BAML: GE Results Bode Well for Selected Med Tech Earnings (STJ, SYK)

After GE earnings last week, BAML is out with its thoughts on selected Medical Technology companies set to report earnings soon:

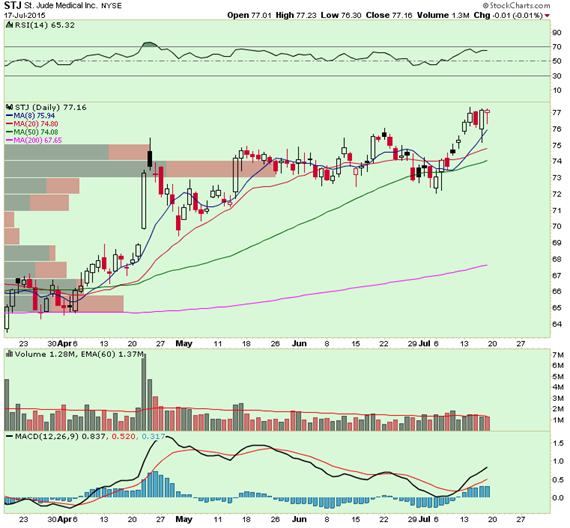

St. Jude Medical (STJ) – Reports earnings on Wednesday, July 22, before market opens. Last week on Friday we saw buyers of 700 October 75 calls for $4.10. From BAML:

“Since our meetings with STJ in May in Las Vegas we have been incrementally positive on STJ and CardioMems. Expectations have climbed since then, but we remain confident that the risk reward in STJ remains positive. Focus should be on the print more than guidance as STJ always guides conservatively. We model $20mm for Mems in Q2 but see the potential for $25mm, which would be well received. Our PO remains $85. Overall, in Q2 STJ only needs to grow revenues 3.5% organically to hit consensus.”

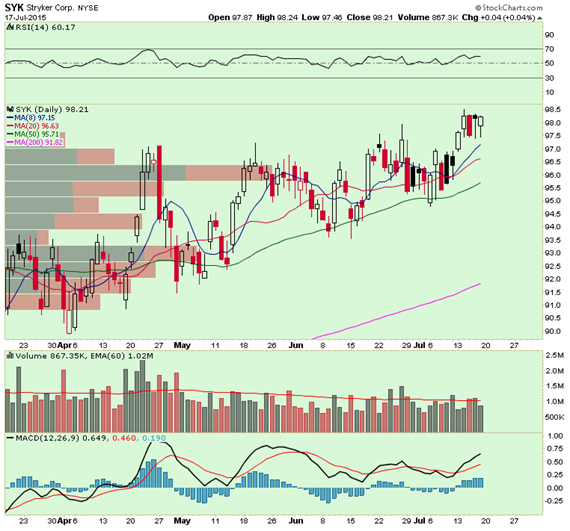

Stryker (SYK) – Reports earnings on Thursday, July 23, after market close. Buyers of 1,600 September 95 calls for $4.40 to $5.60 accumulated back in Jan/Feb remain in open interest. From BAML:

“Comps are tougher, but many things should go right for SYK this quarter. We expect at least 5-6%+ revenue growth in Q2 but see the potential for higher growth. Neurotech should see a nice growth uptick due to the recent data publications in the NEJM; we expect another very strong Mako quarter (there were 20 systems placed in Q4 and 9 in Q1) in front of the total knee launch; the hip/knee markets seem stable and SYK’s momentum in medsurg is clear. Today’s GE results bode well for capital equipment sales. Most importantly, SYK remains highly likely to put its balance sheet to work this year and return to delivering margin leverage in 2016.”