Behind The Numbers – Issuer Direct (ISDR)

Issuer Direct is an industry-leading communications and compliance company whose Platform id includes newswire, disclosure management, investor targeting, earnings events, stock transfer, and IR website and feeds.

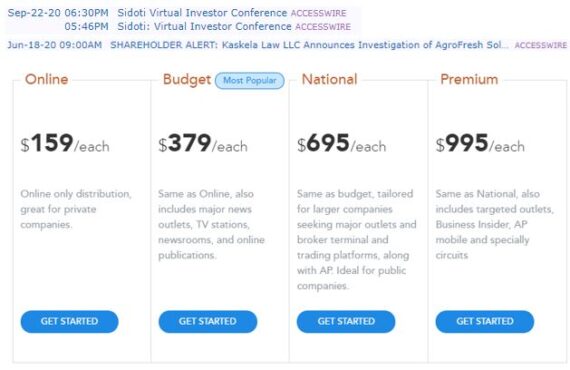

One of the company’s main services under the newswire category is ACCESSWIRE, one of the fastest growing newswires that delivers regional, national, and global headlines. Their platform delivers results to thousands of customers each month (Pricing breakdown shown below). Most traders and investors will see these alerts pop up in their feed throughout the day. Below are some examples taken from finviz.com.

Let’s now revisit the company’s Q3 earnings results that took place last week in which total revenues increased 21% Y/Y. Its Platform & Technology revenue increased 33% and 19% for the 3 and 9 months ended September 30th compared to last year. Management noted that the majority of the increase in revenue came from their virtual products, notably their webcasting and conference software as some of the conferences they previously had scheduled as in-person were changed to virtual. Management would comment that while the market may see a return to normal and personal events sometime next year, it is their belief that virtual events will continue to be a part of this for many years to come. CEO Brian Balbirnie would add:

“I personally believe in the usefulness of an in-person event. But there’s no denying the engagement and efficiency gained from the virtual component with our platform is starting to show true. Investor participation to the Company presentations which generally have garnered 30 — 20 to 30 investors in the physical room, and perhaps dozens listening in a virtual way that made up that event. Today, these company presentations done on our platform all virtually are seeing audiences in the hundreds.”

Moving on to ACCESSWIRE, revenue increased 22% and 14% for the 3 and 9 months ended September 30th compared to last year. As with last quarter, management said this increase was due to both an increase in customers and an increase in revenue per release as they continued to benefit from their digital marketing and ecommerce platform that kicked off toward the end of the first quarter. In the Q&A session following a remark by Northland analyst Mike Grondahl, management highlighted that new products will be rolled out in stages and strategically throughout the ACCESSWIRE system starting early next year. This will give customers the ability to upgrade into a more monthly service. If we do that successfully, and we believe that we will, we get that predictability in the modeling, which makes it much different when we think about the thousands of private companies that will use ACCESSWIRE this year and going into next.

Now, looking at the entire Platform id service, the company signed 42 new contracts with annual contract value (ACV) of $360,000, bringing overall contracts to 320 contracts with an ACV of just under $2.5M. This compares to 255 contracts with ACV of approximately $2M at the beginning of 2020. Brian Balbirnie would add on the conference call that on a Y/Y basis, the private company business continues to outperform expectations where customers were up 60% from 997 to 1,597. Meanwhile, their public company customers also grew 6% during the quarter to 1,475 from 1,394.

“Although growth is evident, we have a lot to do here in this space. Further product innovation is planned. International distribution is beginning to take shape as well as additional domestic distribution points. So we can deliver our customer demands and expectations as it relates to customers telling their story. We spoke last quarter on our goals of getting to the market share we expect by the end of 2022, we are on pace and have expectations to move to 25% year-over-year growth at the beginning of next year.”