Axonics (AXNX) – Charging Along with F15

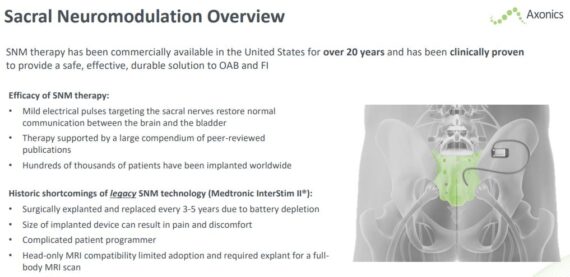

It’s been several months since we’ve mentioned shares of Axonics (AXNX), but decided to bring it up in Conversations this morning. Axonics is a medtech company that offers a sacral neuromodulation (SNM) system which helps patients suffering from overactive bladder (OAB) and/or fecal incontinence. In addition, the company offers a best-in-class urethral bulking hydrogel, Bulkamid, that provides safe and durable symptom relief to women with stress urinary incontinence (SUI).

Last month, the company reported its Q2 numbers in which Revenue came in at $69M, an increase of 50% Y/Y and 43% Q/Q. It was also up 15% vs the Street’s $59.9M estimate. On the conference call, management would also raise FY22 guidance, now anticipating total company revenue of $253M vs. $238M previously. Breaking that down further, SNM revenue is now expected to come in at $205M vs. $199M previously, while Bulkamid revenue is anticipated at $48M vs. $39M previously.

Also, during the call, management called out its record SNM revenue of $55.8M (+39% Y/Y and +43% Q/Q), which benefitted from strong initial traction of its F15 system. A reminder, Axonics announced the launch its F15 non-rechargeable SNM system on April 19th. Management noted that approximately 66% of its Q2 sales were from the F15 though management expects this to shift back toward 50% over time. The F15 has nearly twice the battery life of Medtronic’s (MDT) new Interstim X non-rechargeable system along with other advantages. Management noted that the F15 is enabling it to capture greater share of its existing customers business as well as win new customers. Separately, in First Read this morning, it was reported that the company announced the first patient implants in Canada with the F15. It should also be noted that the company’s Bulkamid product generated revenue of $13.2M, an increase of 40% Q/Q, and that was driven by strong reorder rates from existing accounts alongside new account adds. The company’s updated guidance reflects the expectation for 50,000 women to be treated with Bulkamid by YE22.

Needham Med Tech & Diagnostics Conference

Last month, Needham hosted their Med Tech & Diagnostics Conference where they spoke to a handful of companies. With regards to Axonics, analyst Mike Matson would say that the company highlighted metrics from its direct-to-consumer (DTC) ad campaign which started doing TV ads in April. Management indicated that nearly 400,000 patients visited the AXNX website in June alone with 40,000 patients filling out its survey. Of those that filled out the survey, approximately 40% have previously had their incontinence treated with drugs while around 60% have not. Management believes that this data shows that the potential market opportunity for its products may be even larger than previously thought. Management expects about a 4-6 month time period for the DTC ads to lead to an increase in procedures, so the impact is more likely to be seen in 2023.

Speaking on the company’s new F15 product, the device has been very successful and accounted for 2/3 of its SNM sales in Q2. Management was questioned about the outlook for the mix of rechargeable and non-rechargeable devices but stressed that they were agnostic on which type of device gets used. Physicians may have a bias towards non-rechargeable given a long history of that being the only option and the long life offered by F15 may be further tilting physician preference in this direction. AXNX recently raised gross proceeds of $129M through a stock offering. Management indicated that it plans to use the capital to fund expansion of its business including manufacturing, building space, and inventory investments to help avoid any potential component shortages.

Elective Surgery Trends

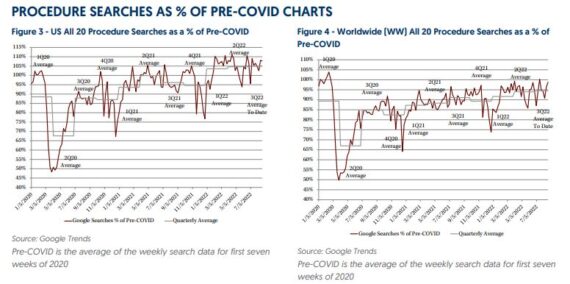

Finally, in Needham’s note on August 31st, they highlighted that during the week of 8/21/22-8/27/22, searches in the U.S. for all 20 elective procedures that they track were at 108% of the pre-COVID level. Searches in the U.S. for the orthopedic, general surgery, and cardiovascular procedures that they track were at 109%, 106%, and 107%, respectively, of the pre-COVID levels.

“Searches for all 20 procedures in the US were up 7% Y/Y over the 90 days through 8/27/22 as compared to an average 6% Y/Y increase over the 90 days through 8/20/22. Compared to last week, 16 of the 20 procedures saw improved Y/Y trailing 90-day growth, with searches for orthopedics and cardiovascular procedures seeing improved Y/Y trailing 90-day growth while general surgery saw stable Y/Y trailing 90-day growth.”

Upcoming Conferences

It should be noted that today, the company spoke at the Wells Fargo Healthcare Conference while next week, on September 12th, they will be speaking at the Morgan Stanley Healthcare Conference at 11:05AM ET.