Behind The Numbers – Orthofix Medical (OFIX)

Orthofix is a global medical device company focused on improving patients’ lives by providing superior reconstruction and regenerative orthopedic and spine solutions to physicians worldwide. Back in June, the company announced they were aligning their business structure around two pillars, Spine (Bone Growth Therapies, Spinal Implants, and Biologics) and Extremities (Formerly Extremity Fixation).

On Monday, after the close, Orthofix reported its Q3 earnings:

-EPS of $0.42 vs $0.36 estimate – Beat

-Revenue of $111.7M vs $110.65M estimate – Beat

-Total Net Sales increased 6.1%

-Gross Margins increased 100bps

Segment Results

Orthofix Spine – Produced $84.8M in reported sales, which was a 6.3% increase Y/Y.

• Bone Growth Therapies – The company reported net sales that grew 8.2% Y/Y. “As expected and as I discussed on our Q2 call, we benefited from a larger to normal open order volume at the end of Q2 that translated into sales in Q3. Even when normalized for this impact sales increased 5.9% over prior year.”

• Spinal Implants – Reported a year-over-year increase of 9.7% overall, with a decrease in sales of 4.5% is Spine Fixation for the quarter, with Spinal Kinetics contributing net sales of $2.9M. “The primary driver of the decrease in Spinal Fixation was the expected international softness that we commented on in our last earnings call. And to a lesser extent the normal disruption that comes with a business reorganization and leadership transition that I also spoke about on our last call. We expect this to be a short-term issue at the benefits of the Orthofix Spine alignment comes together in the next few quarters.”

Orthofix Extremities – Reported that net sales increased 5.8% Y/Y. As was the case in their Bone Growth Therapy, this segment benefited from the carryover of an unusually large number of open orders at the end of the second quarter that were fulfilled in this period.

FDA Approval

On the conference call, CEO Brad Mason would discuss the company’s new initiative they were undertaking in their Spine businesses:

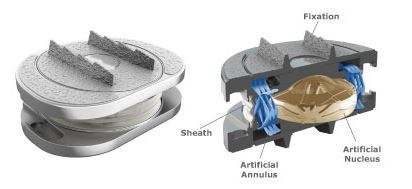

“This work has been essential in preparing us to more fully leverage our market leading bone growth therapy and biologic technologies and upon USFDA approval the M6 disc. Orthofix has a unique combination of products that we believe differentiates us in the spine market and will be the platform for future accelerated growth. And more specifically with the M6 disc and our current cervical spine product offerings, we believe that Orthofix will have the most complete and differentiated cervical spine solutions of any company worldwide, including the only FDA approved osteogenesis device for use infusion of the cervical spine.”

Regarding the M6 disc approval process, the company still anticipates the mid-2019 approval and limited market release. But, according to them, this can be earlier or later in the year depending on the timing of the FDA approval process.