Behind The Numbers – fuboTV (FUBO)

fuboTV (FUBO) is a leading virtual multichannel video programming distributor (vMVPD) that offers a sports-first, live-TV streaming platform. fuboTV generates revenue from subscribers through recurring subscription fees and through advertising that is largely sold programmatically today. It supports streaming on a wide range of devices including streaming boxes/sticks (Amazon Fire TV, Roku, Chromecast), computers, smartphones, tablets, smart TVs, and gaming consoles.

On November 10th, the company reported their debut numbers after coming public on October 8th.

-EPS of ($1.65) vs ($0.37) estimate – Miss

-Revenue of $61.2M vs $53.89M estimate – Beat

-Revenue increased 47% Y/Y

-Subscription Revenue increased 64% Y/Y

-Advertising Revenue increased 153% Y/Y

-Paid Subscribers increased 58% Y/Y

-ARPU increased 14% Y/Y

-Total Content Hours Streamed increased 83% Y/Y

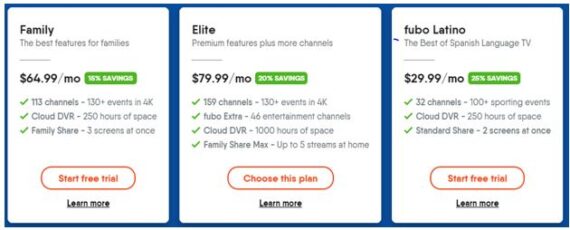

Ending subs came in at 455k, which was above guidance of 435k and analyst estimates of 375k. The company leaned into marketing to capitalize on the return of live sports and addition of ESPN/ ABC, driving 169K net ads. BMO Capital analyst Daniel Salmon highlighted that COVID tailwinds and the return of football set FUBO up well for its debut NYSE earnings and subscribers were nicely ahead of guidance. Improved merchandising of the Family plan and thus a rising attachment rate have gross margins improving. Easing minimum guarantees also help over the mid-term, while the advertising ARPU remains the #1 long term metric, while they expect to hear more on FUBO’s opportunity in sports betting soon.

Oppenheimer analyst Jason Helfstein, who raised his price target to $21 following earnings noted that management expects to share details around online sports betting opportunity by year-end, likely through marketing partnerships and enhanced products catering to these users. Meanwhile, Roth Capital analyst Darren Aftahi said that with their improved outlook, they raise their price target to $29, a significant premium to peers given 3x+ faster growth in FY21, which includes no sports wagering contribution, which could act as further upside at some point as early as FY21, and more importantly a mechanism for improved retention.

Sports Betting

BMO Capital, in their initiation note on November 2nd, said Sports Betting represents a free call option on the stock. FUBO had signed a one-year agreement with Fanduel in 2019, making it the exclusive sportsbook, online casino, horse racing, and DFS partner on the platform, as well as the exclusive advertiser in those categories. This was the first, and to date, only agreement of its kind signed by a vMVPD. However, they note that the deal recently expired but management assured an update is forthcoming. Moreover, fuboTV continues to carry horse racing networks and Fan Duel subsidiaries TVG and TVG2, as well as the Vegas Sports Information Network (VSiN), which is operated by American Eagle Software.

The most important question for fuboTV on sports betting is the extent to which it will immerse itself into the market. Relationships currently in play among media peers range from strict partnerships to equity ownership (Disney’s stake in DraftKings) to active licensing/branded products (Fox Bet). The second consideration is that building the right sports betting product will be a marathon, not a sprint, and be it with gaming partners or consumers, investment in the best online gaming software integration with live content is the area where long-term value can be created. fuboTV is well-suited to this end, as a streamlined, pure-play live-streaming company dialed in on sports.

In Needham’s initiation note, analyst Laura Martin commented that although we know DraftKings or FanDuel represent a fast solution, she believes that if FUBO uses its unique tech stack to fully integrate sports betting into its video feed, this should capture much of the typical 50% margin earned by these third parties. “Additionally, we think it will improve the viewer experience, which should lower subscriber churn and boost betting revs over a 3-year time-frame.”