Behind The Numbers – Amphastar Pharmaceuticals (AMPH)

On January 30th, a bull case was presented in Weekend Research in this generic drug company. Since that time, the stock has held up incredibly well, especially under current market conditions. After the close yesterday, the company reported its Q4 earnings:

-EPS of $0.42 vs $0.37 estimate – Beat

-Revenue of $120.9M vs $111.62M estimate – Beat

-Sales increased 26% Y/Y

-Gross Profit increased 39%

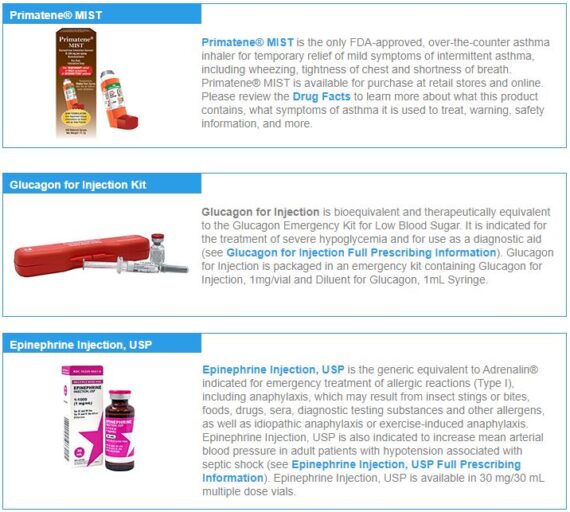

-Company called out its high margin products: Primatene Mist, Glucagon, and Epinephrine

Management would say that a milestone was reached with their Primatene Mist product, with over $73M in annualized sales, surpassing the original $65M in prior peak sales under Primatene Mist CFC. Overall, sales were up 60% from last year. VP Dan Dischner added that in-store weekly sales have maintained a positive trend, seeing a 9% increase from last quarter and a 31% increase on an annualized basis. “Therefore, as Primatene Mist sales continue to trend upward, we remain confident that the product can reach $100M by 2024.”

Regarding their other two high-margin products, Glucagon saw an impressive 26% increase compared to the previous quarter while epinephrine saw a 36% increase compared to the same period.

One additional tailwind that was discussed during the Q&A was regarding market shortages and how that actually benefitted epinephrine. Management said the primary beneficiary of that was the epinephrine prefilled syringe. “So, that’s something that one of our competitors was not able to supply. That’s why one of the reasons why our epinephrine was up so much year-over-year. And we’ve previously said that the overall market shortage opportunity is about $20 million a year, and that’s about what we had for the year, we believe. And making up for those shortages. We expect that the epinephrine shortage to continue for some time as Hospira has publicly said that they’re not expecting a resolution in the near future. So, we expect that to go on at least the first and second quarters of this year.”

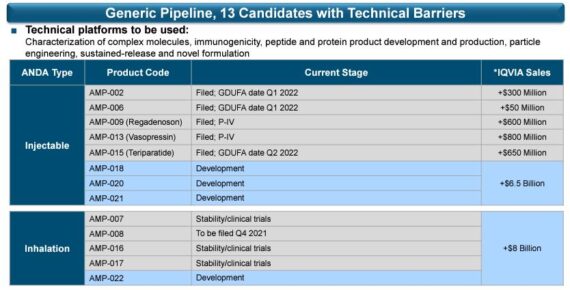

2022 Pipeline

Finally, the company would run through their 2022 pipeline and the upcoming GDUFA (Generic Drug User Fee Amendment) announcements for four specific products:

-Regarding their first product, AMP-002, this product remains on track with a first quarter good GDUFA date. If a pre-approval inspection is necessary for this product or any of the other following products, the GDUFA date may be postponed by a quarter.

-Their second product, AMP-006, which represents a market of $50M in IQVIA sales, remains on track with a Q2 GDUFA date.

-For their third product, teriparatide, or AMP-015, the product remains on track with a Q2 GDUFA date.

-Lastly, their fourth product is their first inhalation filing, AMP-008, which has a Q4 GDUFA date this year.