Behind The Numbers – Catalent (CTLT)

Catalent (CTLT) is a contract development and manufacturing organization (CDMO) for the pharmaceutical and biotech industry. The company offers drug delivery technologies as well as drug development and manufacturing solutions for pharmaceuticals, biologic, and consumer health products.

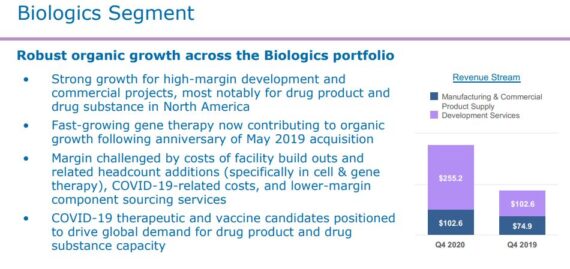

The company operates through four segments: Softgel Technologies, Biologics, Oral Drug Delivery, and Clinical Supply Services. The majority of this write-up will be focused on its Biologics segment, as yesterday morning, the company reported that net revenue for this segment increased 102%.

It should also be noted that net revenue was up 66% when you strip out the recent acquisition the company made for Bristol-Myers Squibb’s (BMY) biologics, sterile, and oral solid dose product manufacturing and packaging facility in Italy.

As JPMorgan stated in their post-earnings note, the secular shift towards large molecules, which represent approximately 40% of drug pipelines, has rendered biologics manufacturing a crucial opportunity for Catalent (as further seen in the growing number of COVID-19 programs), with industry demand expected to outstrip supply for the next several years.

Catalent CEO John Chiminski would reiterate that last quarter through joint investments with Johnson & Johnson (JNJ), they significantly accelerated their expansion plans at their Bloomington facility to meet drug product needs for leading COVID-19 vaccine candidates. “Over the summer, we also announced that Bloomington will provide vial filling and packaging capacity to Moderna (MRNA) as well to support production of an initial 100 million doses of its COVID-19 vaccine candidates intended to supply the U.S. market, with an opportunity to significantly expand the agreement.” The company is also providing clinical supply services, including packaging and labeling as well as storage and distribution to support Moderna’s Phase 3 clinical study for this COVID-19 vaccine candidate.

Turning to Europe, the company is also rapidly expanding its drug product capabilities. For example, at their Anagni facility, they dedicated two vial lines at the site to drug product capacity for COVID-19 vaccine candidates for both AstraZeneca (AZN) and J&J. “We have accelerated the rapid scale up of capacity to support the potential launch and round the clock manufacturing schedules for these vaccine candidates should either be approved.”

BofA, in their post-earnings note, said that CTLT’s FY21 guidance does not assume any COVID-19 vaccine approvals and only factors in 5-7% points of revenue growth from take-or-pay COVID-19 deal terms, which only amounts to about $155-217M. “We understand that this is net of the opportunity cost and revenue losses from the pandemic. However, this still seems low to us given that CTLT has won over 50 COVID-19 awards, including three Operation Warp Speed vaccine contracts.”

Similarly, KeyBanc would say that looking ahead, they model organic, constant currency revenue growth of ~14% in FY21 (ending June 2021) and ~10% in FY22 (ending June 2022). “CTLT has been awarded 50+ programs for a variety of COVID-19 vaccines and therapies (with more in discussion). Regulatory approval of any of these programs could create sharp upside in the back half of FY21 (and in FY22).” In addition, excluding COVID-19 work, CTLT seems comfortably set up for 8-10% revenue growth given the strong industry backdrop of biologics and cell/gene based therapies in development. The only caveat is that an increased mix of clinical trial-related revenue may lead to quarter-to-quarter revenue fluctuations.

Other Segment Performance

Softgel Technologies – Net Revenue increased 2%. Excluding the October 2019 divestiture of the consumer health facility in Australia, revenues and adjusted EBITDA grew ~7% and ~6%, respectively, Y/Y. Growth reflected demand for prescription products in North America and consumer health demand worldwide.

Oral Drug Delivery – Net Revenue increased 22%. Growth was driven by new product launches in the respiratory and ophthalmic areas and demand for the company’s Zydis platform. Also, management referenced a strong pipeline of new product introductions.

Clinical Supply Services – Net Revenue decreased 2%. The decline was due to disruptions in clinical trials due to the COVID-19 pandemic, partially offset by increased demand for storage services. Finally, on July 1, CTLT acquired the Teva Takeda Pharmaceuticals clinical packaging facility in Shiga, Japan. This will add to CTLT’s clinical capability and growth in the Asia-Pacific.