Behind The Numbers – Inari Medical (NARI)

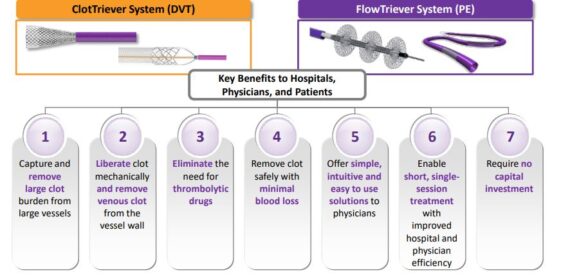

Inari Medical (NARI) is a medtech company that is focused on products for patients suffering from venous diseases. Its two main products include ClotTriever for treatment of deep vein thrombosis and FlowTriever, a thrombectomy system for treatment of pulmonary embolism.

The stock fell by 15% on Wednesday following the company’s Q2 earnings report:

-EPS of $0.07 vs $0.08 estimate – Miss

-Revenue of $63.5M vs $59.65M estimate – Beat

-Revenue increased 10.6% Q/Q and 150% Y/Y

-Procedure Volumes of 5,900, up 7.3% Q/Q and 136% Y/Y

-Raised FY21 Revenue Guidance to $250M – $255M from $240M – $250M

Management did say that procedure growth during Q2 moderated compared to Q1. They believe this was primarily due to the decline in the prevalence of COVID, “which as many of you know can cause VTE.” This was an important source of patients treated with the Inari devices in Q1. In January and February, for example, at the peak of COVID hospitalizations, about 15% of the patients they treated were associated with COVID. By June that number had fallen to about 4%. “In short, COVID created a larger tailwind than perhaps we appreciated in Q1 and the decline in COVID-related VTE procedures, tempered our procedure growth in Q2.”

In their post-earnings note, Canaccord Genuity analyst William Plovanic said there was a disconnect between procedure volumes and product revenue – which likely could be explained by the stocking of new products. While the procedure split between DVT and PE was 3,100 and 2,800 cases (52.5% DVT and 47.5% PE), ClotTriever was 33% of revenue while FlowTriever was 67% of revenue. “We believe that the disconnect was likely driven by many of the new FlowTriever products that were rolled out, and thus part of stocking. Given the rollout of products such as the T20 Curve and Triever24 with FLEX technology. We highlight that while there was higher than normal stocking in the quarter for these new products, and revenues increased ~$6M Q/Q, accounts receivables were flat sequentially and A/R DSOs actually decreased Q/Q.”

Lastly, regarding guidance, while FY was lifted, management cautioned Q3 could be negatively impacted by more employees and physicians taking vacations this summer. “We believe a note of caution through the remainder of Q3 is warranted.”

Company Growth Drivers

Commercial Expansion –

The company’s first growth driver is the expansion of their sales organization to target new hospitals and physicians. “Given the size of our total addressable market, as we just detailed, our performance in Q2, suggests we treated just over 5% of all the patients we believe can benefit from treatment with our devices. We are very early in our effort to treat this patient population and we believe the effort will require a lot more sales professionals.” The company began Q2 with 150 territories and based on their last earnings call, the intent is to finish the calendar year with 180 to 200 territories. They recently completed another round of hiring of field sales professionals and are comfortably on pace to land in the high end of this range by the end of the year.

Clinical Data –

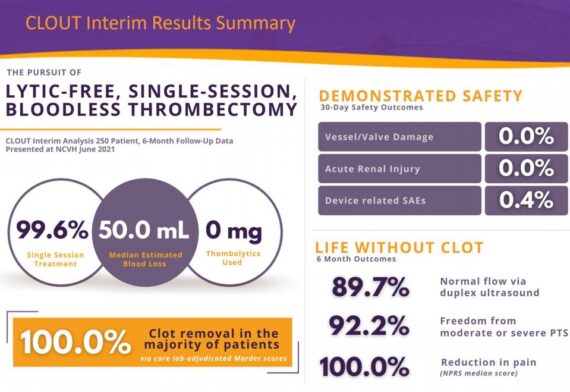

The company presented early in June at the New Cardiovascular Horizons meeting in New Orleans an interim analysis of results of the first 250 patients enrolled into their prospective CLOUT DVT registry. “The safety profile of ClotTriever remains pristine. No patients with valve damage, no patients with vein damage, no patients with renal injury, and a device-related adverse event rate of just 0.4%. Blood loss was just 50 cc which is similar to a standard blood draw making ClotTriever thrombectomy virtually bloodless. Effectiveness was equally compelling. An independent core lab analysis showed near complete clot removal in more than 85% of the patients which led to excellent clinical outcomes. At six months every single patient reported a reduction in pain and 92% were free from moderate and severe post-thrombotic syndrome. All of these results are best-in-class by a pretty wide margin.”

Management added that these results are even more compelling given that two-thirds of the patients treated in CLOUT would not have qualified for trials in which competitive devices have been used because the age of the clot was older than two weeks. As you know as clots age, they become much more firm, more well adherent, more resistant to thrombolytic drugs, and impossible to remove via aspiration.

Shifting gears to Pulmonary Embolism. They continue to make excellent progress in their FLAME and FLASH registries. They have assembled a steering committee of KOLs to design a series of randomized controlled trials or RCTs that it believes will establish FlowTriever as standard-of-care for treatment of PE. “Today, we are excited to announce the first of these trials. This trial will compare FlowTriever to catheter-directed thrombolytic therapy or CDT which we believe still represents the majority of PE interventions today. The composite primary endpoint will comprise death, intracranial hemorrhage, major bleeding, clinical deterioration, and duration of ICU stay. We are targeting first patient enrollments by Q1 of 2022.”

More Products –

On July 22nd, FlowSaver was cleared by the FDA. FlowSaver is an intuitive disposable filtration system that enables physicians to reintroduce extracted blood back into the patient. This delivers two important advantages. ”FlowSaver has been highly anticipated by our physicians and has already been received with great enthusiasm. Our 100-patient limited market release or LMR was completed in just one week and we have already begun full market release.”

Beyond FlowSaver, the product pipeline remains robust. The company expects FDA clearance on several new products late this year and into the early part of next year and look forward to sharing more at that time.