be upgraded to one of the highest value plans.” Axon shared that 125K AB3’s have shipped since last September and over 100K TASER 7s. “We don’t believe investors fully understand the runway to upgrade the existing install base to higher value plans and recent product innovations should accelerate adoption over the next 12-18 months.”

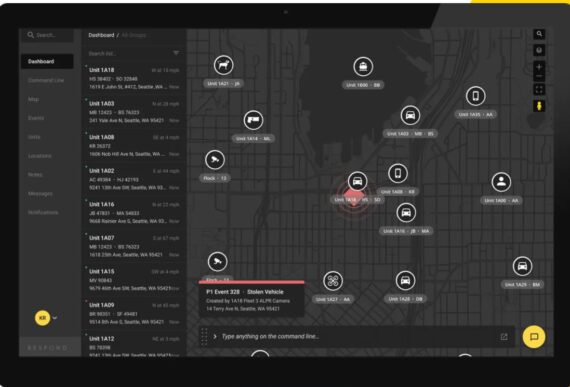

Axon Respond – Axon officially announced Axon Respond, a real-time operations platform targeted at the dispatch software market that Morgan Stanley believes to be one of the largest contributors to AAXN’s TAM. The product solution is meant to extend beyond the functionality of existing dispatch platforms by sharing real-time information from Axon products in body cameras, in-car cameras, TASERs, newer hardware technology such as drones, and existing software products in Axon Aware and Records.

“Over time we would expect Axon to win share in the dispatch market as agencies consolidate their spend with Axon due to the benefits of an integrated platform.” However, while they are encouraged by the vision for the product, they ultimately think dispatch upgrades will be indexed to the replacement cycles of existing deployments given the extensive investments and customization efforts backing incumbent platforms. While this largely poses a challenge to the pace of potential growth acceleration with the product, Morgan Stanley is confident in Axon’s positioning to capture upgrade wins as incumbent systems reach end of life. They also think availability of fire and EMS dispatch functionality expected to be added to the platform within the next 12 months will facilitate Axon’s ability to compete for these opportunities.

Fleet 3 – Finally, Needham believes that the ALPR (Automated License Plate Recognition) built into Fleet 3 is one of the most compelling features released by a company in the public sector software industry. Historically, ALPR would be a $20K add-on to a vehicle, but now the system is built into Fleet 3, which will be priced in the historical range as in-fleet cameras. The technology is made possible through a partnership with Flock Safety, a venture-backed start-up involved in fixed camera systems. With their partnership, the technology is integrated into Fleet 3 cameras. “We believe this partnership is consistent with Axon’s product strategy of “hardware light but software heavy” to maintain and improve their margin structure.” Fleet 3 will be available sometime in 2021. Needham expects to see strong demand for Fleet 3 due to the uneven deployment of ALPR technology today leading to inequities in the justice system. “Currently, only 5% or less of vehicles in a fleet may deploy ALPR technology to cost resulting in some unfair policing practices, we expect Fleet 3 to benefit from the emerging trend of more fair policing policies.”