Behind The Numbers – AstroNova (ALOT)

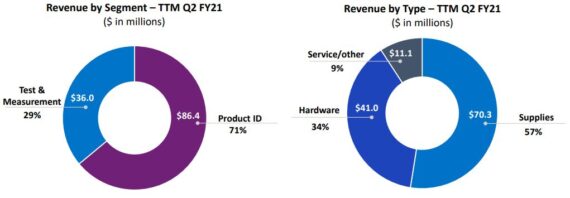

AstroNova (ALOT), headquartered in West Warwick, Rhode Island, is a global leader in data visualization technologies as it delivers solutions that process, analyze, store, print, and present data in a variety of useable forms. Through its two segments, Product Identification and Test & Measurement, it serves data acquisition, avionics, packaging identification, and specialty printer industries.

The company reported its Q3 earnings yesterday morning, with Product Identification revenue coming in at $22.9M, an increase of 5% Y/Y and 6% Q/Q. Management indicated that these results were driven by strong demand for their printers and suppliers through their new color label printers such as the QL-120X and the QL-850, as well as their recent release wide format, direct product and packaging printer, the T3-OPX, “which continues to exceed our expectations.” Meanwhile, the rate of new customer acquisition was also favorable, which contributed to the segment’s strong performance in Q3.

In terms of COVID-tailwinds within this segment, CEO Greg Woods commented that they’re still seeing it in terms of the janitorial cleaning supplies, while chemical products are still ramping, as well as medical products. “And recently, we’ve got few new customers in the eye care area, which I is not really COVID related, but just a better penetration overall for our business within the medical industry.”

In addition, within its label business, they’re getting more and more new customers and new markets. “One example I could try out there, which we pretty much see all across North America’s CBD business. So, we’re getting quite a few new customers there I think in a variety of states and territories.”

Turning to Test & Measurement, management said the combination of COVID and the 737 MAX grounding continue to adversely affect commercial printer deliveries in Q3. Though they don’t have a crystal ball, the potential of approved vaccines in the coming days and the FAA’s November decision clearing the 737 MAX for return to service are positive signs for its commercial aerospace business as they move through fiscal 2022 and beyond.

In terms of recent highlights, during the quarter, they announced the receipt of an exclusive multiyear commitment from a major North American carrier, which is deploying their narrow formats top-rated printers in its Boeing 737 aircraft. “As I noted on the Q2 call, this will likely result in more than 200 printer orders during the term of that agreement.”

Meanwhile, the defense portion of their customers in this segment, while traditionally a much smaller component of revenues in commercial, is growing and trending positively. On the last call, management mentioned the receipt of a printer contract for military transport aircraft, and they continue to pursue similar airborne activities and opportunities. “Additionally, we have received initial orders for our new data acquisition recorders and telemetry systems for evaluation at several U.S. and foreign military ground facilities. These early successes bode well for this next generation equipment.” Management expects T&M revenue in Q4 to be stronger sequentially based on anticipated contributions of shipments for defense applications.

Finally, Colliers analyst Dick Ryan would ask the company on the earnings call about a current contract with Honeywell (HON) and how much longer they anticipate this to impact margins?

**Back in 2017, the company co-signed an exclusive worldwide asset purchase and licensing agreement with Honeywell’s aerospace division. The agreement provided for an up-front payment to HON of $14.6M.

CEO Greg Woods would respond, “We’re hopeful to wrap that up this quarter. I know we’ve been trying to get it done for a few quarters here, but COVID did have some impacts in terms of restructuring at other — both at Airbus and Honeywell as well as our own organization. So that a little disruption to the contract negotiations, but we’re certainly in the final stages right now. I would say, very high probability that we’ll have it done in Q4. And then, that will — the impact will start pretty much immediately from there.”