Bally’s (BALY) – Ingredients for Interactive

On October 13th, Twin River Worldwide announced it acquired the Bally’s brand previously owned by Caesars Entertainment (CZR) and would virtually rebrand all of its properties under the Bally’s Name. Then, on November 9th, the name and ticker change went into effect.

In yesterday’s trading session, with the stock currently at $45, there was a small but unusual buyer of 1,000 January 60 Calls for $0.70 offer when the bid/ask spread was $0.35 x $0.70, a $70,000 bullish bet. Open interest would jump from 3 to 1,493.

Last month, the company announced two notable transactions:

-Announced that it entered into a definitive agreement to acquire Bet.Works, a U.S. based, sports betting platform provider to operators in New Jersey, Iowa, Indiana and Colorado, for $125M.

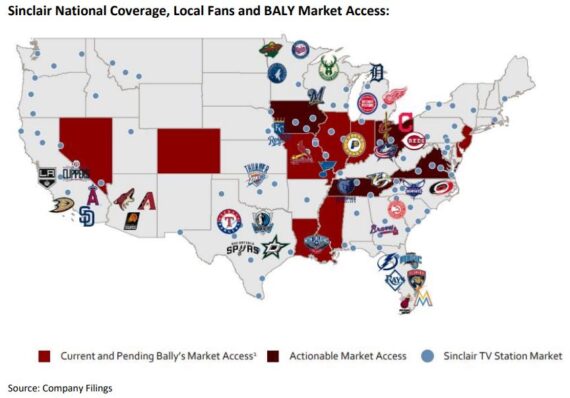

-In collaboration with Sinclair Broadcast Group (SBGI), it announced a long-term strategic partnership that combines Bally’s vertically integrated, proprietary sports betting technology and expansive market access footprint with Sinclair’s premier portfolio of local broadcast stations and live regional sports networks, STIRR, its popular Tennis Channel, and digital and over-the-air television network Stadium. “Bally’s and Sinclair will partner to create unrivaled sports gamification content on a national scale, positioning Bally’s as the premier omni-channel gaming company with physical casinos and online sports betting and iGaming solutions united under a single brand. The transaction is expected to position Bally’s to capture a significant share of the fast-growing U.S. sports betting and iGaming market.”

Union Gaming analyst John Decree said that with all of the ingredients necessary to compete in the interactive space, BALY deserves the appropriate valuation credit for this business.

Meanwhile, Truist analyst Barry Jonas said he sees the potential for more upside. Following this announcement, the company held a conference call where Bally’s noted it believes it can ultimately capture 10% market share of sports betting and iGaming which they noted could reach a market size of $12B by 2025 and $50B at maturity. Truist expects to see additional land-based M&A and/or media partnerships to capture more markets available and also take advantage of Sinclair’s wide reach and visibility with the RSN rebranding. Bally’s will launch a sports betting app in Colorado, Indiana, Iowa and New Jersey in Q2 2021, with more to come. While they will clearly not have first-mover advantage in existing states, Truist does think they could be a formidable player, especially with their omni-channel strategy.

In addition, Sinclair will release a Bally’s-branded sports app in the spring to offer personalized viewing experiences. While the deal does not have exclusivity for either party, this likely provides flexibility for Bally’s to advertise on multiple avenues, while Sinclair’s ownership stake in Bally’s (as high as 30%) incentivize them to see Bally’s succeed. Sinclair does not plan on pursuing gaming licenses– which would explain why their equity is structured as warrants and options. Truist believes that will either change at some point or Sinclair will monetize its holdings as they may not hold more than 4.9% of equity without obtaining gaming regulatory approvals.