Behind The Numbers – Lindsay Corp. (LNN)

**This Behind The Numbers article is one of a handful of write-ups being featured in tomorrow’s Weekend Research report, sent to Jaguar clients every Sunday.

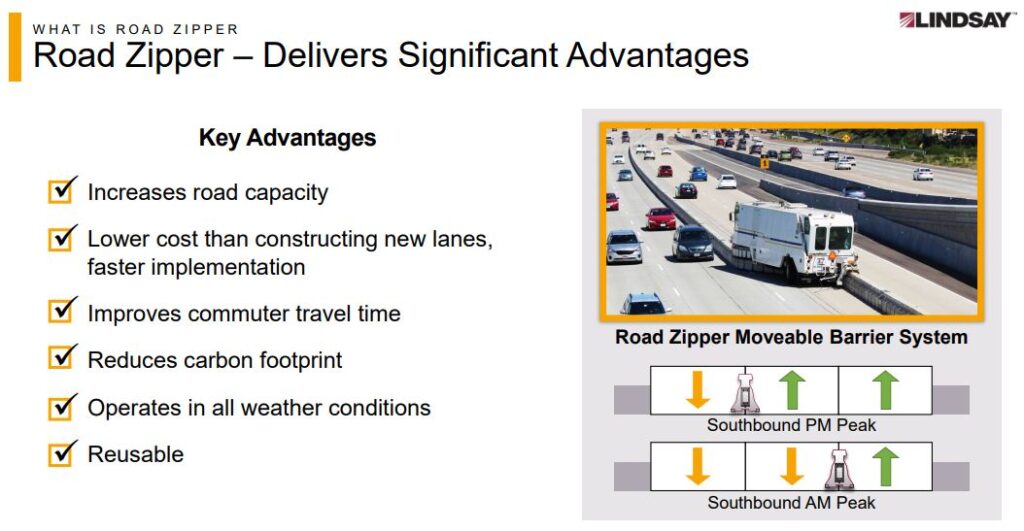

Lindsay Corp (LNN) is a leading global manufacturer and distributor of irrigation and infrastructure equipment and technology. Lindsay’s agricultural irrigation solutions include center pivot and lateral-move systems, remote irrigation management and scheduling technology, engineering services, and a variety of other Industrial Internet of Things (IIoT) solutions. Meanwhile, its infrastructure segment manufactures equipment to improve road safety and keep traffic moving on the world’s roads, bridges and tunnels.

This past week, the company reported its Q1 earnings that missed on the top and bottom line:

-EPS of $0.65 vs $0.75 estimate – Miss

-Revenue of $108.5M vs $113.07M estimate – Miss

-North American Irrigation Revenue of $52.8M vs $53.6M Y/Y

The company said the decrease here resulted primarily from lower engineering services revenue related to a project in the prior year that did not repeat. This was partially offset by higher irrigation equipment unit volume.

-International Irrigation Revenue of $34.6M vs $29.7M Y/Y

The increase in this segment resulted from higher unit sales volumes in several regions, which were partially offset by the unfavorable effects of differences in foreign currency translation rates compared to the prior year.

-Infrastructure Revenue of $21.1M vs $26.1M Y/Y

The decrease in this segment resulted primarily from a large Road Zipper System order delivered in the prior year that did not repeat and from lower road construction activity in the current year.

On the conference call, CEO Randy Wood would highlight the following:

-In late December, the President signed the coronavirus direct aid package that allocated an additional $13B to the ag sector which they expect will provide supplemental support for the corn, soybean, livestock and dairy sectors. These positive market drivers drove stronger-than-expected order flow in the second half of the quarter in North America, leading to higher equipment sales and a large order backlog at the end of the quarter.

-However, the company also saw a rapid escalation of input costs, primarily steel, during the quarter and some transportation disruptions that resulted in higher expediting fees. “The large influx of orders, coupled with increased costs, have put short-term pressure on margins. Price increases have been passed through to the market, and we expect to see margin pressure subside as the year progresses.”

-Turning to technology and innovation, it announced a partnership with Taranis, the market leader in high-resolution economic imagery, and Microsoft (MSFT), which will allow them to deploy machine learning and artificial intelligence to create the Smart Pivot. “The combination of advanced economics and machine health monitoring within the integrated FieldNET platform will be an industry first and further strengthens our position as the innovation leader in mechanized irrigation.”

-On the infrastructure front, the company continues to focus on growing the Road Zipper business by executing their shift-left strategy, increasing global penetration, and growing the lease business. “We did see an increase in Road Zipper lease revenue in the quarter, and our Road Zipper sales funnel continues to improve on a year-over-year basis. The timing of projects exiting the funnel remains challenging to predict, particularly in this current pandemic environment. Both Road Safety and Road Zipper projects face short-term headwinds as governments have delayed road construction projects while managing their pandemic response. The recent COVID relief package did provide additional funding to the states, which we expect will be beneficial for spring projects.”

Finally, in the Q&A session, Boenning & Scattergood analyst Ryan Connors would bring up the Biden administration and infrastructure spending and ask if management could comment on another priority that they’ve mentioned maybe less prominently, which is the equip funding, the sort of environmental program where they give some low-cost money for irrigation and other agricultural issues. “Have you heard any more details on that, whether that’s something that you think is going to be real and whether that tilts the balance of wallet share towards irrigation even in a good ag market?”

CEO Randy Wood woud respond, “I do think you’re right. The administration, obviously, it’s going to have a significant focus on the environment, ESG, sustainability. And the equip program has proven to be a very efficient means of getting capital to the market where customers are going to use it to improve efficiency. I think one of the big changes that we’ve seen in the last farm bill was the ability to fund technology investments like FieldNET Advisor. So I think going forward, we should see strong financial support in the equip program, which will aid in full machine conversions, to more efficient means of irrigation. But we’re also excited that they will include technology investments as well that will allow growers with pivots to buy into technologies that will also save time, water and energy. So we see equip as a good tailwind going forward.”