Behind The Numbers – Moet Hennessy Louis Vuitton (LVMUY)

Moet Hennessy Louis Vuitton, most commonly referred to as LVMH, is a luxury goods powerhouse with notable brands such as Christian Dior, Marc Jacobs, Tiffany, Sephora, TAG Heuer, Bulgari, and more. The company operates through a number of business segments such as Fashion, Wines & Spirits, Perfumes & Cosmetics, and Watches and Jewelry. In terms of geographic exposure, the company has stated that Asia represented 32% of revenue. United States at 26%, Europe at 23%, Japan at 7%, and finally other markets at 12% collectively.

Last week, the company held their Q3 Sales/Trading Call where it highlighted the strong trends it had seen throughout the year, with double-digit revenue growth in all business groups which resulted in a 20% increase in organic growth over the 9-month period. Breaking it down further:

Wines & Spirits – This business group delivered EUR 5.2B in revenue for the first 9 months of 2022, an increase of 14% Y/Y. Breaking that down furthrer, Champagne & Wines generated EUR 2.4B in revenue over the 9-month period, representing organic revenue growth of 24%. Meanwhile, Cognac & Spirits delivered EUR 2.8B in revenue, representing organic revenue growth of 7%.

“In Cognac & Spirits, Hennessy, while still affected by restrictions in China and logistical disruptions in the U.S., continued its upward trajectory with double-digit reported growth, given it maintains a firm price policy. Also during the period, Hennessy announced the expansion of its strong partnership with the NBA across global markets. And lastly in this category, Glenmorangie and Ardbeg exhibited very strong momentum, and Belvedere Vodka continued to deliver excellent performance.”

Fashion & Leather Goods – This business saw revenue reach EUR 27.8B, up a very strong 24% on an organic basis from the same period in 2021. “Christian Dior grew markedly across all product categories with sustained strength in leather goods, which includes the ongoing success of the iconic Lady Dior handbag. The newly reopened boutique at 30 Avenue Montagne has been a very popular destination. In fact, the number of visitors has surpassed 0.5 million in the last 6 months.”

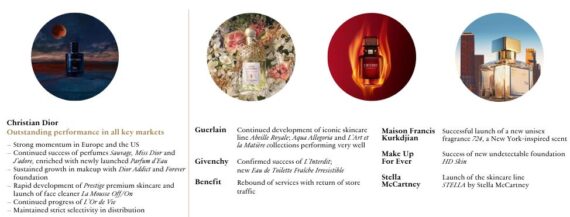

Perfumes & Cosmetics – This business group reached nearly EUR 5.6B in revenue, which was an increase of 12% on an organic basis. Looking at the perfume brands, management said Christian Dior remains a star, delivering outstanding performance in all key markets with particularly strong momentum in Europe and the U.S. “This performance is driven by the continued success of its iconic fragrances, including Sauvage, Miss Dior and J’Adore recently enriched — by the recently launched Parfum d’Eau. The makeup business has also sustained its strong growth driven by Dior Addict and Forever Foundation. And premium skin care is equally rapidly growing category with the Prestige line.”

Watches & Jewelry – Finally, revenue over the 9-month period in this segment reached nearly EUR 7.6B, reflecting 16% organic growth. “At Tiffany, the brand is seeing ongoing revenue gains due to the introduction of exciting new products and marketing. The new Lock collection with its innovative class is off to a solid start in North America while the international rollout of a highly appealing Knot collection continues. Tiffany also had a successful launch of High Jewelry Blue Book collection in Asia.”

Company Read-Throughs

OI-Glass (OI) – As mentioned earlier, LVMH reported that Wines & Spirits sales increased 14% organically in Q3. Truist views these end-market demand trends as positive for OI as spirits and wines comprise ~15% and ~20% of OI’s mix, respectively.

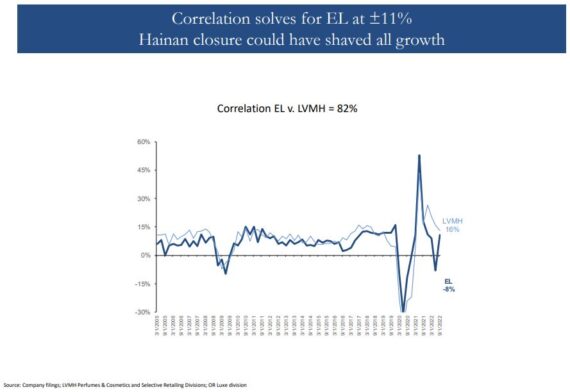

Estee Lauder (EL) – Evercore ISI points out that historically, LVMH sales growth in 2 divisions, Perfumes & Cosmetics and Selective Retailing, has shown a strong correlation to EL, which currently stands at 83%. The analyst said they ran their correlation model and provide context on the differences in geographic footprint (China, Hainan) that should lead to weaker sales growth for Estee than what this correlation solves for.

As long as we’re on the topic of Hainan, on its conference call, LVMH CFO Jean-Jacques Guiony would say, “As you perfectly know, I mean, this doesn’t fit with the bulk of our business. And we’d love to do business in Hainan because there’s significant business to be done there, but not at the expense of our business philosophy, which is to control the business we do in our own retail stores. So you will not see Vuitton or Dior wholesale stores just because we want to be in Hainan, no way. It will never happen.”